Of the three main indices, the HNX-Index stood out as it returned to the green, ending the session up 0.11 points to 227.54. The VN-Index and UPCoM-Index narrowed their losses significantly compared to the lows of the afternoon session, closing down 11.33 points to 1,254.67 and down 0.42 points to 92.65, respectively.

| VN-Index didn’t fall too deep, HNX turned “green” again |

|

Source: VietstockFinance

|

The market breadth witnessed 453 declining stocks, including 12 floor prices, while only 262 stocks rose, including 19 ceiling prices. The stocks that went against the market and touched the “purple” today were YEG, SAM, and TDH.

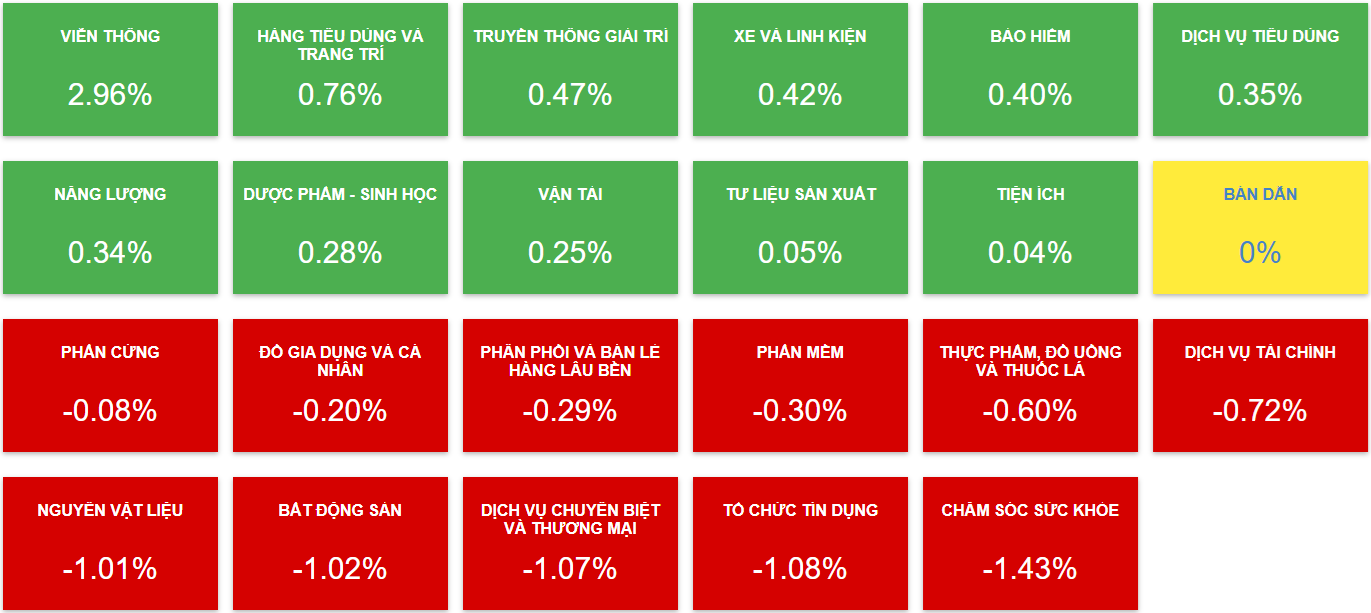

However, when considering sector performance, the market witnessed a balance with 11 advancing sectors and 11 declining sectors, while 1 sector, semiconductors, remained unchanged. This suggests that the sharp decline in the market was mainly concentrated in the pillar sectors, specifically credit institutions (down 1.08%), real estate (down 1.02%), materials (down 1.01%), and financial services (down 0.72%). Meanwhile, most of the advancing sectors did not have a significant influence on the overall market. The best-performing sector was telecommunications (up 2.96%), mainly supported by VGI (up 3.98%) stock.

|

Number of advancing and declining sectors at the end of the session on 12/19/2024

Source: VietstockFinance

|

Market-wide liquidity reached more than 935 million shares, with a value of over VND 20,695 billion, significantly higher than recent trading sessions. The strong selling pressure came after the not-so-positive news from the Fed’s policies and Chairman Powell’s statements, which also occurred in the US stock market overnight and the Asian markets today.

Contributing to today’s selling pressure was foreign investors, with a net sell value of nearly VND 1,762 billion, while only buying VND 1,208 billion, resulting in a net sell value of over VND 553 billion. This was the 11th net selling session out of the 14 sessions so far this last month of the year.

SSI was the stock with the strongest net selling today, with a value of over VND 137 billion. This was followed by VPB with nearly VND 87 billion, VCB with nearly VND 70 billion, and PDR with over VND 62 billion. In terms of net buying, FPT led with a value of over VND 103 billion, far ahead of the next stock, KDH, which was net bought for nearly VND 48 billion.

| Net trading value by stock on December 19, 2024 |

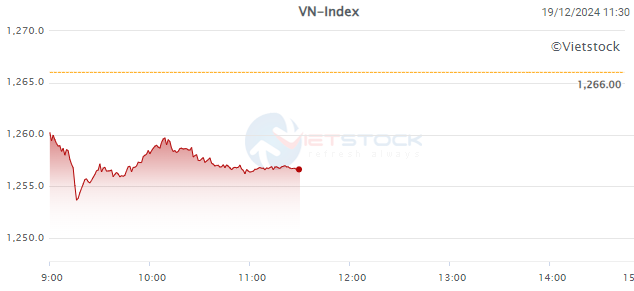

Morning session: Pressure eased towards the end of the morning session

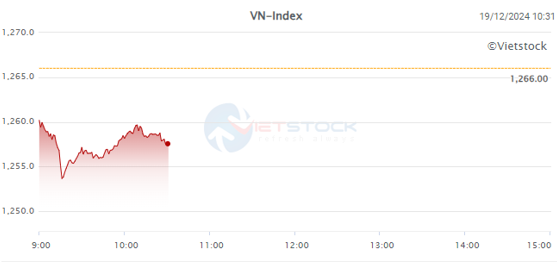

The significant fluctuations in the morning session mainly occurred within the first hour of trading, with the VN-Index falling below 1,254 points at one point before rebounding to almost 1,260 points. The market then returned to a corrective phase, but the decline was not significant, and it traded sideways towards the end of the morning session.

Source: VietstockFinance

|

The morning session ended on a less-than-positive note, with the VN-Index falling 9.37 points to 1,256.63, the HNX-Index falling 1.22 points to 226.2, and UPCoM falling 0.57 points to 92.5. Market liquidity reached nearly 415 million shares, equivalent to a value of over VND 8,980 billion.

There were 14 declining sectors, of which financial services fell 1.31% and specialized & commercial services fell 1.07%, being the two worst-performing sectors in the market. Within the financial services sector, the decline was widespread among securities stocks – a group that usually reacts sensitively to the market.

Although the decline was not significant, the widespread losses of 1-2%, especially among large-cap stocks such as SSI, VCI, HCM, MBS, and FTS, led to a considerable overall decline.

In the specialized & commercial services sector, VEF fell 1.22%, and TV2 fell 1.42%, being the main contributors to the sector’s decline.

At lower levels of decline, however, due to their large market capitalization, sectors such as banking, real estate, retail, and materials became the main pressure on the market.

Nevertheless, eight sectors went against the trend, led by telecommunications, which rose 2.76%, thanks to the momentum from VGI (up 3.54%). The insurance, transportation, and consumer goods sectors also advanced.

|

Most sectors declined during the morning session on December 19, 2024

Source: VietstockFinance

|

10:40 am: Recovery efforts

After a sharp drop at the beginning of the session, the indices quickly showed signs of recovery. As of 10:30 am, the VN-Index was down 8.33 points to 1,257.67, notably rebounding from the 1,254 level to almost 1,260. The HNX-Index and UPCoM-Index also showed recovery, falling 0.88 points to 226.54 and 0.52 points to 92.55, respectively.

Source: VietstockFinance

|

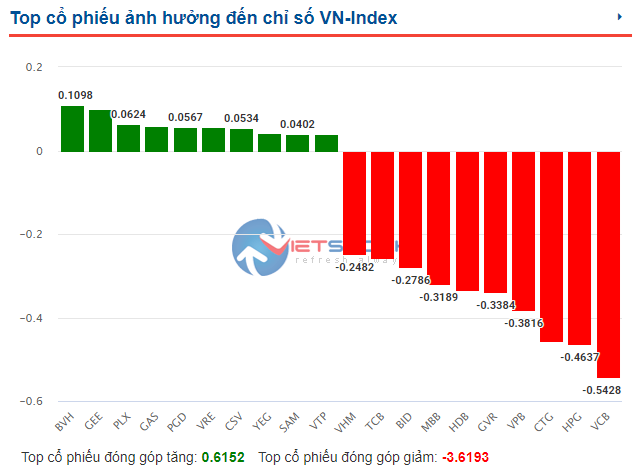

Stocks belonging to large-cap sectors such as banking, real estate, and securities still mostly traded in the red and weighed down the indices. On the VN-Index, VCB, HPG, CTG, VPB, GVR, HDB, MBB, BID, TCB, and VHM were the top 10 negative contributors to the index, collectively taking away more than 3.6 points.

Source: VietstockFinance

|

By sector, the market recorded 13 declining sectors out of a total of 23, led by financial services, which fell 1.27% due to the impact of securities stocks such as SSI, VCI, HCM, VND, VIX, MBS, and FTS…

Liquidity continued to increase, with the value exceeding VND 6 trillion, which is unusual in the recent period. Foreign investors also increased their net selling to nearly VND 340 billion, with the main selling pressure coming from VPB, at nearly VND 43 billion, followed by SSI, at over VND 30 billion. In terms of net buying, FPT led, but the value was only over VND 18 billion.

Opening: Early wobble after Fed’s interest rate stance

Global stock markets reacted negatively to the signals from the future policy direction of the US Federal Reserve (Fed), and Vietnamese stocks were no exception.

After the Fed announced its plan to cut rates only twice in 2025 and Chairman Jerome Powell’s view of being “more cautious when considering adjustments to monetary policy in the future,” global stock markets were disappointed and wobbled.

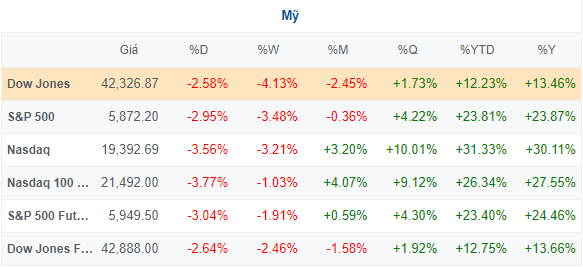

Last night, there was a sense of disappointment on Wall Street as the Fed signaled it would cut rates less than the four times projected in its latest forecast.

Source: VietstockFinance

|

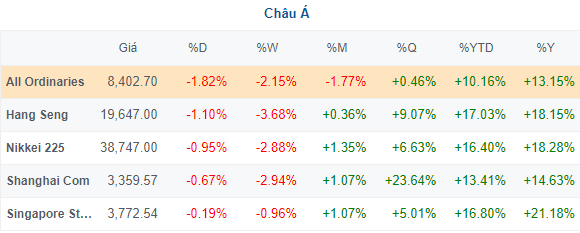

Asian markets are also opening on a less-than-optimistic note, with major indices such as the All Ordinaries, Hang Seng, Nikkei 225, Shanghai Composite, and Singapore Straits Times all declining to varying degrees.

Source: VietstockFinance

|

In Vietnam, the main indices, VN-Index, HNX-Index, and UPCoM-Index, all declined, with the VN-Index falling as much as 9.23 points to 1,256.77 within the first 30 minutes of trading.

Liquidity increased rapidly, indicating a generally pessimistic sentiment, reaching more than 103 million shares, equivalent to a value of nearly VND 2,290 billion, higher than the average of recent sessions. Foreign investors were also net sellers, with a net sell value of over VND 110 billion.

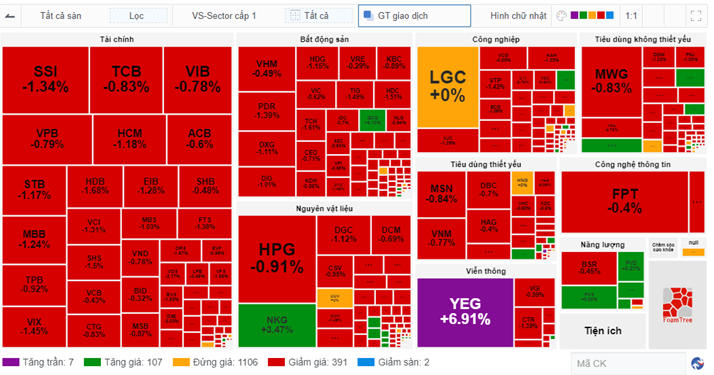

The market recorded 393 declining stocks at the beginning of the morning session, while only 114 stocks rose. Looking at the heatmap, it was not difficult to see the market dominated by red, with notable declines in banking, securities, real estate, materials, and consumer stocks.

Amid the challenging backdrop, YEG stood out as it hit the ceiling price and helped the media & entertainment group to be the best-performing sector in the market (up 0.95%).

|

Red dominated the Vietnamese stock market

Source: VietstockFinance

|

Vietstock Daily: Is the Short-Term Outlook Not Too Gloomy?

The VN-Index witnessed a slight dip as trading volumes fell below the 20-day average, indicating a cautious investor sentiment following a strong previous rally. However, a key technical indicator, the MACD, has turned positive, crossing above the Signal Line, and the Stochastic Oscillator is also flashing a similar signal. Should this status quo persist in the upcoming sessions, the outlook may not be as pessimistic as some might believe.

The Market Pulse: Is the Risk of Adjustment Rising?

The VN-Index witnessed a significant decline, forming a bearish Falling Window candlestick pattern and dipping below the Middle Bollinger Band. This suggests a potential shift in market sentiment. The volume also spiked above the 20-day average, indicating heightened investor anxiety. The Stochastic Oscillator is firmly in oversold territory and continues to signal a sell-off. If the MACD also turns bearish in the coming days, the likelihood of a more pronounced correction will increase.

A New Vision for Vietnam’s Financial Sector: The Eight Key Tasks for the Capital Markets in 2025

On December 18, 2024, the State Securities Commission of Vietnam (SSC) organized a conference to review its regulatory and supervisory performance in 2024 and outline its objectives for 2025. The event was chaired and directed by Mr. Nguyen Van Thang, the country’s Minister of Finance.