I. VIETNAMESE STOCK MARKET WEEK 09-13/12/2024

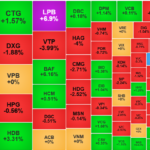

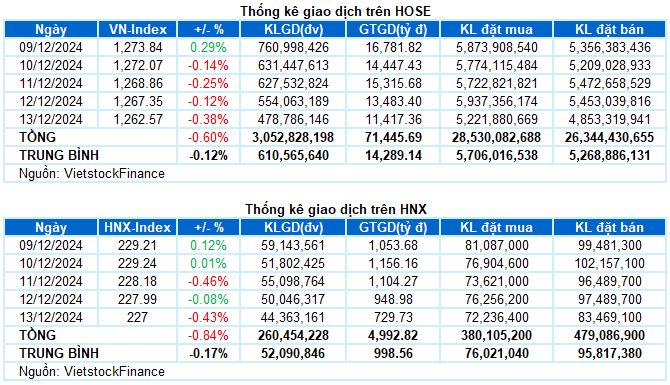

Trading: The main indices continued to fall in the last trading session of the week. At the close of December 13, VN-Index fell 0.38% from the previous session to 1,262.57 points; HNX-Index decreased by 0.43% to 227 points. For the whole week, the VN-Index lost 7.57 points (-0.6%), and the HNX-Index dropped by 1.93 points (-0.84%).

The stock market corrected with 4/5 decreasing sessions last week. Profit-taking pressure increased as weak demand caused difficulties for the market. Moreover, the continuous foreign net selling, along with the lack of supportive information and leading stocks, further shook investors’ confidence. The VN-Index ended the trading week at the 1,262.57 mark.

In terms of impact, VCB, HPG, and MSN were the main pillars dragging the index down the most today, taking away about 1.5 points from the VN-Index. In contrast, there was no prominent name on the positive side to support the market. MWG took the lead but only helped the index increase by less than 0.4 points, while the remaining stocks had an insignificant impact.

The overwhelming selling pressure caused most sectors to end the week in red. Except for the outstanding performance of BSR (+4.65%), which helped the energy group record a 2.68% gain. However, most of the remaining stocks in this industry could not escape the general downward trend.

The telecommunications and materials sectors recorded the most negative declines in the last session of the week, with red covering large-cap stocks such as VGI (-0.78%), FOX (-2.25%), CTR (-1.39%), VNZ (-1.32%); HPG (-1.09%), GVR (-0.79%), DGC (-1.29%), VGC (-1.35%), HSG (-1.87%), PHR (-1.79%), and KSV (-6.1%).

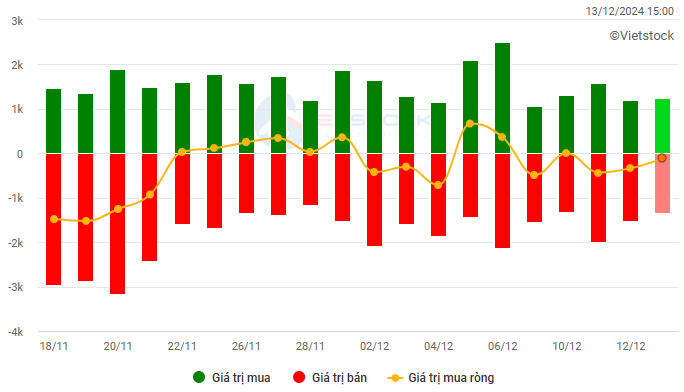

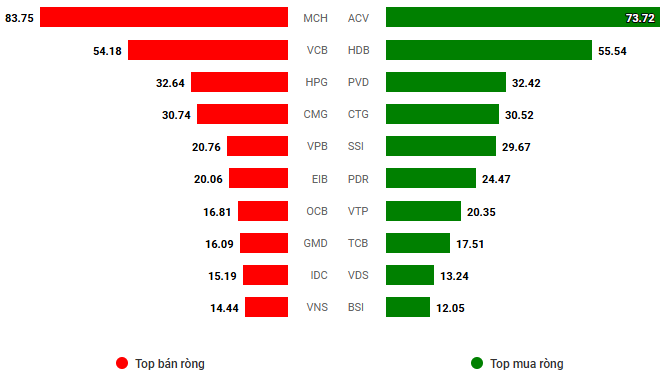

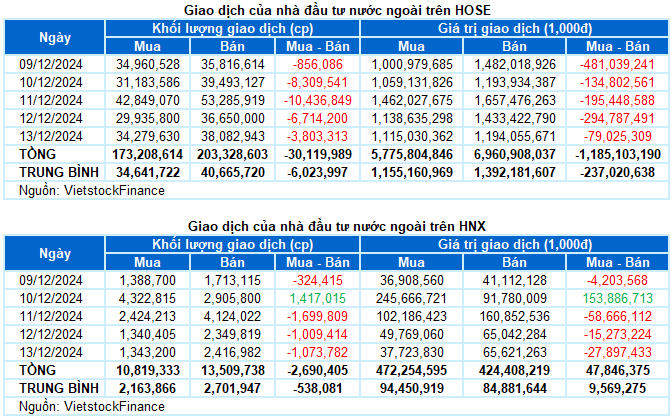

Foreign investors continued to net sell with a value of more than VND 1,130 billion on both exchanges last week. Accordingly, they net sold more than VND 1,180 billion on the HOSE and net bought nearly VND 48 billion on the HNX.

Trading value of foreign investors on HOSE, HNX, and UPCOM by day. Unit: VND billion

Net trading value by stock code. Unit: VND billion

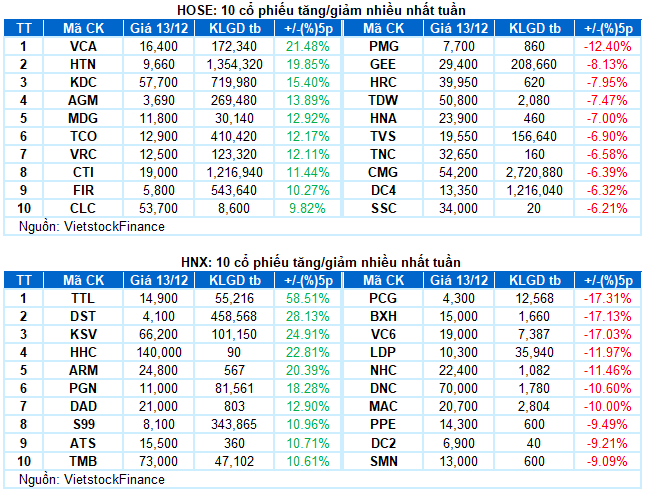

Stocks that increased significantly last week were HTN

HTN rose by 19.85%: HTN had a brilliant trading week with a gain of 19.85%. The stock continuously increased with the appearance of the Rising Window and White Marubozu candlestick patterns. At the same time, the trading volume surged strongly above the 20-day average, indicating a very optimistic investor psychology.

However, the Stochastic Oscillator indicator has penetrated deep into the overbought zone and is likely to give a sell signal soon. If this happens, the stock’s correction risk will increase.

Stocks that decreased sharply last week were GEE

GEE fell by 8.13%: GEE experienced a rather negative trading week as it continuously decreased and broke down below the SMA 200-day moving average. In addition, the trading volume exceeded the 20-day average, reflecting investors’ pessimistic psychology.

Currently, the Stochastic Oscillator and MACD indicators continue to decline after giving sell signals. This suggests that the short-term correction risk remains.

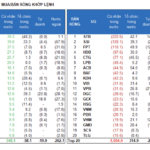

II. STOCK MARKET STATISTICS FOR LAST WEEK

Economics & Market Strategy Division, Vietstock Consulting Department

The Stock Market Sell-Off: A Whopping 1,756.1 Billion VND Net Selling by Individual Investors

The market is buzzing with liquidity as banks take the lead. Today’s trading volume across all three exchanges reached an impressive 19,000 billion VND, with foreign investors making a remarkable turnaround. They net bought an outstanding 738.1 billion VND, and their matched orders alone accounted for 588.2 billion VND in net purchases. It’s a clear sign of confidence in the market, and we can expect some exciting movements in the coming days.

The Psychology of Rest Dominates, Liquidity Plunges

Investor sentiment was muted in the final days of the 2024 financial year. This morning’s trading activity by foreign investors hit a record low, with overall market liquidity plunging 34% from the previous session. The stock market witnessed a sea of red, although the majority of stocks experienced only minor fluctuations. A few securities and investment stocks continued to buck the trend, swimming against the tide.

The Stock Market Week of December 23-27, 2024: Foreign Investors Turn Net Buyers

The VN-Index rose last week, with alternating up and down sessions. Erratic trading volume around the 20-day average reflected investor sentiment lacking stability. However, foreign investors’ net buying after a continuous net-selling period bodes well for a more optimistic outlook.

The Perfect Headline: “The Adjustment Pressure Persists”

The VN-Index narrowed losses with the emergence of a Hammer candlestick pattern, holding firmly above the 200-day SMA. Moreover, trading volume surged above the 20-day average, indicating a return of liquidity to the market. However, the Stochastic Oscillator and MACD continued their downward trajectory, issuing sell signals. This suggests that the risk of short-term corrections persists.