Illustrative image

According to Reuters, President-elect Donald Trump has threatened to impose tariffs on the European Union if its member states do not purchase more oil and gas from the United States.

“I’ve told the European Union that they have to make up for their massive trade deficits with the United States by buying our oil and gas, or we’ll be tariffing the hell out of them!” he said on Truth Social.

As the world’s largest crude oil producer and a major exporter of liquefied natural gas (LNG), the U.S. has been in discussions with LNG buyers, including the EU, to purchase more fuel, partly to avoid potential tariffs.

EU officials and member states have been bracing for potential trade blows since Trump’s reelection as U.S. President. In 2017, most of the bloc was caught off guard when Trump imposed tariffs on European aluminum and steel due to “national security concerns.”

Last November, European Commission President Ursula von der Leyen proposed to Trump that the U.S. could supply more LNG to the EU as an alternative to Russian supplies.

“We still import a lot of LNG from Russia, so why not replace it with cheaper U.S. LNG, which would also help lower the EU’s energy prices,” she said.

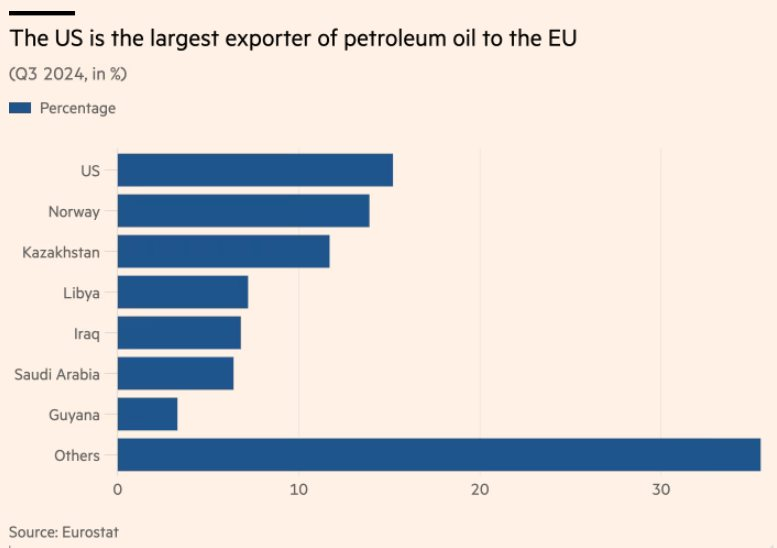

The U.S. was Europe’s top oil and gas supplier in Q3 2024

Currently, Europe is the largest destination for U.S. LNG, accounting for over half of its exports. According to data from the EU’s statistics agency, Eurostat, the U.S. supplied 47% of the bloc’s liquefied natural gas (LNG) and 17% of its oil imports in the first quarter of 2024. Meanwhile, the U.S. goods trade deficit with the EU stood at nearly $162 billion in 2023, with $108 billion of that in services.

Energy analysts say the U.S. would need to expand its LNG production to supply more to the EU. Florence Schmit, an energy strategist at Rabobank, said, “The main issue is that the U.S. currently does not have spare LNG capacity to send to Europe,” adding that European countries would have to pay more than Asian buyers.

Trump has previously stated that he views tariffs as a significant negotiating tool with other countries. He has also threatened to impose a 25% tariff on Mexico and Canada to force them to step up border security to curb illegal immigration into the U.S. and a 10% tariff on Chinese goods to pressure the country to crack down on the flow of opioids into the United States.

References: FT, Reuters

Trump’s Second Term: Global Financial Fallout

Donald Trump’s second term brought about significant changes to the financial system, particularly in its approach to Basel III – the global standard for bank risk management. The delay and adjustment of Basel III implementation in the US not only impacted the domestic financial system but also had far-reaching effects on international markets, including Vietnam.

Gold Prices Rise Slightly After US Jobs Report and Political Turmoil in South Korea, France

The spot gold price in New York edged higher on Tuesday (December 3) after stronger-than-expected employment data reinforced expectations of a more cautious Fed in its monetary policy easing process. In the Asian market, gold prices also ticked up following political turmoil in South Korea and France.

The Top 8 Trading Partners of the U.S. – Vietnam Makes the Cut

The infographic below depicts the largest trading partners of the United States, based on data from the U.S. Census Bureau and the U.S. Bureau of Economic Analysis.