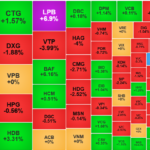

The market showed signs of mixed performance as money continued to flow out of mid- and small-cap stocks into bank stocks. LPB shares were expected to be included in the VN30 index, and ETFs bought 15 million units, causing a sharp rise. This positive momentum spread to other bank stocks, with HDB up 3.31%, TCB up 1.03%, CTG up 1.57%, and the key stocks VCB and BID up slightly by 0.11% and 0.38%, respectively. The banking group alone added 4 points to the overall index. As a result, the VN-Index closed up 2.27 points to 1,275.

Securities stocks also saw a significant increase today, with SSI up 0.95%, HCM up 0.51%, and MBS up 1.04%. In contrast, the real estate sector witnessed a reversal in a series of stocks, with VHM and VIC, from the Vin Group, being the two stocks with the most negative impact on the market. Real estate stocks such as NVL, PDR, DIG, DXG, and KDH, as well as industrial real estate stocks, could not escape the overall downward trend.

The materials sector, including chemicals, steel, and rubber, was also engulfed in a sea of red. HPG fell by 0.56%, GVR by 0.65%, and DCG by 0.51%. However, telecommunications was the sector that saw the most significant decline, with VGI down 4.15% and CTR down 1.68%.

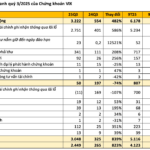

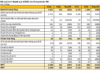

The market was mainly led by the banking group, and the breadth was generally negative, with 242 declining stocks against 177 advancing ones. A characteristic of the market when banks are leading is that liquidity will always remain high. Today, the three exchanges traded 19,000 billion VND, with foreign investors excellently net buying 738.1 billion VND. If we look at matched orders only, they net bought 588.2 billion VND.

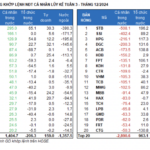

Foreign investors’ net buying in the matched orders was focused on the Banking and Financial Services sectors. The top net bought stocks by foreign investors in matched orders included STB, CTG, SSI, FPT, HDB, LPB, BAF, DGC, KDH, and VPB.

On the net selling side, in matched orders, foreign investors focused on the Industrial Products & Services sector. The top net sold stocks by foreign investors in matched orders were VCB, VRE, HPG, VTP, MSN, PLX, GAS, MWG, and CTR.

Individual investors net sold 1,756.1 billion VND, of which 893.9 billion VND was net sold in matched orders.

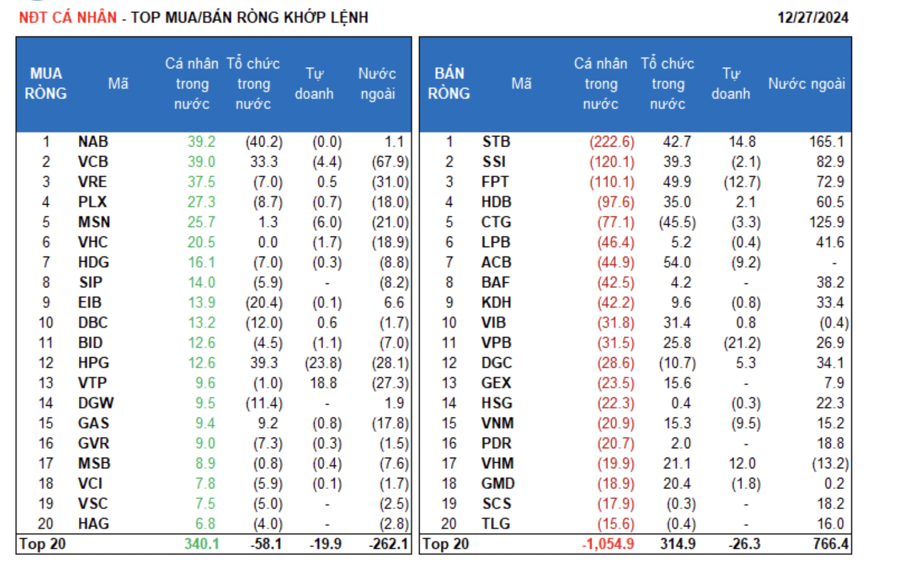

Looking at matched orders only, individual investors net bought 4 out of 18 sectors, mainly in the Oil & Gas sector. The top net bought stocks by individual investors included NAB, VCB, VRE, PLX, MSN, VHC, HDG, SIP, EIB, and DBC.

On the net selling side, in matched orders, individual investors net sold 14 out of 18 sectors, mainly in the Banking and Financial Services sectors. The top net sold stocks by individual investors included STB, SSI, FPT, HDB, CTG, LPB, BAF, KDH, and VIB.

Proprietary trading net bought 750.8 billion VND, and in matched orders, they net sold 23.2 billion VND.

Looking at matched orders only, proprietary trading net bought 6 out of 18 sectors. The top net bought sectors were Construction & Materials and Financial Services. The top net bought stocks by proprietary trading today included CTR, FUEVFVND, VTP, STB, VHM, CMG, DGC, E1VFVN30, HHV, and TCB. The top net sold sector was Banking. The top net sold stocks included HPG, VPB, MBB, MWG, FPT, VNM, ACB, MSN, FRT, and VCB.

Domestic institutional investors net bought 387.5 billion VND, and in matched orders, they net bought 328.9 billion VND.

Looking at matched orders only, domestic institutions net sold 6 out of 18 sectors, with the Oil & Gas sector seeing the largest net selling value. The top net sold stocks by domestic institutions included CTG, NAB, FUEVFVND, EIB, PVD, DBC, DXG, DGW, CMG, and DGC. On the net buying side, the Banking sector saw the highest net buying value. The top net bought stocks included ACB, FPT, MWG, STB, SSI, HPG, HDB, VCB, VIB, and NLG.

Today’s negotiated trading value reached 3,577.0 billion VND, a decrease of 9.6% from the previous session, contributing 18.8% of the total trading value.

Notable negotiated trades were seen in MSN shares, with over 15 million units, equivalent to 1,062.4 billion VND, changing hands among individual investors.

Additionally, there were negotiated trades where individual investors sold 10 million units of STB shares (worth 374 billion VND) and more than 2 million units of FPT shares (worth 308.5 billion VND) to domestic proprietary trading.

The money flow allocation increased in Banking, Securities, Chemicals, Agricultural & Marine Products, and Courier Services while decreasing in Real Estate, Construction, Food, Retail, Oil & Gas, Software, Special Finance, Aviation, and Plastics, Rubber & Fibers.

Looking at matched orders only, the money flow allocation increased in the mid-cap VNMID group and decreased in the large-cap VN30 and small-cap VNSML groups.

The Psychology of Rest Dominates, Liquidity Plunges

Investor sentiment was muted in the final days of the 2024 financial year. This morning’s trading activity by foreign investors hit a record low, with overall market liquidity plunging 34% from the previous session. The stock market witnessed a sea of red, although the majority of stocks experienced only minor fluctuations. A few securities and investment stocks continued to buck the trend, swimming against the tide.

The Pre-Festive Season Sell-Off: Individual Investors Dump Stocks, Net-Selling 2.6 Trillion VND Last Week

Individual investors sold a net 2,594.7 billion VND, of which they sold a net 2,194.5 billion VND in stocks.

The Looming Threat of ETF Sell-Off for Banking Stocks: A Precarious Scenario Unveiled

Estimates suggest that ETFs will purchase 15.1 million new LPB shares and offload 3.23 million POW shares entirely. Other stocks witnessed sell-offs without corresponding buy-ins, including TCB, which shed 1.38 million shares, ACB with 1.2 million shares sold, VPB at 1.3 million, and HPG, offloading 1 million shares.

Bank Stocks Continue to Attract Cash Flow, Speculative Stocks Take a Hit

The banking stocks on the HoSE exchange contributed a significant 32% to the total matched orders value today. All ten of the VN-Index’s top-performing stocks were from the banking sector, which has become a market pillar, holding its ground while speculative stocks faced heavier selling pressure.