Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 452 million shares, equivalent to a value of more than 10 trillion VND; HNX-Index reached over 35 million shares, equivalent to a value of more than 584 billion VND.

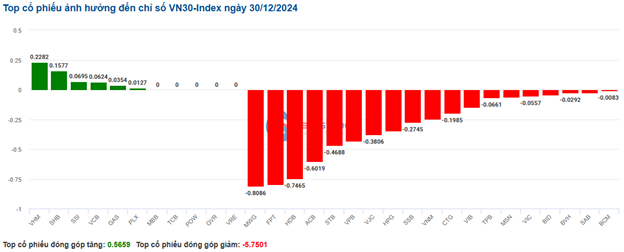

The afternoon session began without much surprise as the VN-Index continued its narrow sideways trend below the reference level and closed in the red. In terms of impact, BID, TCB, MBB, and VCB were the four bank codes that had the most negative impact, taking away more than 2.1 points from the index. On the other hand, HDB, LPB, FPT, and STB were the codes with the most positive impact, contributing over 2.3 points to the VN-Index.

| Top 10 stocks with the strongest impact on the VN-Index on December 30, 2024 |

Similarly, the HNX-Index also did not show much optimism, with the index negatively impacted by the codes KSV (-10%), DHT (-4.74%), PVS (-0.58%), HUT (-0.63%)…

|

Source: VietstockFinance

|

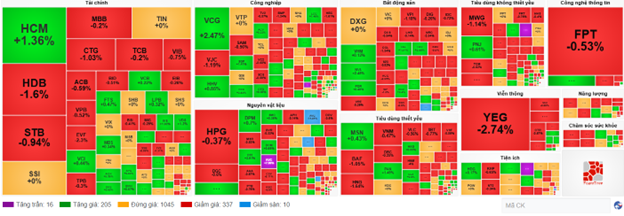

The materials sector was the sector with the largest decrease of 0.82%, mainly due to the code HPG (-0.37%), DGC (-0.77%), DPM (-0.42%), and DCM (-0.14%). This was followed by the healthcare and non-essential consumer sectors, which decreased by 0.81% and 0.57%, respectively. On the other hand, the essential consumer sector saw the strongest recovery in the market, with a gain of 2.31%. The green color appeared mainly in PAN (+1.27%), MCH (+10.78%), SAB (+0.54%), and KDC (+0.51%). The recovery momentum was also seen in the industrial sector, which posted a modest gain of 0.64%.

In terms of foreign trading, they continued to net buy over 2 billion VND on the HOSE floor, focusing on the codes CTG (60.84 billion), PDR (55.48 billion), SSI (46.4 billion), and KDH (29.31 billion). On the HNX floor, foreigners net bought over 5 billion VND, focusing on the code PVS (8.09 billion), IDC (7.42 billion), HUT (1.58 billion), and MBS (1.24 billion).

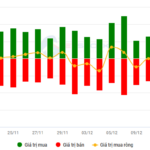

| Foreign Trading Buy – Sell Dynamics |

Morning Session: Bleak Liquidity at Year-End

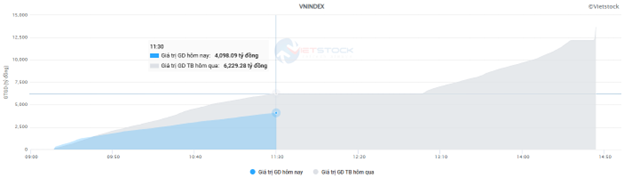

The market has not shown any significant positive signals in the context of bleak liquidity. At the midday break, the VN-Index fell 2.34 points, or 0.18%, to 1,272.8 points; HNX-Index also fell 0.43% to 228.15 points. The market breadth was negative, with 371 declining stocks and 232 advancing stocks.

The matching volume of the VN-Index this morning reached over 186 million units, equivalent to a value of more than 4 trillion VND, down 34% compared to the previous week’s morning session. The HNX-Index recorded a matching volume of nearly 16 million units, with a value of over 265 billion VND.

Source: VietstockFinance

|

After the previous week’s rally, the “king stocks” are now adjusting, putting significant pressure on the overall index. CTG, HDB, and TCB are currently the pillars with the most negative impact, taking away more than 1 point from the VN-Index. On the other hand, LPB accelerated before the lunch break, helping the overall index regain nearly half a point. The remaining stocks did not have a significant impact.

In terms of sectors, the red color still dominated the morning session. The telecommunications group was at the bottom with a decline of more than 1%. This was mainly due to stocks such as YEG (-2.49%), VGI (-1.2%), CTR (-0.81%), and FOX (-0.94%). This was followed by the materials and energy sectors, which fell more than 0.6% due to selling pressure in large-cap stocks such as HPG (-0.19%), DGC (-0.68%), BMP (-1.11%), GVR (-0.33%), KSV (-10%); BSR (-0.45%), PVS (-0.88%), and PVD (-1.04%).

The financial sector is currently witnessing a mixed performance. At the end of the morning session, securities and insurance stocks were gradually turning green, with HCM (+1.36%), PSI (+3.95%), VCI (+0.59%), FTS (+0.7%), BVH (+0.38%), and PVI (+0.31%)… Meanwhile, the selling pressure prevailed in most bank stocks. Except for LPB (+2.1%), which posted a significant gain, BID, CTG, TCB, MBB, ACB, HDB, STB, etc., all ended the morning session in the red.

On the other hand, positive trading was mainly seen in transportation stocks such as ACV (+0.24%), MVN (+4.36%), PVT (+0.54%), SGP (+1.41%), VTP (+0.38%), etc., helping the industrial sector temporarily lead the market with a slight gain of 0.36%.

Foreign investors also slowed down significantly, net selling more than 81 billion VND on the HOSE floor this morning. There were no significant transactions, and VCB was the most net sold stock, but the value was only over 18 billion VND. On the HNX floor, foreigners net sold more than 13 billion VND, focusing on selling the SHS stock.

10:30 am: Cautious Sentiment Emerges, VN-Index Fluctuates Around 1,271 Points

The market continued to be mixed as profit-taking pressure persisted, causing the main indices to fluctuate below the reference level. As of 10:30 am, the VN-Index fell 3.24 points, trading around 1,271 points. The HNX-Index fell 0.91 points, trading around 228 points.

Most of the stocks in the VN30 basket are currently facing strong selling pressure. Specifically, on the selling side, MWG, FPT, HDB, and ACB took away 0.8 points, 0.79 points, 0.74 points, and 0.6 points from the index, respectively. In contrast, VHM, SHB, SSI, and VCB were the few codes that managed to stay in the green, but their positive impact on the index was not significant.

Source: VietstockFinance

|

The telecommunications sector is currently the industry with the largest decline of 1.23%. The selling pressure mainly focused on large-cap stocks such as YEG, which fell by 1.74%, VGI by 0.88%, CTR by 0.65%, and ELC by 0.37%… Only a small portion of the stocks managed to stay in the green, such as SGT, which rose by 6.36%, MFS by 2.84%, and TTN by 0.46%…

On the other hand, the financial sector continued to be mixed, and the selling pressure was slightly stronger. Specifically, the selling pressure was focused on bank stocks such as STB, which fell by 0.67%, TCB by 0.2%, HDB by 1.4%, and CTG by 0.64%… Conversely, a few stocks were supported by buying interest, but the gains were modest, such as SSI rising by 0.19%, VCB by 0.22%, EIB by 0.26%, and FTS by 0.47%…

Compared to the beginning of the session, selling pressure continued to increase, and the market breadth was mostly negative, with 337 declining stocks and 205 advancing stocks.

Source: VietstockFinance

|

9:30 am: Caution at the Start of the Session

The market opened with a slight negative bias, indicating investors’ caution. The main indices fluctuated around the reference level. The VN-Index edged lower and traded around 1,272 points, while the HNX-Index dipped slightly around 229 points.

As of 9:40 am, the red color temporarily prevailed in the VN30 basket, with 20 declining stocks, 7 advancing stocks, and 3 unchanged stocks. Among them, HDB, VJC, and BCM were the stocks with the sharpest declines. On the other hand, GAS, VHM, and SSI were the stocks with the strongest gains.

The Hesitancy Hurdle: Navigating Market Uncertainty

The VN-Index edged slightly higher, snapping a four-day losing streak with the emergence of a Doji candlestick pattern. Accompanying this pattern, the trading volume remained below the 20-day average, indicating investor indecision in the market. Notably, the Stochastic Oscillator has now crossed into overbought territory and is flashing a sell signal. This development suggests that the risk of a market correction increases if the indicator falls out of this zone.

The Power of Positive Thinking

The VN-Index surged and retested its old peak in early December 2024 (around the 1,270-1,280 points region). If, in the upcoming sessions, the index surpasses this threshold alongside maintaining trading volume above the 20-day average, the uptrend will be reinforced. Notably, the MACD indicator has already signaled a buy opportunity by crossing above the signal line. If the Stochastic Oscillator also flashes a similar signal in the forthcoming sessions, the outlook will turn even more optimistic.

The Art of Liquidity Recovery

The VN-Index witnessed a positive trading week, surging above the Middle Bollinger Band and firmly holding above the 50-week SMA. However, trading volume has remained below the 20-week average since November 2024, indicating a lack of significant participation from investors. If upcoming sessions witness an improvement in liquidity, the index could potentially target the old peak of October 2024, which lies in the 1,285-1,300 point range.

Vietstock Daily: Is the Short-Term Outlook Not Too Gloomy?

The VN-Index witnessed a slight dip as trading volumes fell below the 20-day average, indicating a cautious investor sentiment following a strong previous rally. However, a key technical indicator, the MACD, has turned positive, crossing above the Signal Line, and the Stochastic Oscillator is also flashing a similar signal. Should this status quo persist in the upcoming sessions, the outlook may not be as pessimistic as some might believe.