I. VIETNAMESE STOCK MARKET WEEK 23-27/12/2024

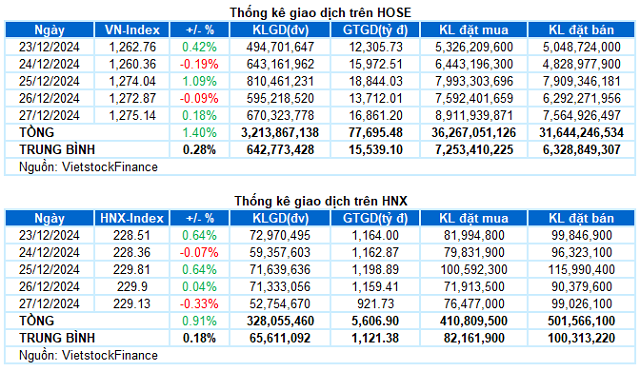

Trading: The main indices moved in different directions during the last trading session of the week. By the end of December 27, VN-Index increased by 0.18% compared to the previous session, reaching 1,275.14 points. In contrast, HNX-Index decreased by 0.33%, falling to 229.13 points. For the whole week, VN-Index gained a total of 17.64 points (+1.4%), while HNX-Index rose by 2.06 points (+0.91%).

In the last trading week of 2024, the Vietnamese stock market witnessed a rather positive development as the VN-Index rebounded after two consecutive weeks of decline. Although profit-taking pressure remained as the index approached the resistance level of 1,280 points, the improved liquidity, slightly above the 20-week average, along with the return of foreign capital inflows, were positive signals that helped boost investor confidence. The VN-Index ended the week at the 1,275.14-point mark.

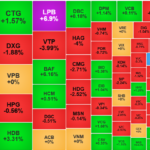

In terms of impact, all ten stocks that contributed positively to the market today were bank stocks. Among them, LPB took the lead, with a vibrant purple color, helping the VN-Index gain 1.3 points. This was followed by CTG, HDB, and TCB, which added nearly two points to the overall index. On the other hand, VHM and HPG were the two stocks with the most negative impact, taking away half a point from the VN-Index.

The financial group was the most prominent highlight, “carrying the burden” of helping the VN-Index maintain its green color in the last session of the week. The upward momentum was mainly driven by bank stocks, with the most notable being LPB (+6.9%), HDB (+3.31%), CTG (+1.57%), VIB (+1.52%), MSB (+1.3%), TPB (+1.21%), VAB (+1.1%), EIB (+1.04%), and TCB (+1.03%).

Following was the essential consumer group, which also saw many stocks attracting positive buying power, such as MCH (+2.03%), QNS (+1.17%), MML (+5.63%), BAF (+6.16%), and TAR (+9.3%). However, many large-cap stocks in the industry also faced significant adjustment pressure, including HAG (-4%), VHC (-1.51%), ANV (-2.22%), FMC (-1.78%), ASM (-1.13%), IDI (-1.42%), and HNG (-1.61%). Similarly, most other sectors also fluctuated within a narrow range.

On the downside, the telecommunications group was at the bottom of the table, plunging 3.55%. This was largely influenced by the strong selling of major players such as VGI (-4.15%), CTR (-1.68%), ELC (-3.41%), VNZ (-1.81%), and FOX (-1.65%). Notably, YEG in this group experienced its second consecutive “floor session.”

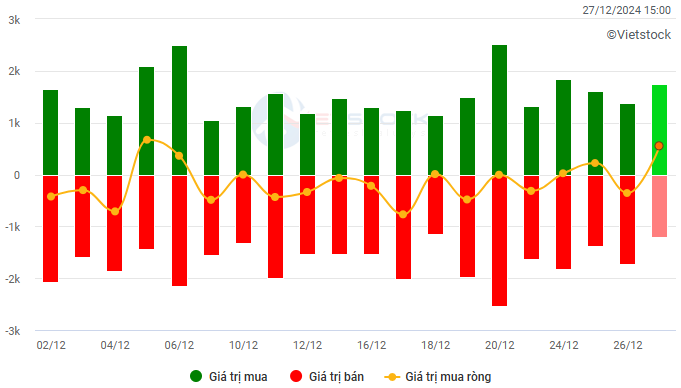

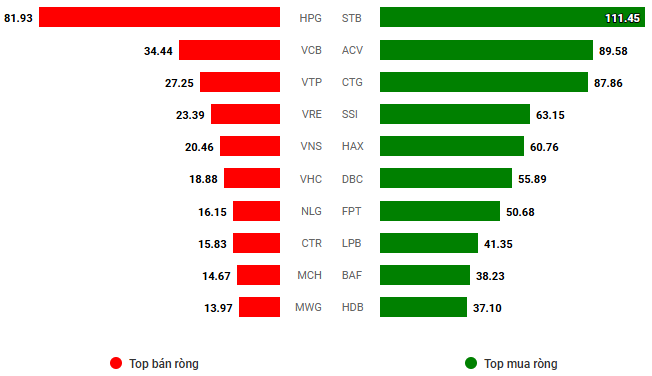

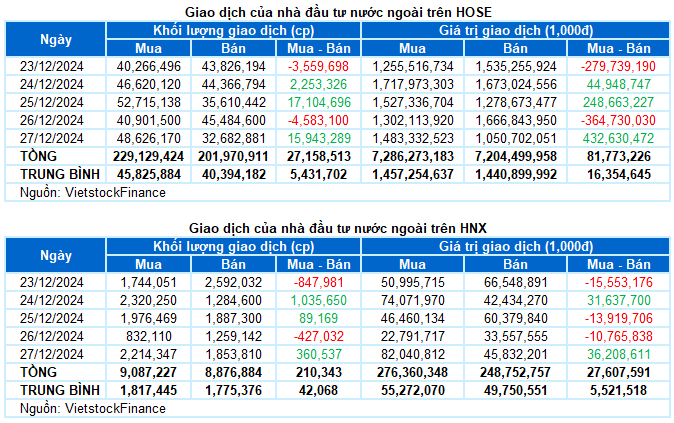

Foreign investors returned to net buying with a value of more than 109 billion VND on both exchanges during the past week. Specifically, they net bought nearly 82 billion VND on the HOSE and more than 27 billion VND on the HNX exchange.

Trading value of foreign investors on HOSE, HNX, and UPCOM by date. Unit: Billion VND

Net trading value by stock ticker. Unit: Billion VND

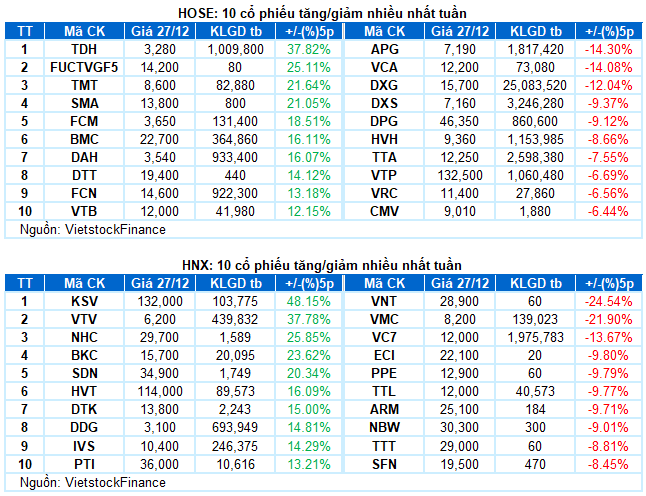

Stocks that increased significantly last week: TDH

TDH rose by 37.82%: TDH experienced a vibrant trading week, with a gain of 37.82%. The stock continuously surged with the appearance of the Rising Window candlestick pattern and broke above the SMA 200-day moving average.

However, the Stochastic Oscillator indicator has entered the overbought zone. If the stock shows a sell signal in the coming period, the risk of adjustment will increase.

Stocks that decreased significantly last week: APG

APG fell by 14.3%: APG had a rather negative trading week, continuously declining in four out of five sessions. However, the upward effort in the last session of the week partly eased the pressure on this stock.

Currently, the Stochastic Oscillator and MACD indicators continue to decline after giving sell signals. This suggests that the risk of short-term adjustments remains.

II. STOCK MARKET STATISTICS FOR LAST WEEK

Economic and Market Strategy Analysis Department, Vietstock Consulting

– 17:02 27/12/2024

The Perfect Headline: “The Adjustment Pressure Persists”

The VN-Index narrowed losses with the emergence of a Hammer candlestick pattern, holding firmly above the 200-day SMA. Moreover, trading volume surged above the 20-day average, indicating a return of liquidity to the market. However, the Stochastic Oscillator and MACD continued their downward trajectory, issuing sell signals. This suggests that the risk of short-term corrections persists.

Market Beat on Dec 27th: Foreigners Net Buy Financial Group, VN-Index Maintains 1,275 Point Landmark

The market closed with the VN-Index up 2.27 points (0.18%) to 1,275.14, while the HNX-Index fell 0.77 points (0.33%) to 229.13. The market breadth tilted towards decliners with 432 losers and 331 gainers. The large-cap stocks in the VN30 basket painted a positive picture, with 13 gainers, 10 losers, and 7 stocks ending flat.

The Art of Contrarian Investing: Navigating Market Swings with a Twist

The VN-Index has been on a rollercoaster ride lately, with alternating up and down sessions. Erratic trading volumes, fluctuating around the 20-day average, reflect investors’ unstable sentiment. However, the MACD and Stochastic Oscillator indicators continue to point upwards, providing a buy signal. If this status quo persists in the upcoming sessions, the short-term outlook may not be as risky as it seems.

Market Beat: Transport Sector Sustains Recovery, VN-Index Holds Green Fort

The market ended the session on a positive note, with the VN-Index climbing 0.42% to 1,262.76, and the HNX-Index gaining 0.63% to close at 228.51. Buyers dominated the market breadth, with 484 tickers advancing against 253 declining tickers. However, the VN30 basket tilted towards the red, recording 19 gainers, 7 losers, and 4 unchanged stocks.