Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 384 million shares, equivalent to a value of more than 9.3 trillion VND; HNX-Index reached over 52.9 million shares, equivalent to a value of more than 925 billion VND.

VN-Index continued to fluctuate in the afternoon session with the advantage tilting towards buyers, but profit-taking pressure increased, causing the index to weaken at times, closing in the green with investor uncertainty. In terms of impact, HVN, HPG, BVH, and STB were the most positive influences on the VN-Index, contributing over 1.7 points. On the other hand, VNM, SSI, VCB, and PLX had the most negative impact, but their influence was not significant.

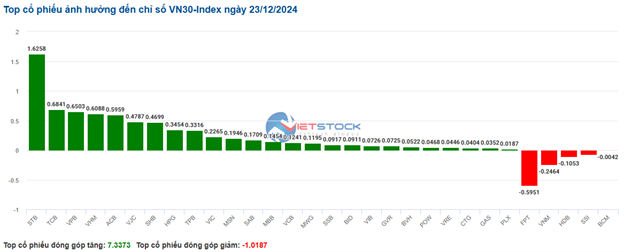

| Top 10 stocks with the biggest impact on the VN-Index on 12/23/2024 |

Similarly, the HNX-Index also had a positive performance, influenced by the gains in KSV (+9.99%), PVI (+7.26%), NTP (+6.15%), and HGM (+7.61%)…

|

Source: VietstockFinance

|

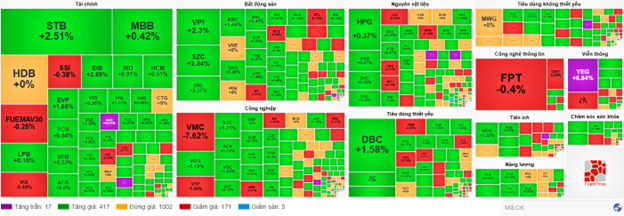

The industrial sector was the best-performing group in the market, rising 2.27%, led by HVN (+3.92%), HAH (+1.62%), VOS (+0.59%), and ACV (+3.79%). Following the recovery were the materials and consumer staples sectors, with gains of 1.12% and 0.73%, respectively. On the other hand, the telecommunications sector saw the biggest decline in the market, falling by -0.24%, mainly due to losses in VGI (-0.52%), SBD (-3.37%), ICT (-2.48%), and VNZ (-2%).

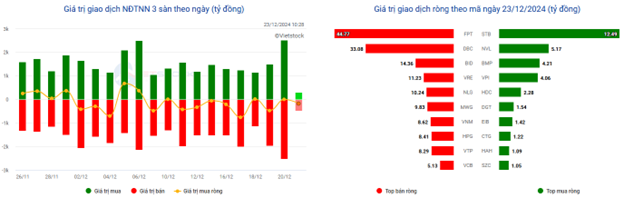

In terms of foreign investors’ activities, they continued to be net sellers on the HOSE exchange, focusing on VCB (98.67 billion VND), FPT (73.05 billion VND), VTP (47.72 billion VND), and VNM (36.47 billion VND). On the HNX exchange, foreign investors net sold over 15 billion VND, mainly offloading PVS (18.85 billion VND), IDC (9.04 billion VND), SHS (5.94 billion VND), and BVS (2.02 billion VND).

| Foreign investors’ buying and selling activities |

Morning Session: Foreign investors continued to sell, while the VN-Index maintained its upward momentum.

At the end of the morning session, all three indices were in the green. The VN-Index gained 4.43 points, temporarily settling above 1,261 points, while the HNX-Index rose 1.02 points to 228.09 points. The VN30 basket saw 18 stocks advance, 6 decline, and 6 remain unchanged, with the majority in positive territory.

Market liquidity remained low, indicating investors’ cautious sentiment. By midday on December 23, the trading volume of the VN-Index reached only 191 million shares, with a value of 4.4 trillion VND. The HNX-Index recorded a trading volume of 25.9 million shares, equivalent to a value of 399 billion VND. These were modest figures observed during the morning session.

Among the stocks that negatively impacted the market, VNM contributed the most significant decline, shaving off 0.25 points from the index. FPT was the second-largest detractor, followed by HDB, FRT, VTP, and others. Conversely, stocks like STB, BID, SAB, and GVR continued their upward momentum, providing support to the market.

Additionally, there was improved buying interest in transportation stocks, such as ACV (+2.64%), MVN (+11.11%), PHP (+2.69%), TMS (+3.63%), VJC (+1.92%), and SGP (+2.48%), among others. Conversely, VTP and PVP traded in the red from the start of the session, falling by 1.48% and 0.83%, respectively.

Money flowed into food and beverage stocks, with notable gains in SAB, HAG, DBC, BAF, and others. In particular, VSF witnessed a strong surge during the morning session, climbing by 5.26%.

Similarly, the banking sector witnessed a broad-based rally, with most stocks trading in positive territory. The large-cap banks, including STB, TPB, EIB, and NAB, posted solid gains, contributing significantly to the index’s advance. Other lenders, such as BID, TCB, VPB, MBB, ACB, SSB, SHB, and NVB, also recorded positive performances.

Turning to foreign investors’ activities, selling pressure intensified, with net selling values of over 251 billion VND on the HOSE exchange and over 19 billion VND on the HNX exchange at the end of the morning session.

10:35 am: Fluctuating with a slight upward bias

Investor sentiment shifted from positive at the start of the session to cautious, resulting in fluctuations in the VN-Index. The industrial and materials sectors led the market’s recovery.

Most stocks in the VN30 basket witnessed strong upward momentum. Notably, STB contributed a gain of 1.62 points to the index, followed by TCB with 0.68 points, VPB with 0.65 points, and VHM with 0.6 points. Conversely, a few stocks, including FPT, VNM, HDB, SSI, and BCM, faced selling pressure, dragging the index down by more than 1 point.

Source: VietstockFinance

|

Although the market exhibited some divergence, the industrial sector took the lead in the recovery, advancing by 2.38%. Within this sector, transportation stocks continued to find favor with buyers, such as VOS (+0.89%), VJC (+1.71%), ACV (+3.21%), and HAH (+0.2%). On the other hand, a few stocks remained unchanged or traded around the reference price, while selling pressure persisted in some stocks, although the declines were not significant, such as VTP (-1.06%), DC4 (-1.07%), VC2 (-0.98%), and VEA (-0.25%).

Following closely was the materials sector, which also witnessed a predominance of green ticks, including gains in HPG (+0.37%), DHC (+5.17%), DGC (+0.35%), VGC (+1.03%), and BMP (+2.08%). Only a handful of stocks traded unchanged or in negative territory, such as CSV (-0.67%), SHI (-1.69%), and VGS (-0.31%).

On the flip side, the information technology sector painted a negative picture, with notable declines in FPT (-0.4%), CMG (-0.71%), CMT (-2.42%), and VTB (-0.47%).

The market breadth inclined towards the bullish side, with over 410 gainers versus around 170 losers. The VN-Index climbed nearly 6 points to 1,263 points, while the HNX-Index rose 0.59%, hovering around the 228-point level. The UPCoM-Index also joined the rally, advancing by 0.15%.

Source: VietstockFinance

|

Total trading volume across the three exchanges surpassed 195 million shares, corresponding to a value of over 4 trillion VND. However, foreign investors remained net sellers, offloading over 183 billion VND worth of shares, mainly in FPT, DBC, BID, and VRE.

Source: VietstockFinance

|

Opening: Green across the board from the start

At the beginning of the December 23 session, as of 9:30 am, the VN-Index opened in positive territory, climbing to 1,262.85 points. Meanwhile, the HNX-Index also edged higher, hovering around the 228.3-point level.

The VN30 basket witnessed a majority of its components in the green, with only 5 decliners, 24 gainers, and 1 unchanged stock. Among the decliners, FPT, VNM, and SSI posted the most significant losses. On the other hand, STB, TPB, and BVH were the top gainers.

The industrial sector took the lead in the market’s advance, rising by 2.13%. Within this sector, several stocks witnessed strong buying interest from the opening bell, including ACV (+4.2%), HAH (+0.91%), VOS (+3.26%), VTP (+0.77%), VJC (+0.4%), and PC1 (+1.32%), among others.

Additionally, the telecommunications services sector contributed positively to the market’s performance. Notably, YEG continued its upward surge, hitting the daily limit-up, while other stocks in the sector, such as VGI (+1.25%), CTR (+0.57%), MFS (+4.71%), and FOX (+2.29%), also recorded solid gains.

The Market Beat: A Tale of Diverging Fortunes

The market closed with the VN-Index down 3.12 points (-0.24%) to 1,272.02, and the HNX-Index fell 0.99 points (-0.43%) to 228.14. The market breadth tilted towards decliners with 436 losers and 274 gainers. Notably, 20 stocks in the VN30 basket ended in negative territory, with 6 advancing and 4 unchanged.

The Hesitancy Hurdle: Navigating Market Uncertainty

The VN-Index edged slightly higher, snapping a four-day losing streak with the emergence of a Doji candlestick pattern. Accompanying this pattern, the trading volume remained below the 20-day average, indicating investor indecision in the market. Notably, the Stochastic Oscillator has now crossed into overbought territory and is flashing a sell signal. This development suggests that the risk of a market correction increases if the indicator falls out of this zone.

The Power of Positive Thinking

The VN-Index surged and retested its old peak in early December 2024 (around the 1,270-1,280 points region). If, in the upcoming sessions, the index surpasses this threshold alongside maintaining trading volume above the 20-day average, the uptrend will be reinforced. Notably, the MACD indicator has already signaled a buy opportunity by crossing above the signal line. If the Stochastic Oscillator also flashes a similar signal in the forthcoming sessions, the outlook will turn even more optimistic.

The Art of Liquidity Recovery

The VN-Index witnessed a positive trading week, surging above the Middle Bollinger Band and firmly holding above the 50-week SMA. However, trading volume has remained below the 20-week average since November 2024, indicating a lack of significant participation from investors. If upcoming sessions witness an improvement in liquidity, the index could potentially target the old peak of October 2024, which lies in the 1,285-1,300 point range.

Market Beat: Final Hour Push Prevents Steep VN-Index Dip, HNX Turns Green

The market was poised for a significant downturn as the VN-Index briefly dipped below the 1,250-point threshold amid mounting pressures in the afternoon session. However, a surge of buying momentum from 2:20 pm onwards helped indices pare their losses, resulting in a less pessimistic close.