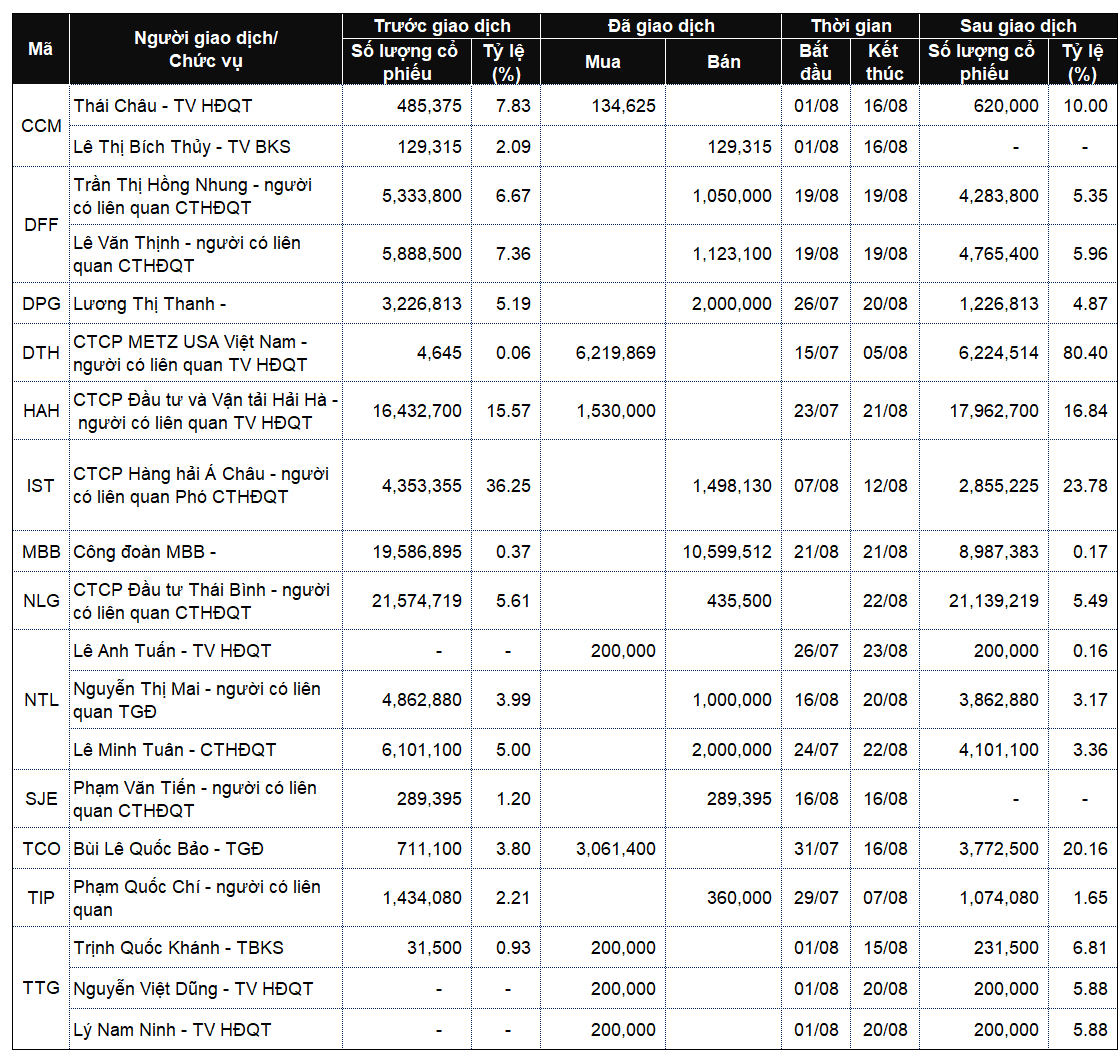

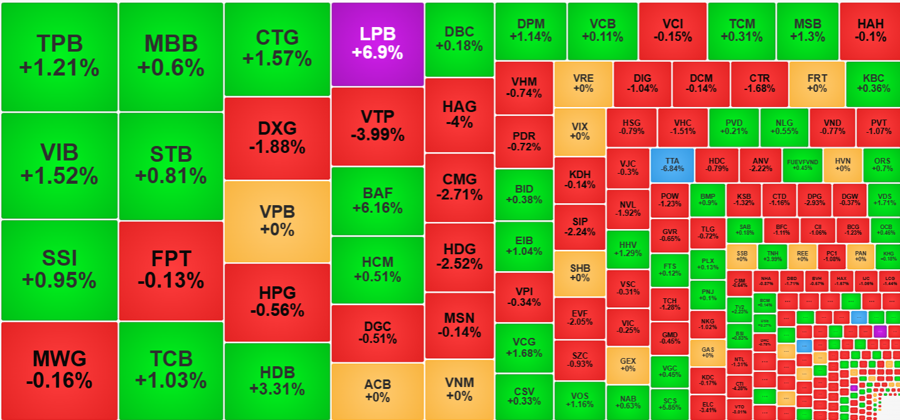

Bank stocks on the HoSE today contributed nearly 32% of the total matched orders on the exchange. All 10 of the VN-Index’s top point-pulling stocks were from the banking sector. Bank stocks have become the market’s pillar of support, as speculative stocks began to face stronger selling pressure.

LPB, which traded ex-dividend today, saw its reference price adjusted downwards to VND 29,000 per share, about 6.5% lower than yesterday’s closing price. However, a sudden surge in buying interest pushed LPB to its daily limit, resulting in a 6.9% gain and a new all-time high. While LPB is not a large-cap stock, ranking only 18th in the VN-Index, this significant move propelled it to the top position in terms of point contribution, adding 1.23 points to the index. All nine remaining stocks were also from the banking sector, contributing a total of 4.1 points to the VN-Index’s 2.27-point gain.

LPB is just one notable example, and the banking sector as a whole performed quite well today. Out of the 27 listed stocks, 15 recorded gains, and only two, PGB and BVB, were in the red. Nine of the gainers closed more than 1% above the reference price. In addition to LPB, notable performers included HDB, up 3.31%; CTG, up 1.57%; VIB, up 1.52%; TPB, up 1.21%; and TCB, up 1.03%. Two of these, CTG and TCB, are among the top 10 in terms of market capitalization.

The banking group also witnessed healthy trading activity, with stocks in the VN30 basket accounting for 60% of the basket’s matched orders. TPB and VIB even led the market in terms of liquidity, while MBB, STB, TCB, and CTG were among the top 10 most liquid stocks. Combined trading value for all bank stocks on the HoSE reached nearly VND 4,345 billion, a 38% increase from the previous day, and accounted for nearly 32% of the total matched orders on the exchange. This is the highest liquidity ratio since October 24.

In terms of both price gains and liquidity, bank stocks were the most impressive. This group attracted significant capital inflows and saw active buying interest pushing prices higher. Out of the 69 stocks on the HoSE that closed more than 1% higher, bank stocks accounted for 74% of the group’s total liquidity. Not many other stocks witnessed substantial gains with high liquidity. Notable exceptions included BAF, up 6.16% with a matched value of VND 235.4 billion; DPM, up 1.14% with VND 154.3 billion; VCG, up 1.68% with VND 107.7 billion; VOS, up 1.16% with VND 75.4 billion; HHV, up 1.29% with VND 62.9 billion; and SCS, up 5.85% with VND 46.2 billion.

Small and medium-sized stocks, as well as speculative stocks, faced stronger profit-taking today. The VN-Index’s breadth ratio showed only 177 gainers compared to 242 decliners. Among the losers, 110 stocks fell by more than 1%. Notable decliners included DXG, down 1.88%; VTP, down 3.99%; HAG, down 4%; CMG, down 2.71%; HDG, down 2.52%; and DIG, down 1.04%. These stocks had very high liquidity, with matched values of around VND 100 billion or more. CTR, SIP, EVF, VHC, and PVT also faced strong selling pressure. The total liquidity of this deeply declining group accounted for 20% of the exchange’s trading volume.

Despite the VN-Index trading in positive territory for almost the entire session, the magnitude of the gains was not significant. The index reached its intraday high early in the morning session, with a peak gain of just over five points, and eventually closed up 2.27 points (+0.18%). The main challenge was a lack of consensus among the large-cap stocks. While the banking sector performed well, there was a degree of variation within it. TCB and CTG were the most notable performers, while VCB, BID, and MBB posted modest gains, and VPB and ACB closed flat. Additionally, FPT fell 0.13%, HPG declined 0.56%, VHM slipped 0.7%, VIC decreased by 0.25%, and GVR dropped 0.65%. The bank stocks were just able to maintain the market’s positive sentiment rather than propel the index significantly higher.

A positive factor was the strong net buying by foreign investors on the HoSE, amounting to approximately VND 615.4 billion. Initially, they were net sellers, recording a net sell position of VND 59.6 billion in the morning session. However, a surge in buying interest in the afternoon session led to a significant shift. Specifically, foreign investors invested VND 1,358.8 billion in the afternoon alone, three times the amount invested in the morning, resulting in a net buy position of VND 675 billion. Several blue chips saw strong buying interest, including STB (VND 164.8 billion), CTG (VND 125.4 billion), SSI (VND 82.7 billion), FPT (VND 73 billion), and HDB (VND 59.9 billion). On the selling side, notable stocks included HPG (VND 81.9 billion), VCB (VND 68 billion), VRE (VND 31 billion), and VTP (VND 27.2 billion)…

Today’s recovery session, despite its modest magnitude, is a positive sign as it helps the VN-Index maintain its elevated levels following the explosive gains on December 25. The index has now returned to the short-term peak reached at the beginning of December and has the opportunity to test this level before revealing its next trend.

Market Beat on Dec 27th: Foreigners Net Buy Financial Group, VN-Index Maintains 1,275 Point Landmark

The market closed with the VN-Index up 2.27 points (0.18%) to 1,275.14, while the HNX-Index fell 0.77 points (0.33%) to 229.13. The market breadth tilted towards decliners with 432 losers and 331 gainers. The large-cap stocks in the VN30 basket painted a positive picture, with 13 gainers, 10 losers, and 7 stocks ending flat.

The Art of Contrarian Investing: Navigating Market Swings with a Twist

The VN-Index has been on a rollercoaster ride lately, with alternating up and down sessions. Erratic trading volumes, fluctuating around the 20-day average, reflect investors’ unstable sentiment. However, the MACD and Stochastic Oscillator indicators continue to point upwards, providing a buy signal. If this status quo persists in the upcoming sessions, the short-term outlook may not be as risky as it seems.

The Hesitancy Hurdle: Navigating Market Uncertainty

The VN-Index edged slightly higher, snapping a four-day losing streak with the emergence of a Doji candlestick pattern. Accompanying this pattern, the trading volume remained below the 20-day average, indicating investor indecision in the market. Notably, the Stochastic Oscillator has now crossed into overbought territory and is flashing a sell signal. This development suggests that the risk of a market correction increases if the indicator falls out of this zone.

The Power of Positive Thinking

The VN-Index surged and retested its old peak in early December 2024 (around the 1,270-1,280 points region). If, in the upcoming sessions, the index surpasses this threshold alongside maintaining trading volume above the 20-day average, the uptrend will be reinforced. Notably, the MACD indicator has already signaled a buy opportunity by crossing above the signal line. If the Stochastic Oscillator also flashes a similar signal in the forthcoming sessions, the outlook will turn even more optimistic.

The Art of Liquidity Recovery

The VN-Index witnessed a positive trading week, surging above the Middle Bollinger Band and firmly holding above the 50-week SMA. However, trading volume has remained below the 20-week average since November 2024, indicating a lack of significant participation from investors. If upcoming sessions witness an improvement in liquidity, the index could potentially target the old peak of October 2024, which lies in the 1,285-1,300 point range.