I. MARKET ANALYSIS OF THE STOCK MARKET BASED ON DATA FROM DECEMBER 30, 2024

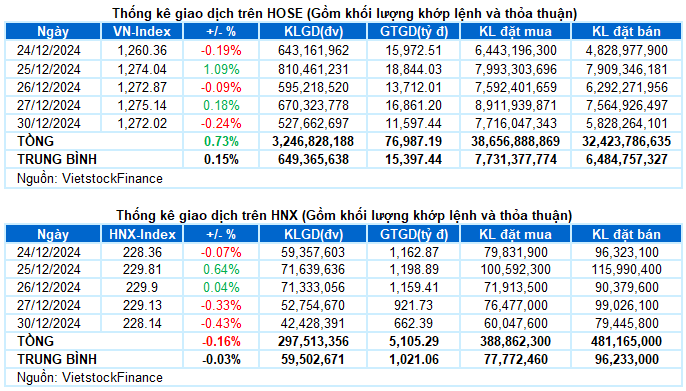

– Key indices witnessed a decline during the trading session on December 30. The VN-Index closed 0.24% lower at 1,272.02 points, while the HNX-Index dropped by 0.43% compared to the previous session, settling at 228.14 points.

– Trading volume on the HOSE reached nearly 453 million units, marking a 23.2% decrease from the previous session. Meanwhile, the trading volume on the HNX also witnessed a decline of 25.3%, amounting to over 35 million units.

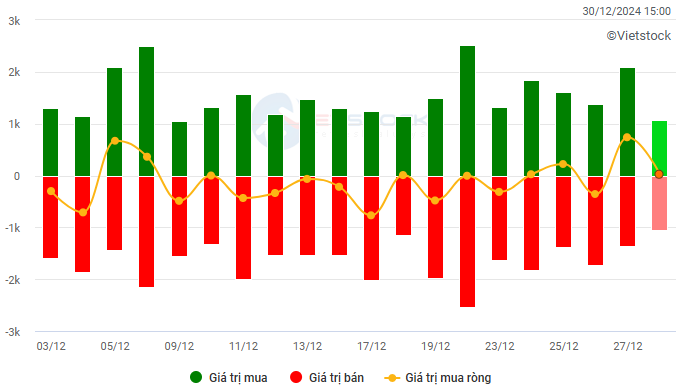

– Foreign investors recorded a slight net buying on the HOSE and HNX exchanges, with values of over VND 2 billion and nearly VND 6 billion, respectively.

Trading value of foreign investors on HOSE, HNX, and UPCOM exchanges for December 30, 2024. Unit: VND billion

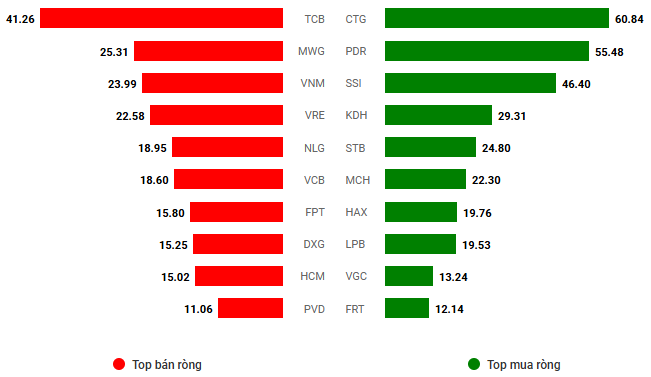

Net trading value by stock ticker. Unit: VND billion

– The stock market witnessed a lackluster performance during the final days of the year. The adjustment in the group of large-cap stocks after the previous week’s rally left the indices lacking support, resulting in a dominance of selling pressure throughout the trading session. Investors, both domestic and foreign, exhibited a wait-and-see attitude, anticipating clearer signals in the new year. As a result, buying interest remained weak, and no significant recovery efforts were observed. At the close of the December 30 session, the VN-Index lost 3.12 points (-0.24%), settling at 1,272.02 points.

– In terms of impact, BID was the stock that exerted the most pressure on the index, resulting in a loss of more than 1.2 points for the VN-Index. This was followed by TCB, MBB, and VCB, which were also dominated by selling pressure, causing the overall index to lose nearly 1 point. On the positive side, the remarkable surge in the share price of HDB after the ATC session helped it emerge as the top gainer, contributing over 1.5 points to the VN-Index‘s advance.

– The VN30-Index rebounded slightly above the reference level, registering a modest gain of 0.04% to close at 1,347.35 points. However, the breadth remained skewed towards decliners, with 20 stocks falling, 6 advancing, and 4 remaining unchanged. Among the decliners, BID, VIB, SSB, and VJC occupied the bottom positions, each posting a decline of over 1%. Conversely, HDB stood out with its impressive performance, followed by POW and STB, which also moved against the broader market trend, registering gains of over 1%.

Seven out of eleven sector indices closed in negative territory. The materials and healthcare sectors were the worst performers, declining by 0.8%. Selling pressure prevailed across the board, with notable losers including KSV, which hit the daily lower limit, BMP (-1.56%), PHR (-1.12%), TVN (-1.25%), AAA (-2.02%), DHC (-2.22%), PLC (-1.3%); DHT (-4.74%), PMC (-3.93%), FIT (-1.41%), IMP (-0.94%), and DHG (-0.87%).

The financial sector, after its rally in the previous week, exhibited increased divergence. Aside from the standout performance of HDB (+6.81%), a handful of stocks managed to attract decent buying interest, including LPB (+1.77%), STB (+1.2%), VAB (+2.2%), VBB (+1.1%), OCB (+0.46%), and HCM (+0.51%). Conversely, the majority of stocks in this sector underwent adjustments, with notable losers being BID (-2.3%), VIB (-1.5%), MBB (-1%), SSB (-1.18%), and TCB (-0.81%), among others.

On the upside, the consumer staples sector led the market, primarily driven by the robust performance of MCH (+10.78%), SAB (+0.54%), MML (+3.33%), PAN (+1.27%), and VCF (+1%). Nevertheless, several stocks within this sector still ended the day in negative territory, including VNM (-0.78%), DBC (-1.58%), HNG (-1.64%), ANV (-1.01%), and VHC (-0.56%), to name a few.

The VN-Index has returned to negative territory, exhibiting alternating sessions of gains and losses recently. Moreover, trading volume has been erratic, fluctuating around the 20-day average, indicating unstable investor sentiment. However, the MACD and Stochastic Oscillator indicators continue to trend upward after generating buy signals. Should this trend persist in the upcoming sessions, the short-term outlook may not be overly risky.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – MACD and Stochastic Oscillator Maintain Buy Signals

The VN-Index has returned to negative territory, exhibiting alternating sessions of gains and losses recently. Moreover, trading volume has been erratic, fluctuating around the 20-day average, indicating unstable investor sentiment.

Nonetheless, the MACD and Stochastic Oscillator indicators continue to trend upward after generating buy signals. Should this trend be sustained in the upcoming sessions, the short-term outlook may not be overly pessimistic.

HNX-Index – Trading Volume Declines Below 20-Day Average

The HNX-Index continued its downward trajectory amid a decline in trading volume below the 20-day average. This suggests that investors remain cautious.

At present, the MACD and Stochastic Oscillator indicators have generated sell signals, and the MACD is approaching a potential crossover below the Signal Line. Should this occur, the risk of further corrections will increase.

Money Flow Analysis

Movement of Smart Money: The Negative Volume Index indicator for the VN-Index has crossed below the EMA 20-day moving average. If this state persists in the next session, the risk of a sudden downward thrust will increase.

Foreign Capital Flow: Foreign investors continued net buying on December 30, 2024. If this trend is maintained in the upcoming sessions, the situation may become less pessimistic.

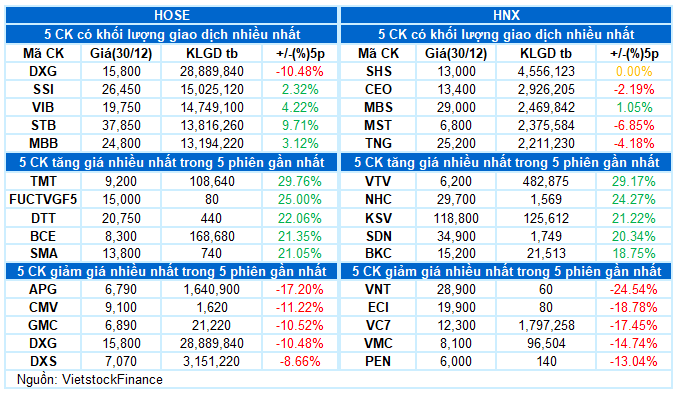

III. MARKET STATISTICS FOR DECEMBER 30, 2024

Analysis and Strategy Department, Vietstock Consulting

– 17:10 30/12/2024

Market Beat: Transport Sector Sustains Recovery, VN-Index Holds Green Fort

The market ended the session on a positive note, with the VN-Index climbing 0.42% to 1,262.76, and the HNX-Index gaining 0.63% to close at 228.51. Buyers dominated the market breadth, with 484 tickers advancing against 253 declining tickers. However, the VN30 basket tilted towards the red, recording 19 gainers, 7 losers, and 4 unchanged stocks.

The Market Beat: A Tale of Diverging Fortunes

The market closed with the VN-Index down 3.12 points (-0.24%) to 1,272.02, and the HNX-Index fell 0.99 points (-0.43%) to 228.14. The market breadth tilted towards decliners with 436 losers and 274 gainers. Notably, 20 stocks in the VN30 basket ended in negative territory, with 6 advancing and 4 unchanged.

The Hesitancy Hurdle: Navigating Market Uncertainty

The VN-Index edged slightly higher, snapping a four-day losing streak with the emergence of a Doji candlestick pattern. Accompanying this pattern, the trading volume remained below the 20-day average, indicating investor indecision in the market. Notably, the Stochastic Oscillator has now crossed into overbought territory and is flashing a sell signal. This development suggests that the risk of a market correction increases if the indicator falls out of this zone.

The Power of Positive Thinking

The VN-Index surged and retested its old peak in early December 2024 (around the 1,270-1,280 points region). If, in the upcoming sessions, the index surpasses this threshold alongside maintaining trading volume above the 20-day average, the uptrend will be reinforced. Notably, the MACD indicator has already signaled a buy opportunity by crossing above the signal line. If the Stochastic Oscillator also flashes a similar signal in the forthcoming sessions, the outlook will turn even more optimistic.

The Art of Liquidity Recovery

The VN-Index witnessed a positive trading week, surging above the Middle Bollinger Band and firmly holding above the 50-week SMA. However, trading volume has remained below the 20-week average since November 2024, indicating a lack of significant participation from investors. If upcoming sessions witness an improvement in liquidity, the index could potentially target the old peak of October 2024, which lies in the 1,285-1,300 point range.