I. MARKET ANALYSIS OF THE STOCK MARKET BASED ON DATA FROM DECEMBER 16, 2024

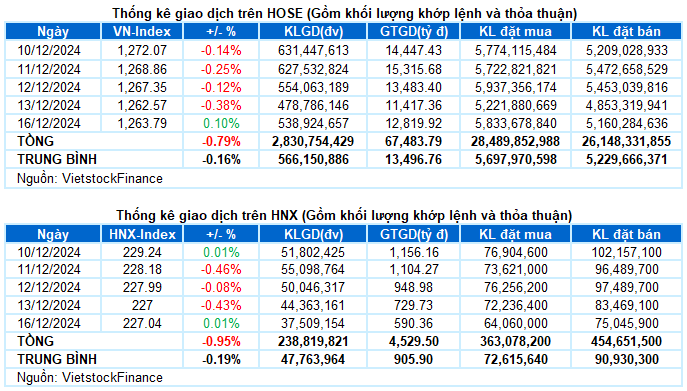

– The main indices fluctuated around the reference level during the trading session on December 16. The VN-Index closed slightly up 0.1%, reaching 1,263.79 points; while the HNX-Index edged up 0.01% from the previous session, to 227.04 points.

– The matching volume on the HOSE reached nearly 386 million units, a 2.4% decrease compared to the previous session. The matching volume on the HNX decreased by 9.8%, reaching nearly 36 million units.

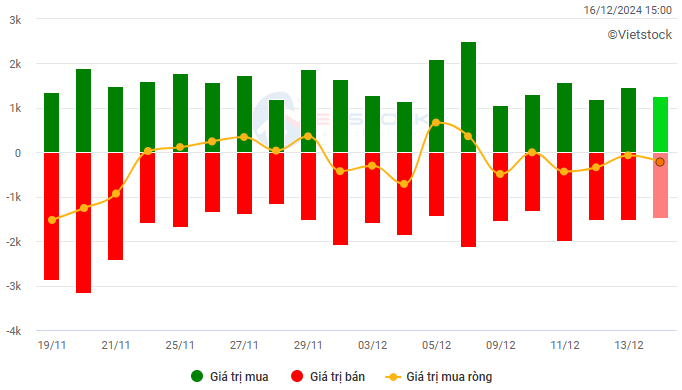

– Foreign investors net sold on the HOSE with a value of more than 204 billion VND and net bought nearly 4 billion VND on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: Billion VND

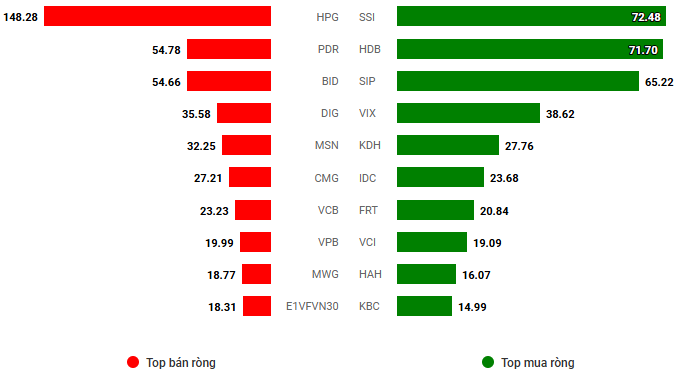

Net trading value by stock code. Unit: Billion VND

– The first trading session of the week witnessed a tug-of-war between buyers and sellers, with the indices fluctuating amid low liquidity. This reflected the cautious sentiment of investors, awaiting further catalysts. A late rebound helped the VN-Index hold the support level of 1,260 and close in the green, up 1.22 points to 1,263.79.

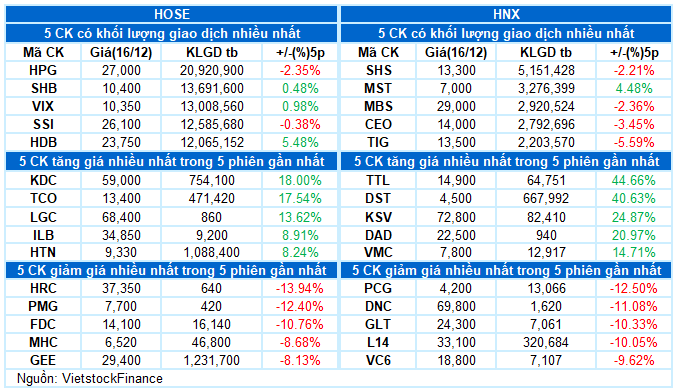

– BID, HVN, and VNM were the top positive influencers, each contributing almost half a point to the VN-Index. On the other hand, HPG, GVR, and MBB performed less impressively, with the most considerable negative impact, although not significantly so.

– The VN30-Index closed near the reference level, at 1,331.82 points. The market breadth was relatively balanced, with 14 declining stocks, 10 advancing stocks, and 6 stocks closing unchanged. POW, SSI, and VNM led the gainers, rising by 1.2%. Conversely, BVH experienced the most considerable selling pressure, falling by 1.7%. The remaining stocks witnessed only slight fluctuations of less than 1%.

The consumer staples sector led the gains, rising nearly 1%, thanks to the strong performance of MCH (+3.33%), VNM (+1.25%), KDC (+2.25%), ANV (+2.19%), and VLC (+4.09%). The telecommunications sector followed with a 0.63% increase, driven mainly by VGI (+1.01%) and SGT (+3.06%).

Several bright spots attracted positive momentum in the remaining sectors, including HVN (+3.21%), ACV (+1.27%), FRT (+2.25%), PNJ (+1.24%), TLG (+3.73%), GEX (+2.7%), CMG (+2.77%), KBC (+1.8%), IDC (+1.42%), SIP (+2.79%), VIX (+2.99%), and SSI (+1.16%).

On the downside, the energy sector lagged the most, falling by 1.4%, mainly due to the decline in BSR (-2.22%) and PVS (-0.59%). The healthcare, materials, and utilities sectors also closed slightly in the red.

The VN-Index posted a slight gain while ending its four-day losing streak, forming a Doji candlestick pattern. Additionally, the trading volume remained below the 20-day average, indicating investors’ hesitation. At the moment, the Stochastic Oscillator has given a sell signal within the overbought region. This suggests that the risk of a downward adjustment will increase in the near future if the indicator falls out of this zone.

II. TREND AND PRICE MOVEMENT ANALYSIS

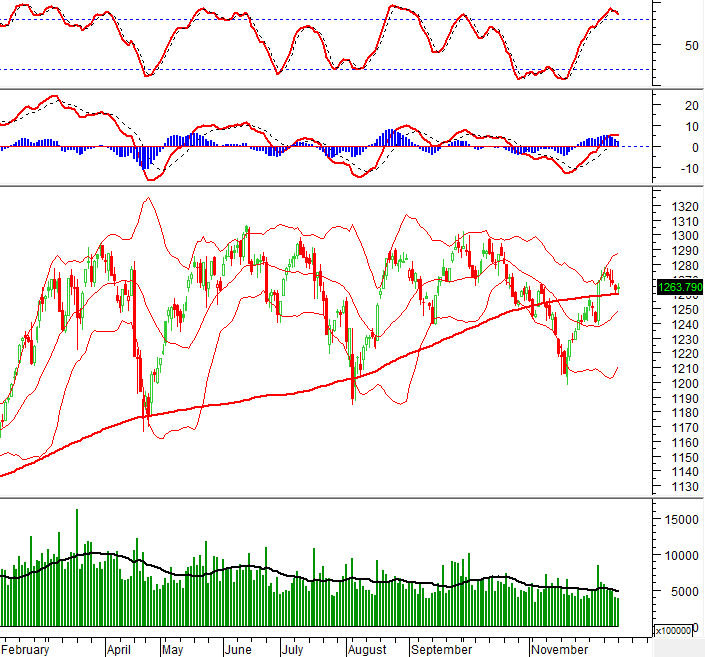

VN-Index – Doji Candlestick Pattern Emerges

The VN-Index posted a slight gain, breaking its four-day losing streak, and formed a Doji candlestick pattern. Moreover, the trading volume remained below the 20-day average, indicating investors’ cautious sentiment.

At present, the Stochastic Oscillator has issued a sell signal within the overbought territory. This suggests an increased likelihood of a downward adjustment in the coming period if the indicator falls out of this region.

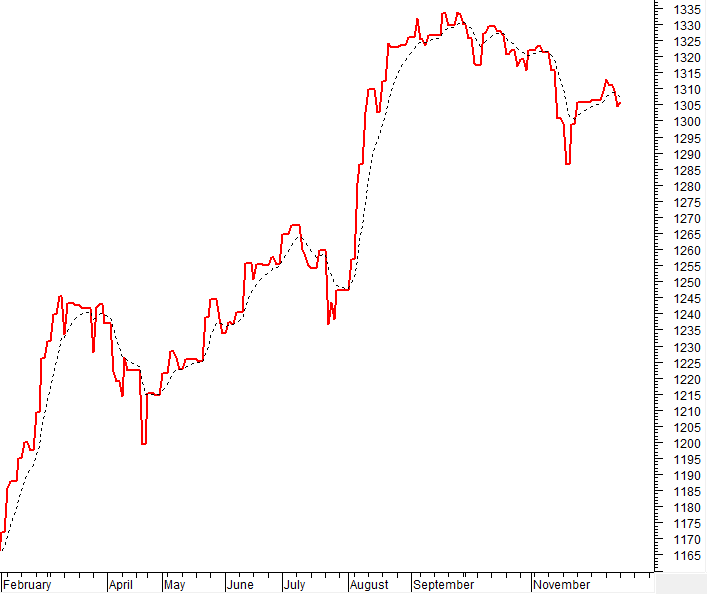

HNX-Index – Stochastic Oscillator Continues Downward after Sell Signal

The HNX-Index edged higher, accompanied by a High Wave Candle pattern, indicating investors’ cautious sentiment.

Currently, the Stochastic Oscillator continues to move downward after providing a sell signal and exiting the overbought zone. This suggests that the index’s outlook remains uncertain in the near term.

Analysis of Money Flow

Movement of Smart Money: The Negative Volume Index of the VN-Index fell below the 20-day EMA. If this condition persists in the next session, the risk of a sudden decline (thrust down) will increase.

Foreign Capital Flow: Foreign investors continued to net sell during the trading session on December 16, 2024. If foreign investors maintain this stance in the coming sessions, the market sentiment may turn less optimistic.

III. MARKET STATISTICS FOR DECEMBER 16, 2024

Economic and Market Strategy Analysis Department, Vietstock Consulting

The Power of Positive Thinking

The VN-Index surged and retested its old peak in early December 2024 (around the 1,270-1,280 points region). If, in the upcoming sessions, the index surpasses this threshold alongside maintaining trading volume above the 20-day average, the uptrend will be reinforced. Notably, the MACD indicator has already signaled a buy opportunity by crossing above the signal line. If the Stochastic Oscillator also flashes a similar signal in the forthcoming sessions, the outlook will turn even more optimistic.

The Art of Liquidity Recovery

The VN-Index witnessed a positive trading week, surging above the Middle Bollinger Band and firmly holding above the 50-week SMA. However, trading volume has remained below the 20-week average since November 2024, indicating a lack of significant participation from investors. If upcoming sessions witness an improvement in liquidity, the index could potentially target the old peak of October 2024, which lies in the 1,285-1,300 point range.

The Market Beat on December 24th: Strong Inflows in the Afternoon Session See VN-Index Recover to Near Reference.

Despite a negative mid-session turn, the market recovered to close near reference levels today. The VN-Index ended at 1,260 points, a minor loss of 2.4 points, while the HNX-Index dipped 0.15 points to 228.36 points.

Vietstock Daily: Is the Short-Term Outlook Not Too Gloomy?

The VN-Index witnessed a slight dip as trading volumes fell below the 20-day average, indicating a cautious investor sentiment following a strong previous rally. However, a key technical indicator, the MACD, has turned positive, crossing above the Signal Line, and the Stochastic Oscillator is also flashing a similar signal. Should this status quo persist in the upcoming sessions, the outlook may not be as pessimistic as some might believe.