|

Source: VietstockFinance

|

Strong cash flow during today’s session boosted the index’s recovery in the afternoon. Total trading value for the whole market exceeded 18 trillion VND today, with over 4 trillion VND in matched transactions. If we consider only matched orders, liquidity increased by about 30% compared to yesterday’s session.

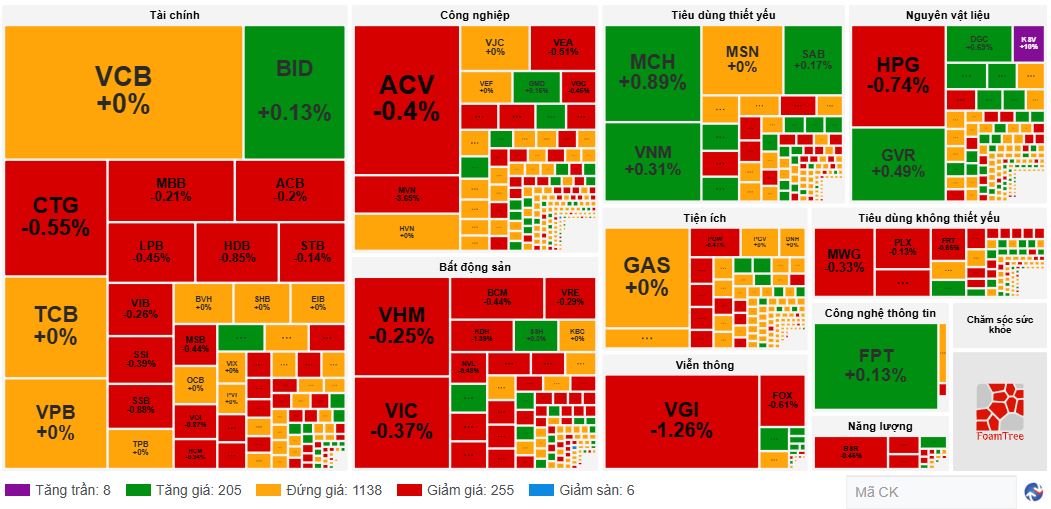

Towards the end of the session, the market breadth tilted towards sellers but not by a large margin, with nearly 360 stocks advancing and nearly 400 declining.

All sectors mitigated their negativity compared to midday. Notably, the real estate sector turned green. Although the dominant color was red due to losses in PDR, VHM, DIG, NLG, and HDC, the sector saw gains in SJS, KDH, DTD, SIP, and VPI, among others. However, DXG and DXS continued to fall sharply.

In the banking sector, EIB, TCB, STB, SSB, ACB, and LPB rebounded.

The materials sector also witnessed positive developments, with gains in DGC, CSV, DCM, DPM, and NKG, among others. Numerous mining stocks, such as KSV, BMC, and KCB, surged to their daily limit.

YEG continued its upward momentum, marking its sixth consecutive session of gains.

Today’s standout performers were hardware producers, with POT rising 7%, VTB up nearly 2%, and SMT climbing 1.75%.

Foreign investors net sold nearly 83 billion VND worth of shares today, focusing their sales on ACV and BID. On the other hand, SSI witnessed strong net buying.

| Top 10 stocks by foreign net buying/selling for December 24, 2024 |

Morning Session: VN-Index Lacks Support from Large-cap Stocks

Selling pressure intensified towards the end of the morning session, pushing the index deeper into negative territory. By midday, the VN-Index fell more than 7 points to 1,255.

BID, HPG, VHM, and CTG were the main drags on the index. On the flip side, the stocks pushing the market higher were mostly small and mid-cap stocks. Without momentum from large-cap stocks, the market struggled to turn positive.

DXG and DXS were the focal points of the morning session as they plummeted to their daily limit with massive volume.

Market liquidity surged despite the decline in the index. Total trading value for the morning session exceeded 8.2 trillion VND.

10:45 AM: Real Estate Stocks Plunge, DXG Hits Daily Limit

The real estate sector witnessed a pessimistic sentiment, with many stocks falling and dragging the index down.

DXG stood out as the most notable stock in the sector, plunging to its daily limit with the highest volume in the group. By 10:40 AM, its trading volume exceeded 44 million shares, with a sell queue of 1-2 million shares at the daily limit. DXS, the sister company of HXG, also hit its daily limit in the morning session.

A slew of other real estate stocks, including PDR, HDC, VIC, VPI, DIG, SJS, VRE, and CEO, fell between 1% and 2%.

The financial sector was also engulfed in negativity, with most banking and securities stocks declining by around 1-2%.

A broad-based divergence was observed across various sectors, including materials, industrials, consumer staples, telecommunications, and information technology.

In the telecommunications sector, YEG continued its impressive performance, rising over 3% despite not hitting the daily limit as in previous sessions.

Market Open: Financial and Real Estate Stocks Weigh on the Market

The market opened the session on December 24 with a familiar tug-of-war between buyers and sellers. The VN-Index fluctuated around the reference level, but selling pressure seemed to prevail as the index on the HOSE dipped below the reference line. By 9:30 AM, the VN-Index had lost 2 points to 1,260.

The main culprits behind the slight decline were large-cap stocks such as ACV, VGI, VHM, VIC, CTG, and HPG. Most large-cap stocks started the day in negative territory.

The consumer staples sector showed resilience in the early minutes of the session, with gains in MCH, VNM, SAB, DBC, and MPC, among others.

On the other hand, the materials sector demonstrated positive dynamics, with KSV surging to its daily limit from the opening bell. Other stocks in the sector, including DGC, GVR, DPM, DCM, and VCS, also edged higher.

Financial and real estate stocks, which hold a significant weight in the market’s structure, were predominantly in the red, exerting considerable pressure on the index.

Market performance as of 9:30 AM. Source: VietstockFinance

|

Vietstock Daily: Is the Short-Term Outlook Not Too Gloomy?

The VN-Index witnessed a slight dip as trading volumes fell below the 20-day average, indicating a cautious investor sentiment following a strong previous rally. However, a key technical indicator, the MACD, has turned positive, crossing above the Signal Line, and the Stochastic Oscillator is also flashing a similar signal. Should this status quo persist in the upcoming sessions, the outlook may not be as pessimistic as some might believe.

Unveiling the Heroes Behind VN-Index’s Revving Rally: A Near 30-Point Surge Propels HoSE’s Capitalization Past 52 Trillion

The VN-Index outperformed all other Asian markets on December 5, surging by over 2%. This impressive performance added over VND 112 trillion to the HoSE’s market capitalization, taking it beyond the VND 5,200 trillion mark.

The Market Pulse: Is the Risk of Adjustment Rising?

The VN-Index witnessed a significant decline, forming a bearish Falling Window candlestick pattern and dipping below the Middle Bollinger Band. This suggests a potential shift in market sentiment. The volume also spiked above the 20-day average, indicating heightened investor anxiety. The Stochastic Oscillator is firmly in oversold territory and continues to signal a sell-off. If the MACD also turns bearish in the coming days, the likelihood of a more pronounced correction will increase.

Trump 2.0: Opportunity or Challenge for Stock Investors?

The upcoming livestream, “Trump’s Election Win: Opportunity or Challenge for Stock Investors?” airing at 3:00 PM on December 19, 2024, on the official Fanpage and YouTube channel of DNSE Joint Stock Securities Company, promises to deliver sharp insights and a multifaceted perspective on the 2025 stock market outlook.