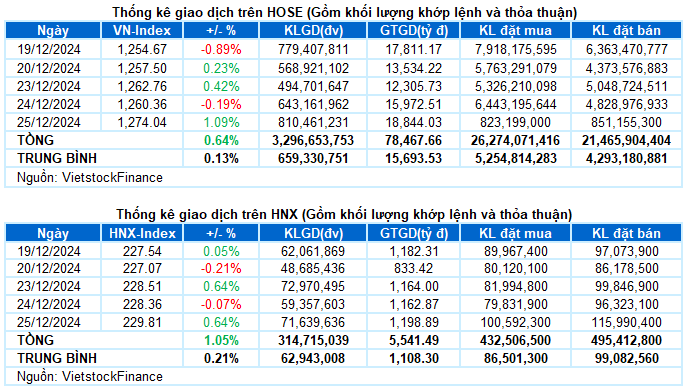

I. MARKET ANALYSIS OF THE STOCK MARKET ON 12/25/2024

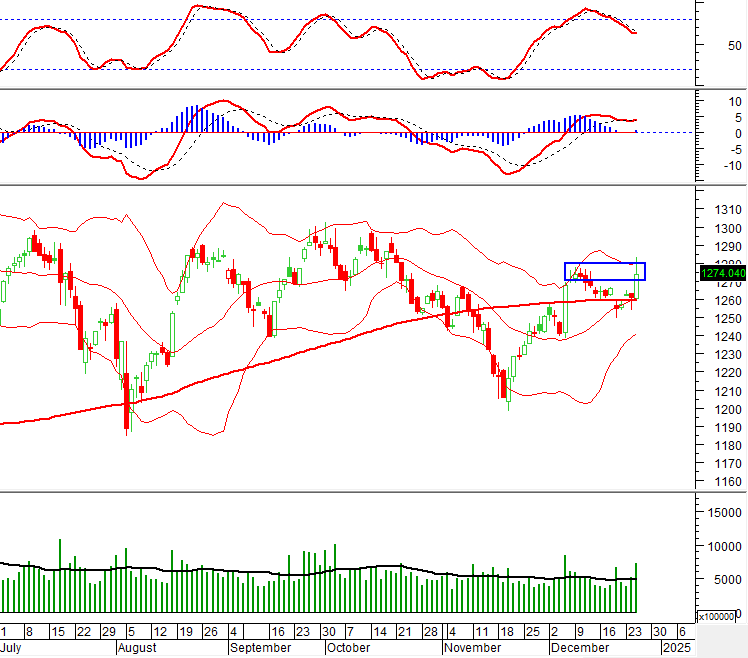

– The main indices rebounded in the trading session on December 25th. The VN-Index closed up 1.09%, to 1,274.04 points; HNX-Index increased by 0.64% compared to the previous session, reaching 229.81 points.

– Liquidity improved significantly, with the matching volume on the HOSE reaching over 724 million units, a 39% increase compared to the previous session. The matching volume on the HNX also increased by 30%, reaching more than 67 million units.

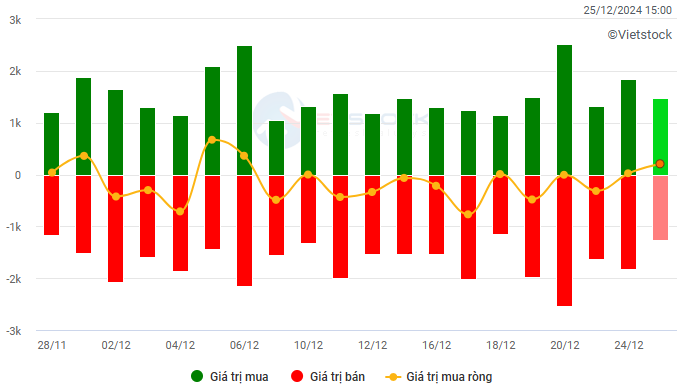

– Foreign investors net bought on the HOSE with a value of more than VND 232 billion and net sold nearly VND 14 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

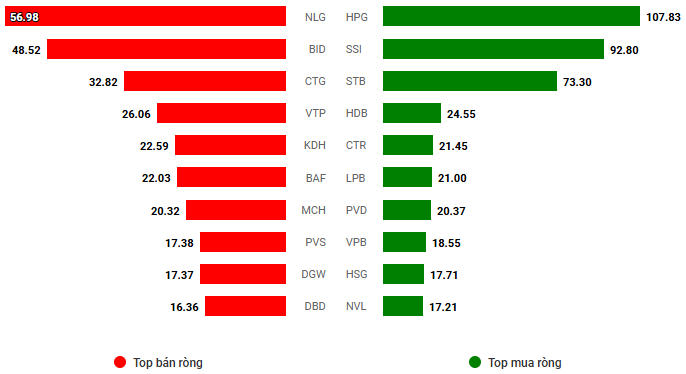

Net trading value by stock code. Unit: VND billion

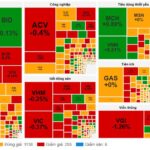

– The market was vibrant in the December 25th session. The bright spot from the construction and materials group opened up positive signals that spread across all sectors. Large-cap stocks led strongly, helping the VN-Index to rise more than 22 points at one point during the morning session. However, this sudden breakout also triggered profit-taking, causing the momentum to slow down considerably afterward. There were no other notable developments in the afternoon session, and the VN-Index closed with a gain of 13.68 points, reaching 1,274.04 points.

– In terms of impact, 9 out of 10 codes with the most positive influence on the VN-Index today belonged to the banking group. Among them, CTG led the way, helping the VN-Index to increase by nearly 3 points, followed by TCB, BID, and STB, which also contributed more than 2 points. On the opposite side, HVN took away more than half a point from the overall index, being the stock with the most negative impact. The remaining stocks did not have a significant effect.

– Large-cap stocks made a strong comeback, with the VN30-Index ending the session up 1.45% at 1,342.48 points. Buyers dominated as all 30 codes in the basket turned green. In particular, CTG and STB broke out the most, rising 5.52% and 4.47%, respectively. More than half of the remaining stocks also rose sharply by 1-3%.

Most sectors posted positive gains. Leading the rally today was the financial group. Banking, securities, and insurance stocks were all covered in green, with the most prominent being CTG (+5.52%), STB (+4.47%), MBB (+2.3%), HDB (+2.14%), TPB (+2.18%), LPB (+2.09%), BID (+1.44%), SSB (+1.17%), NAB (+0.63%), SSI (+2.31%), HCM (+2.08%), VND (+1.96%), FTS (+1.9%), BVH (+1.52%), PVI (+1.99%), and PRE (+2.04%), among others.

Following was the materials group, which also attracted positive buying demand, rising by 1.53%. Notably, many stocks turned purple early on, such as KSB, PLC, BMC, and KSV. In addition, outstanding gains were also recorded in HPG (+1.69%), HSG (+1.61%), NKG (+1.01%), BMP (+1.7%), DHC (+1.44%), GVR (+1.3%), VLB (+3.76%), and HT1 (+2.14%).

On the other hand, the industrial group had to close in the red, despite many construction stocks in this group being the highlight, hitting the ceiling price from the beginning of the session, such as HHV, HBC, FCN, and TV2. This was because transportation stocks, which have a higher market capitalization, corrected quite strongly after the previous gaining sessions, typically ACV (-0.64%), MVN (-6.39%), HVN (-3.86%), PVT (-1.05%), HAH (-1.77%), and VTP (-0.85%). In addition, healthcare was the other group dominated by selling pressure, mainly affected by large-cap stocks such as DHG (-1.12%), IMP (-2.06%), DVN (-1.59%), and DBD (-3.95%), among others.

VN-Index surged and retested the old peak at the beginning of December 2024 (equivalent to the 1,270-1,280-point range). If, in the coming sessions, the index surpasses this threshold, accompanied by trading volume maintained above the 20-day average, the uptrend will be further reinforced. Currently, the MACD indicator has given a buy signal again after cutting above the Signal Line. If the Stochastic Oscillator indicator also gives a similar signal, the situation will become even more optimistic.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – MACD indicator gives a buy signal again

VN-Index surged and retested the old peak at the beginning of T12/2024 (equivalent to the 1,270-1,280-point range). If, in the coming sessions, the index surpasses this threshold, accompanied by trading volume maintained above the 20-day average, the uptrend will be further reinforced.

Currently, the MACD indicator has given a buy signal again after cutting above the Signal Line. If the Stochastic Oscillator indicator also gives a similar signal, the situation will become even more optimistic.

HNX-Index – Stochastic Oscillator and MACD indicators continue to maintain buy signals

HNX-Index declined slightly but remained positive above the SMA 50-day and the Middle line of the Bollinger Bands. In addition, trading volume continued to be above the 20-day average, indicating stable participation.

At the moment, the MACD indicator continues to maintain a buy signal, while the Stochastic Oscillator indicator also appears to be giving a similar signal. If this state is maintained in the coming sessions, the index’s outlook will become even more optimistic.

Analysis of Money Flow

Movement of smart money flow: The Negative Volume Index of the VN-Index cut above the EMA 20-day. If this state continues in the next session, the risk of an unexpected downturn (thrust down) will be limited.

Foreign capital flow movement: Foreign investors returned to net buying in the trading session on December 25, 2024. If foreign investors maintain this action in the coming sessions, the situation will become even more optimistic.

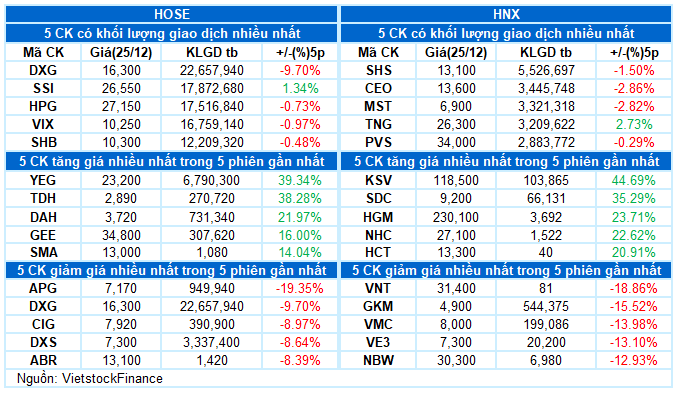

III. MARKET STATISTICS ON 12/25/2024

Economic and Market Strategy Analysis Department, Vietstock Consulting

The Art of Liquidity Recovery

The VN-Index witnessed a positive trading week, surging above the Middle Bollinger Band and firmly holding above the 50-week SMA. However, trading volume has remained below the 20-week average since November 2024, indicating a lack of significant participation from investors. If upcoming sessions witness an improvement in liquidity, the index could potentially target the old peak of October 2024, which lies in the 1,285-1,300 point range.

Vietstock Daily: Is the Short-Term Outlook Not Too Gloomy?

The VN-Index witnessed a slight dip as trading volumes fell below the 20-day average, indicating a cautious investor sentiment following a strong previous rally. However, a key technical indicator, the MACD, has turned positive, crossing above the Signal Line, and the Stochastic Oscillator is also flashing a similar signal. Should this status quo persist in the upcoming sessions, the outlook may not be as pessimistic as some might believe.