Source: VietstockFinance

|

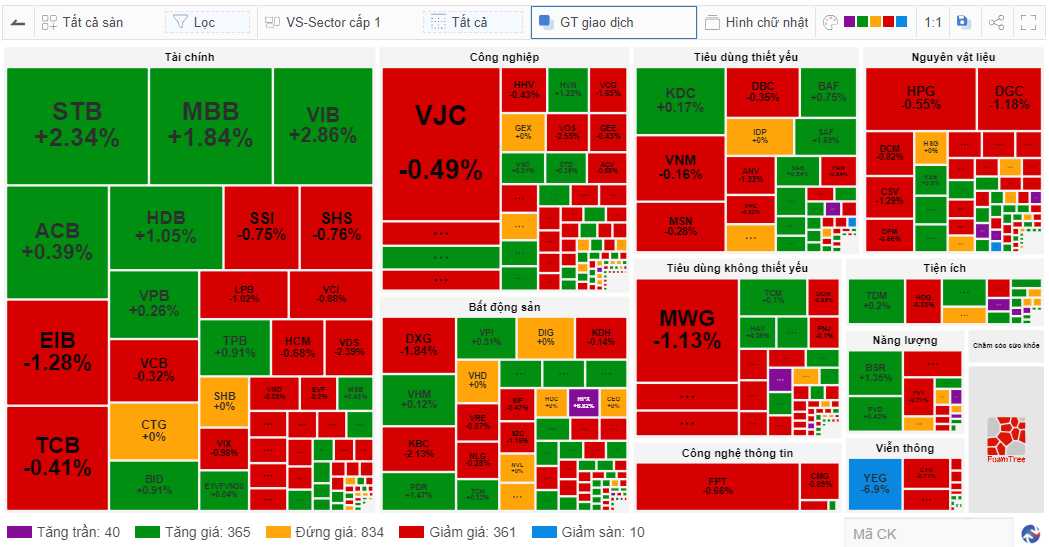

Bank stocks dominated today’s market scores, with 7 out of the top 10 codes having the most positive impact on the VN-Index, including

MBB, BID, VIB, STB, HDB, ACB, and TPB. The remaining 3 codes were PGV, HVN, and BCM,

bringing in a total of over 3 points. It didn’t stop there, according to the negative impact, 4 other bank stocks also appeared in the top 10, which were

VCB, SSB, LPB, and TCB.

|

Top stocks influencing the VN-Index on December 26 |

|

|

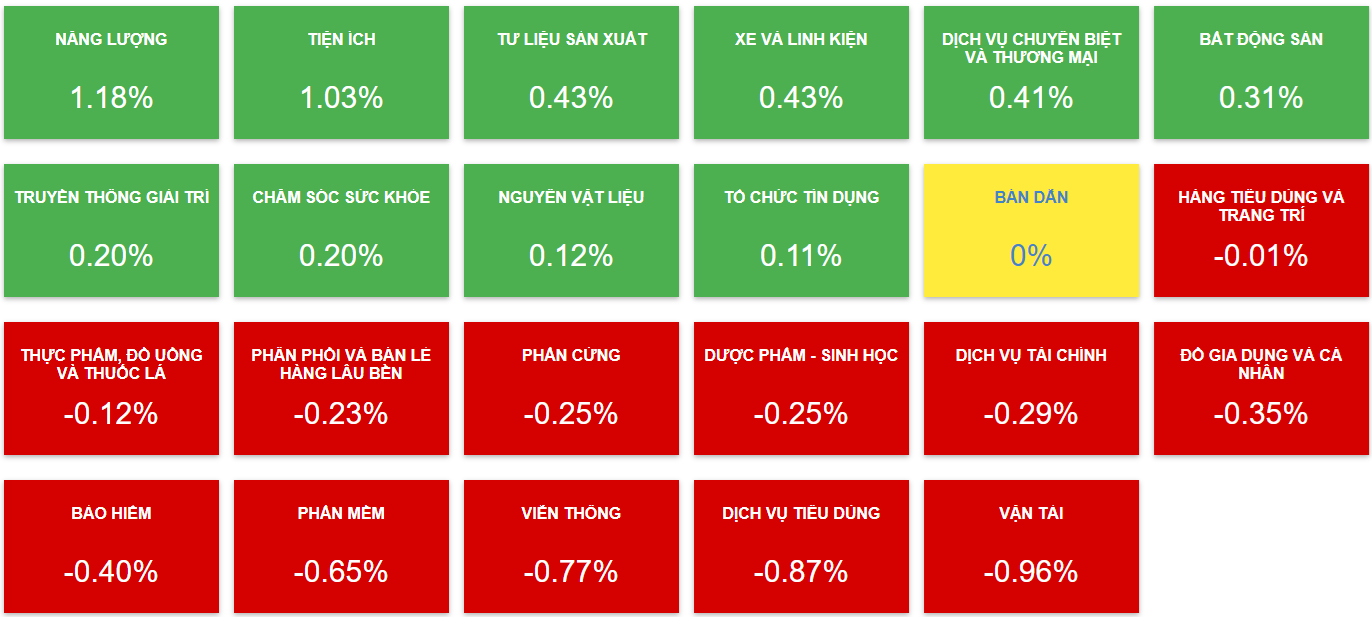

Along with the common pressures in the market, the number of industries with increased points decreased towards the end of the afternoon session. As a

result, 9 industries increased today, all below 1%. In the decreasing direction, 13 industries were recorded, the strongest being telecommunications,

decreasing by 1.22%, before the pressures from VGI, FOX, CTR, etc.

Although the number and degree of increase were modest, the presence of large-cap sectors such as banks and real estate helped balance the market

scores and avoided a deeper decline.

Notably, in the banking group, STB increased by 2.34%, MBB by 1.84%, VIB by 2.86%, HDB by 1.05%,

BID by 0.91%, and TPB by 0.91%.

In another development, the very noticeable stock recently, YEG, fell to the floor after many consecutive ceiling-hitting sessions.

|

Many bank stocks “save” the market

Source: VietstockFinance

|

In terms of liquidity, the market today recorded a transaction value of nearly VND 16 trillion, which was significantly lower than in recent

sessions, and also explained the market’s lack of momentum to be able to break through the strong resistance zone of 1,280 points.

In this context, foreign investors increased pressure by net selling nearly VND 376 billion. The selling force focused on VCB with more

than VND 149 billion, FPT with nearly VND 68 billion, VNM with more than VND 49 billion, or STB with more than VND 44 billion.

Morning session: The main keyword is “fluctuation”

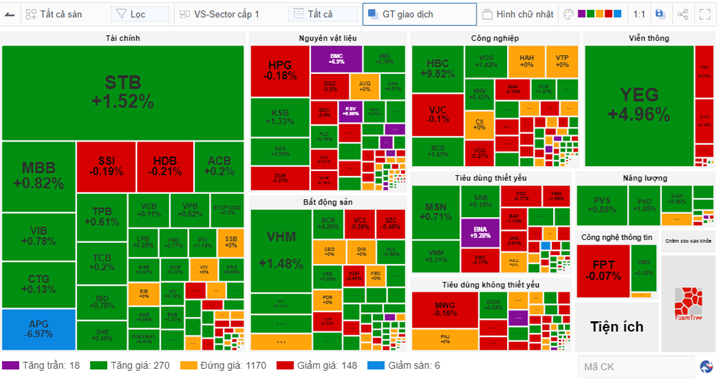

Fluctuation is the main keyword of the market in the morning session. At the end of the morning session, the VN-Index slightly

decreased by 0.2 points to 1,273.84, the UPCoM-Index decreased by 0.06 points to 94.53, and only the HNX-Index remained green

with an increase of 0.47 points to 230.29.

Source: VietstockFinance

|

The VN-Index continuously fluctuated, switching between green and red in the morning session, reflecting the pressures encountered at the

1,280-point resistance zone.

At the end of the morning session, there were 10 industries recording increased scores, while the number of decreasing industries was slightly higher at

12.

Although there were fewer, the list of increasing industries included the names of large-cap sectors such as banks (up 0.11%), real estate (up 0.31%),

and materials (up 0.12%), thus temporarily supporting the market well before the fluctuations.

In the banking group, notable gainers included STB (up 1.79%), VIB (up 1.56%), and BID (up 1.03%). In real

estate, there were two ceiling-hitting stocks, SCR and HPX. In the materials industry, although the “giant” HPG was slightly in

the red, the efforts of many other stocks such as AAA (up 2.03%), SMC (up 1.48%), and ceiling-hitting BMC, KSV, and

KCB contributed greatly to the overall result.

The industry with the strongest increase was energy (up 1.18%), with BSR (up 1.35%), PVD (up 1.25%), CST (up 4.56%), and AAH

(up 5.56%). Another industry that increased by more than 1% was utilities (up 1.03%), driven by GAS (up 1.17%) and ceiling-hitting PGV

…

On the decreasing side, transportation created the biggest pressure due to the impact of MVN (down 4.67%) and ACV (down 0.96%), among

others.

Industry movements in the morning session

Source: VietstockFinance

|

10:30 am: The market fluctuated slightly at strong resistance

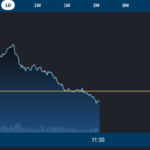

As of 10:30 am, although the green still appeared on the indices, it narrowed compared to the beginning of the morning session. The

VN-Index is currently up slightly by 1.04 points, reaching 1,275.08.

Market liquidity recorded more than 196 million shares traded, equivalent to a value of more than VND 4 trillion.

Foreign investors were net sellers of more than VND 260 billion, with the selling force concentrated in many “giants” such as VCB with more

than VND 50 billion, STB with more than VND 35 billion, and FPT with more than VND 20 billion…

The stock that attracted the most attention was probably YEG when it fell to the floor by 7%, despite a 5% increase at the beginning.

Previously, the stock of the producer of “Anh trai vượt ngàn chông gai” had 7 consecutive ceiling-hitting sessions and had to explain to the

management agency.

The rest of the stocks did not show much difference compared to the beginning of the day.

Opening: Continue towards the 1,280 zone

After a strong increase in points but failing to break through the resistance zone of around 1,280, the VN-Index continued to gain

points at the beginning of the morning session of December 26 to continue to test this zone.

As of 9:30 am, the main indices all increased slightly, with the VN-Index up 2.6 points to 1,276.64, the

HNX-Index up 0.98 points to 230.79, and the UPCoM-Index up 0.03 points to 94.62. In general, the green spread across major sectors such as

banking, securities, and real estate.

The market breadth recorded 288 gaining codes, including 18 ceiling-hitting codes, with notable materials stocks such as BMC,

KSV, and KCB… On the other hand, there were 154 losing codes, including 6 floor-hitting codes, with APG being the most

noticeable.

In the case of YEG, after 7 consecutive ceiling-hitting sessions, the stock is currently up nearly 5%.

|

Green spread across the stock market at the beginning of the morning session

Source: VietstockFinance

|

Looking at the notable Asian markets, the opening movements tended towards the green with Hang Seng, Nikkei 225, and All Ordinaries all increasing. In

contrast, Singapore’s Straits Times and Shanghai Composite decreased slightly.

Source: VietstockFinance

|

– 09:46 26/12/2024

The Flow of Capital: A Week of Healthy Adjustments

Although the VN-Index fell in 4 out of 5 trading sessions last week, experts do not consider this a cause for concern. In fact, a slowdown and a pullback are healthy signals for the market after the initial strong gains and the explosive session on December 5th.

The Market Beat: Afternoon Dip Turns All Three Boards Red

The unexpected afternoon slump saw all three market indices close in the red on December 12th. The VN-Index led the decline, falling 1.51 points to 1,267.35, followed by the HNX-Index, which dropped 0.19 points to 227.99. The UPCoM index also slipped, shedding 0.06 points to close at 92.68. Foreign investors offloaded Vietnamese shares for the fourth consecutive session.