At the press briefing on the production and business activities of the Vietnam Textile and Apparel Group (Vinatex) and labor movements in 2024, with orientations for 2025, Mr. Cao Huu Hieu, CEO of Vinatex, shared that the group has successfully accomplished and exceeded its plans. Both revenue and profit have surpassed the targets set by the shareholders during their June meeting.

A DRAMATIC TURNAROUND IN THE LAST 6 MONTHS OF 2024

Specifically, the consolidated revenue for 2024 is estimated at VND 18,100 billion, equivalent to 102.8% compared to 2023. The consolidated profit is estimated at VND 740 billion, a remarkable 137.5% increase from the previous year.

According to Vinatex’s leadership, achieving these results required navigating through a challenging and tumultuous year. The Vietnamese textile and garment industry, including Vinatex, faced significant hardships in 2023. For the first time in 30 years of export history, the industry witnessed an over 11% decline in export turnover.

Entering 2024, the momentum from 2023 continued, resulting in a very difficult first and second quarter due to the global economic downturn, rising inflation, heightened political tensions, stagnant demand for textiles and garments, small-scale orders, stringent technical and quality requirements, and quick delivery times. Moreover, the unit price at the beginning of the year remained extremely low, following the trend from 2023.

However, the export picture for the textile and garment industry unexpectedly turned around in the last six months. Starting in July, there was an increase in orders, and prices improved slightly. Many Vietnamese textile and garment companies have been busy with orders extending until December 2024. As of now, several garment units have secured orders until the end of the first quarter, and even the second quarter, of 2025.

Comparing Vietnam’s performance with other major players in the textile and garment industry, Mr. Hoang Manh Cam, Vice Chairman of Vinatex’s Board of Directors, asserted that Vietnam has achieved the highest growth rate among the leading exporting countries this year.

According to estimates, by the end of 2024, Vietnam’s textile and garment exports will reach approximately US$44 billion, an increase of nearly 11% compared to 2023. With this result, Vietnam will ascend to the second position, only behind China, in terms of total textile and garment export turnover, surpassing Bangladesh.

“Following Vietnam is India, which, as of now, has achieved a growth rate of 6.97%. They have similar product lines and the geographical advantage of being close to Bangladesh. Therefore, India has benefited the most from the shift in orders away from Bangladesh,” Mr. Cam informed.

Turning to China, their cumulative exports for the first 11 months of 2024 reached US$273.4 billion, a marginal increase of 0.2% compared to the same period last year. However, their exports of apparel, a direct competitor to Vietnam, amounted to US$144 billion, representing a 2.8% decrease over 11 months. On the other hand, China’s strength lies in textile and yarn exports, which reached US$129 billion, a 3.7% increase, and an area where we cannot compete with them.

Bangladesh, on the other hand, experienced a 3.7% decline in exports during the first ten months of 2024, reaching US$27.7 billion. Their monthly exports averaged US$2.8 billion, whereas, during the peak of demand in 2022, they exported over US$4 billion per month.

AIMING FOR US$45-46 BILLION IN 2025

“The year 2024 was challenging, but in the end, the textile and garment industry was justly rewarded for the efforts of its management and workforce,” said Mr. Hieu. He added, “The average income of workers this year increased by VND 10.3 million per person per month, and we were able to retain our entire workforce.”

Explaining the reasons behind this success, Mr. Hieu attributed it not to a sudden improvement in the market or a surge in demand, but rather to a stroke of “luck.” Bangladesh, our competitor in the industry, faced political instability (strikes, protests, etc.), causing orders to be redirected, and Vietnam was one of the preferred choices.

Bangladesh caters to the mass market and is a strong competitor to Vietnam in the standard segment. Therefore, when orders shifted to Vietnam, the prices did not improve significantly, but the quantity of orders increased substantially.

In addition to this rare stroke of luck, Mr. Hieu credited the flexible solutions implemented by the textile and garment units in their production management. The companies also intensified their market efforts, exploring new markets based on the newly effective FTAs. Many product lines entered the FTA market with tax rates reduced to zero, allowing businesses to take full advantage of the industry’s strengths and the benefits offered by the FTAs.

Furthermore, modern governance, digital transformation, and increased investment in automation and equipment also contributed to the industry’s success in 2024.

While 2025 is expected to present its own set of challenges, predictions by organizations like the IMF and WB, along with the performance of major textile and garment markets such as the US, EU, Japan, and South Korea, indicate a positive outlook for the industry next year.

Based on the baseline scenario presented by Vinatex, which assumes a global demand for textile and garment products growing at a baseline rate to reach US$850 billion, Bangladesh is anticipated to recover to normal export levels in the second quarter of 2025. Consequently, intense competition will resume, with less-developed countries regaining their advantage in preferential tariffs. Meanwhile, Vietnam faces the disadvantage of labor costs being nearly three times higher than those of Bangladesh in the textile and garment industry.

Given this scenario, Mr. Cam emphasized the need for the industry to closely monitor the situation and devise more adaptive solutions. With this in mind, Vinatex forecasts a 5-6% growth in Vietnam’s textile and garment exports in 2025, reaching US$45-46 billion.

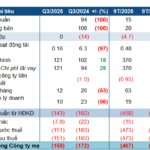

The Q3 2024 Financial Report Rundown: Banks and Retail Continue Their Stellar Performance, While Insurance and Securities Cool Off and Real Estate Shows a ‘Strange’ Phenomenon

The banking sector continues to be the ‘backbone’ of the stock market, with robust performance and positive results.

Weaving a Brighter Future: Vietnam’s Textile Industry on Track to Achieve $44 Billion Export Target

The Vietnam Textile and Apparel Association (Vitas) asserts that the textile industry’s export target of 44 billion USD by 2024 is well within reach. The association bases this optimism on the fact that the end of the year typically sees a surge in production orders for the festive season, encompassing both Christmas and New Year celebrations.