I. MARKET ANALYSIS OF THE STOCK MARKET BASICS ON 12/24/2024

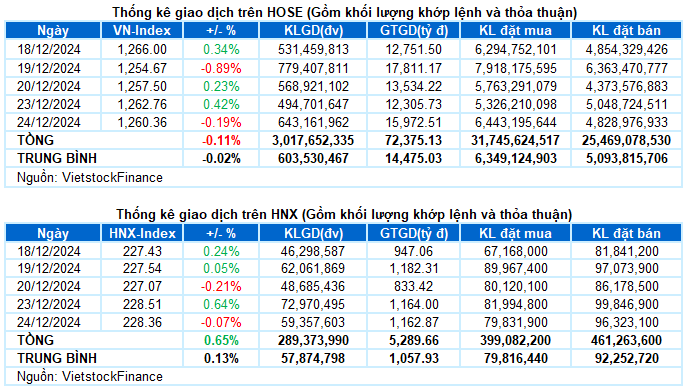

– Key indices adjusted during the 12/24 trading session. The VN-Index closed down 0.19%, to 1,260.36 points; HNX-Index slightly decreased by 0.07% compared to the previous session, reaching 228.36 points.

– Matching volume on HOSE reached nearly 521 million units, up 35.4% compared to the previous session. Meanwhile, the matching volume on HNX decreased by nearly 3%, reaching more than 51 million units.

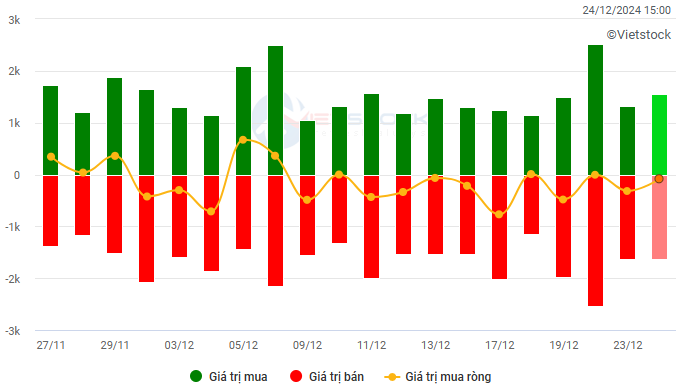

– Foreigners net sold on HOSE with a value of nearly VND 62 billion and net bought nearly VND 32 billion on HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

Net trading value by stock code. Unit: VND billion

– Selling pressure returned in the 12/24 trading session. The market was dominated by sellers and traded in the red from the early session. In particular, real estate stocks suddenly plunged, causing the VN-Index to lose more than 7 points at the end of the morning session. However, improved demand in the afternoon session helped the index recover quite significantly, regaining the 1,260-point mark before closing. At the end of the session, the VN-Index decreased by 2.4 points (-0.19%), closing at 1,260.36 points.

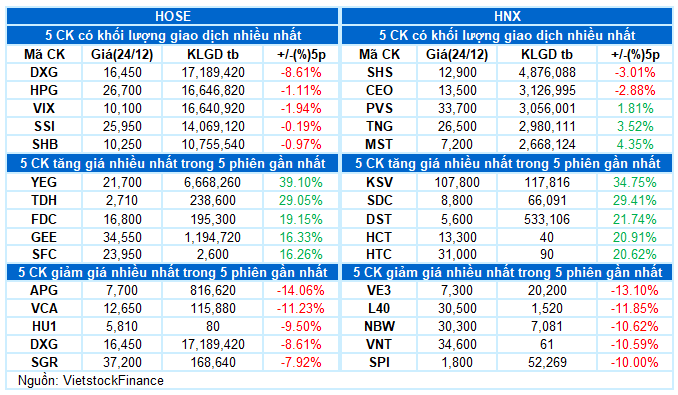

– In terms of impact, BID, HPG, and VCB were the most negative stocks, taking away more than 1.5 points from the VN-Index. On the other hand, there was no standout name on the positive side, with FPT stock contributing a meager 0.2 points.

– VN30-Index regained green, ending up slightly by 0.02%, reaching 1,323.27 points. The breadth of the basket was balanced, recording 13 decreasing stocks, 9 increasing stocks, and 8 stocks standing at reference prices. Most stocks fluctuated within a narrow range of less than 1%, while only BID and HPG decreased by more than 1%.

Sectors performed in a diverging manner. On the declining side, the real estate group experienced a challenging trading session with strong selling pressure from the early session. Notably, DXG and DXS hit the daily limit down with surging volume. Despite the recovery efforts in the afternoon session, which helped the group narrow its losses to 0.46% at the close, many stocks still corrected quite strongly, such as PDR (-2.88%), NVL (-1.9%), NLG (-1.52%), HDG (-2.6%), DIG (-1.03%), CEO (-1.46%), HDC (-3.07%), NTL (-2.56%),…

On the opposite side, the consumer staples sector led the table today with a 0.7% gain, thanks to the strong performance of food stocks like MCH (+3.14%), VHC (+1.09%), ANV (+1.49%), MPC (+2.74%), FMC (+1.5%),…

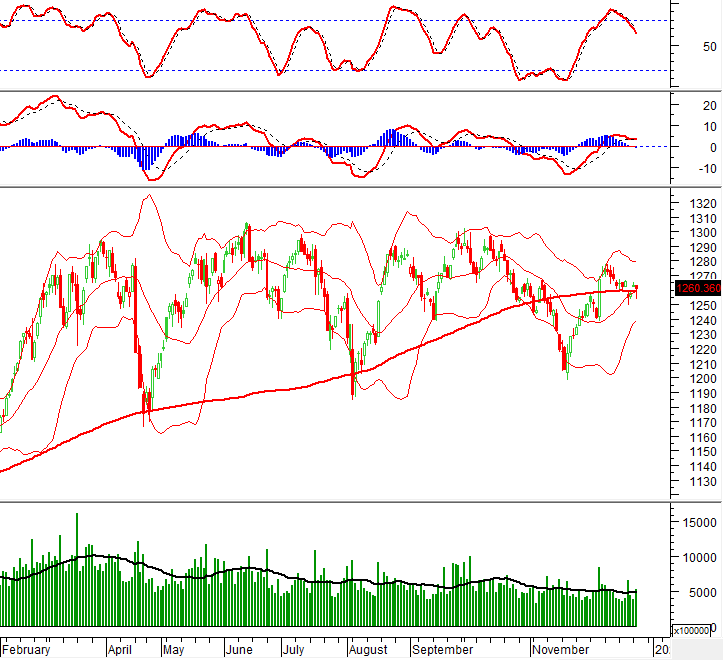

VN-Index narrowed its loss with the appearance of a Hammer candlestick pattern while staying above the SMA 200-day moving average. Additionally, the trading volume surpassed the 20-day average, indicating a return of cash flow into the market. However, the Stochastic Oscillator and MACD indicators continued to decline after generating sell signals, suggesting that short-term correction risks remain.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Hammer Candlestick Pattern Emerges

VN-Index narrowed its loss with the appearance of a Hammer candlestick pattern while staying above the SMA 200-day moving average. Additionally, the trading volume surpassed the 20-day average, indicating improved market participation.

However, the Stochastic Oscillator and MACD indicators continued to trend downward after producing sell signals, suggesting that the risk of short-term corrections persists.

HNX-Index – MACD Indicator Maintains Positive Signal

HNX-Index edged slightly lower while remaining above the SMA 50-day moving average and the Middle line of the Bollinger Bands. Moreover, the trading volume continued to surpass the 20-day average, reflecting consistent market participation.

At present, the MACD indicator sustains a positive signal, and the Stochastic Oscillator also exhibits a similar indication. If this condition is maintained in the upcoming sessions, the outlook for the index may not be overly pessimistic.

Money Flow Analysis

Movement of Smart Money: The Negative Volume Index indicator of the VN-Index crossed above the EMA 20-day moving average. If this state persists in the next session, the risk of a sudden downturn (thrust down) will be limited.

Foreign Capital Flow: Foreign investors continued to net sell during the trading session on 12/24/2024. If foreign investors maintain this behavior in the upcoming sessions, the situation will become more pessimistic.

III. MARKET STATISTICS ON 12/24/2024

Economic Analysis and Market Strategy Department, Vietstock Consulting

Market Beat on Dec 27th: Foreigners Net Buy Financial Group, VN-Index Maintains 1,275 Point Landmark

The market closed with the VN-Index up 2.27 points (0.18%) to 1,275.14, while the HNX-Index fell 0.77 points (0.33%) to 229.13. The market breadth tilted towards decliners with 432 losers and 331 gainers. The large-cap stocks in the VN30 basket painted a positive picture, with 13 gainers, 10 losers, and 7 stocks ending flat.

The Art of Contrarian Investing: Navigating Market Swings with a Twist

The VN-Index has been on a rollercoaster ride lately, with alternating up and down sessions. Erratic trading volumes, fluctuating around the 20-day average, reflect investors’ unstable sentiment. However, the MACD and Stochastic Oscillator indicators continue to point upwards, providing a buy signal. If this status quo persists in the upcoming sessions, the short-term outlook may not be as risky as it seems.

Market Beat: Transport Sector Sustains Recovery, VN-Index Holds Green Fort

The market ended the session on a positive note, with the VN-Index climbing 0.42% to 1,262.76, and the HNX-Index gaining 0.63% to close at 228.51. Buyers dominated the market breadth, with 484 tickers advancing against 253 declining tickers. However, the VN30 basket tilted towards the red, recording 19 gainers, 7 losers, and 4 unchanged stocks.

The Market Beat: A Tale of Diverging Fortunes

The market closed with the VN-Index down 3.12 points (-0.24%) to 1,272.02, and the HNX-Index fell 0.99 points (-0.43%) to 228.14. The market breadth tilted towards decliners with 436 losers and 274 gainers. Notably, 20 stocks in the VN30 basket ended in negative territory, with 6 advancing and 4 unchanged.

The Hesitancy Hurdle: Navigating Market Uncertainty

The VN-Index edged slightly higher, snapping a four-day losing streak with the emergence of a Doji candlestick pattern. Accompanying this pattern, the trading volume remained below the 20-day average, indicating investor indecision in the market. Notably, the Stochastic Oscillator has now crossed into overbought territory and is flashing a sell signal. This development suggests that the risk of a market correction increases if the indicator falls out of this zone.