Gold prices dropped significantly on Friday (Dec 27) as rising Treasury bond yields pressured the precious metal market. The focus for gold investors at the moment is on President-elect Donald Trump’s return to the White House and how his policies may overshadow prospects for monetary easing in the coming year.

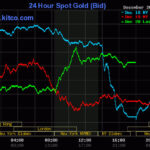

At the close of New York trading, spot gold fell by $12.9/oz compared to the previous session’s close, equivalent to a 0.49% drop, settling at $2,621.3/oz, according to Kitco exchange data. Converted at Vietcombank’s selling rate, this price is equivalent to about VND 80.8 million/lotte, down VND 200,000/lotte from yesterday morning.

The yield on the 10-year US Treasury bond rose more than 4 basis points on Friday, reaching 4.627% at the end of the session, after hitting its highest level since May on Thursday.

“Yields rose a bit and gold prices came under pressure today, while trading volume in the market remained low during the holiday season,” said senior strategist Bob Haberkorn of RJO Futures.

This week, spot gold fell by $2.1/oz, less than 0.01%. World gold prices also remained almost unchanged from last weekend’s levels.

Long-term factors favorable to gold prices, such as geopolitical tensions and central bank gold demand, continue to support the market. However, concerns about higher interest rates in the US during Trump’s next term have pushed up US Treasury bond yields and the USD exchange rate, putting downward pressure on gold.

From over 4.5% last week, the yield on the 10-year US Treasury bond has now crossed the 4.6% mark.

The Dollar Index, which measures the strength of the USD against a basket of six other major currencies, fell 0.11% on Friday to 108.01. However, the index rose 0.36% this week and has climbed 7.6% in the last three months.

Vietcombank’s USD buying and selling rates for the week were set at VND 25,208 and VND 25,538, respectively, down VND 2 from last weekend’s rates.

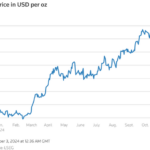

In a report on the gold price outlook for the coming year, senior analyst Fawad Razaqzada of City Index said the strong USD trend – supported by the Fed’s less dovish monetary policy stance and positive US economic data – would limit gold’s upside potential in the first half.

“But despite the short-term challenges, the $3,000/oz gold price target remains achievable,” Mr. Razaqzada said, adding that any adjustment or accumulation of gold prices in the first half of 2025 could pave the way for a rally in the second half.

“Thanks to the strong momentum in gold prices in 2024, any dip will attract bargain hunters and long-term investors. They are the ones who took profits or missed the big rally this year. These factors will help stabilize the market and pave the way for higher gold prices in the future,” wrote Mr. Razaqzada. He also believed that significant macroeconomic shifts and rising geopolitical risks would play a crucial role in gold’s path next year.

Many other experts also remain optimistic about the gold price outlook for 2025, even if the Fed raises rates less. “Next year, with central banks’ net gold purchases, I believe gold prices will surpass $3,000/oz at some point, possibly in the summer,” Haberkorn predicted.

This week, the world’s largest gold ETF, SPDR Gold Trust, sold a net 4.9 tons of gold, reducing its holdings to 872.5 tons.

The Bitter Truth: Coffee Prices Plummet

Closing the first trading session of the week, two coffee commodities shocked the market as their prices plummeted drastically.

The Curious Case of Gold’s Global Price Movement

The gold price hovers tentatively, awaiting a new catalyst to spark action. Investors are cautious ahead of impending U.S. economic data and the Federal Reserve’s interest rate trajectory. With markets holding their breath, all eyes are on the Fed’s next move, as they delicately balance inflation concerns with economic growth. This delicate dance has investors poised, ready to pounce or retreat, depending on the Fed’s forthcoming steps.