At an online investment workshop in 2025, Ms. Nguyen Thi My Lien, Head of Analysis at Phu Hung Securities (PHS), shared her insights on the prospects of the Vietnamese stock market in 2025. She believes that 2025 will be a pivotal year for the country’s stock market.

The State Securities Commission of Vietnam has demonstrated its commitment to addressing the challenges of upgrading the market by amending the securities law. The pre-funding requirement for foreign investors has been removed, opening up more opportunities for market advancement.

However, to achieve the goal of market upgrade by 2025 and attract significant international capital, Vietnam needs to focus on improving transparency, liquidity, and legal infrastructure, in addition to maintaining a strong overall economic growth. These factors will lay a solid foundation for the Vietnamese stock market to attract international investments.

In terms of valuation, the Vietnamese stock market is trading at an attractive level of approximately 13.3 times trailing P/E ratio, compared to other Southeast Asian markets. Despite escalating geopolitical tensions and global economic uncertainties, Vietnam’s economy demonstrated resilient GDP growth in 2024.

With a favorable macroeconomic outlook, PHS predicts a potential 18% increase in market-wide profits in 2025. Consequently, the projected P/E ratio for 2025 is estimated at 11.0 times in the base scenario, presenting investors with opportunities to start realizing profits in the coming year.

Additionally, the potential market upgrade to the Emerging Market category is another key focus. According to PHS’s forecast, FTSE will announce the results of the market upgrade evaluation in March 2025, with the official upgrade taking place during the annual review in September 2025.

PHS estimates that Vietnamese stocks could account for approximately 0.5% of the FTSE Emerging Index at the time of the official upgrade, corresponding to an expected net inflow of about $550 million from FTSE-mirrored ETF funds. Meanwhile, active funds are anticipated to disburse early to capitalize on this trend.

According to PHS experts, the main investment arguments for 2025 revolve around three key groups. Firstly, external factors include the policy impact of Trump 2.0, stable global economic growth, and the potential resolution of prolonged conflicts. Secondly, domestic institutional reforms focus on government efforts to streamline and reform, a strong commitment to boosting public investment, and changes in laws, monetary and fiscal policies aimed at stimulating growth and market upgrade.

Thirdly, on the economic front, stable macroeconomic indicators, robust production, business, and export activities, and a recovering real estate market are highlighted. Vietnam’s economy presents both advantages and risks in the context of an unpredictable global landscape.

Assessing the impact of Trump 2.0 on Vietnam, PHS emphasizes the opportunities in the semiconductor industry and FDI attraction. On November 29, 2024, the US Department of Commerce imposed preliminary anti-dumping duties on solar cells and modules imported from Cambodia, Malaysia, Thailand, and Vietnam, with Vietnam facing the highest tax rate ranging from 53.3% to 271.28%. This has immediately affected FDI attraction in the solar cell manufacturing industry. However, Vietnam still has room to attract FDI in the electronics industry and the automotive auxiliary industry.

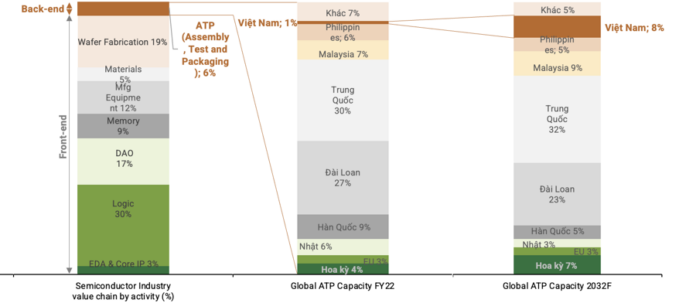

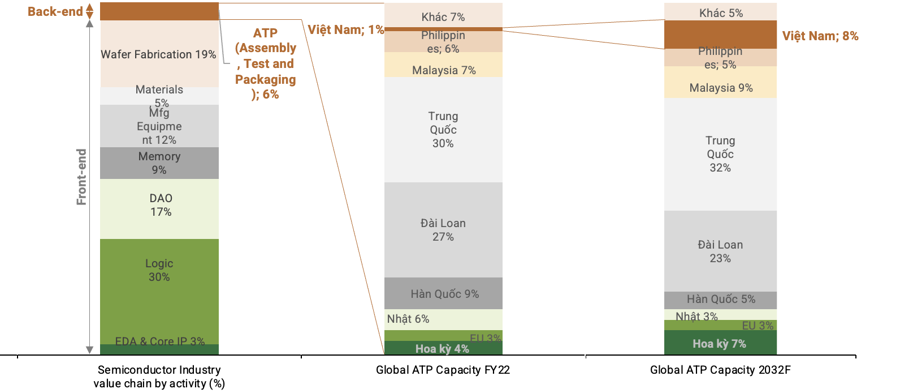

In the semiconductor industry, developed markets like the US, EU, Japan, and South Korea dominate the front-end segment of the chip production value chain.

The backend process, which includes assembly, testing, and packaging (ATP), is a crucial step in preparing semiconductor devices for integration into electronic devices such as phones and computers. According to a report by the Semiconductor Industry Association (SIA) and BCG from May 2024, Vietnam is projected to significantly increase its market share in the ATP segment from 1% in 2022 to 8% by 2032.

“Vietnam is considered a bright spot in the global semiconductor ATP industry, which is valued at $95 billion,” PHS emphasized.

Given the escalating geopolitical tensions worldwide, especially in critical regions within the semiconductor supply chain (military tensions on the Korean Peninsula and military pressure in the Taiwan Strait), Vietnam’s stable political environment and balanced relationships position it to benefit from the diversification of the semiconductor supply chain.

Vietnam has proactively implemented its strategy for the development of the semiconductor industry, with a focus on cultivating 50,000 engineers by 2050. The country is also actively working on infrastructure development and collaborating with leading chip manufacturers worldwide.

Moreover, a robust ecosystem of electronic products and devices that utilize semiconductor chips has been established in Vietnam over the past decade, with increasing specialization and the entry of prominent component suppliers and brands such as Foxconn, Luxshare, Samsung, Pegatron, and SK.

The Vietnamese Stock Market Soars: A Surprising Rise to the Top in Asia

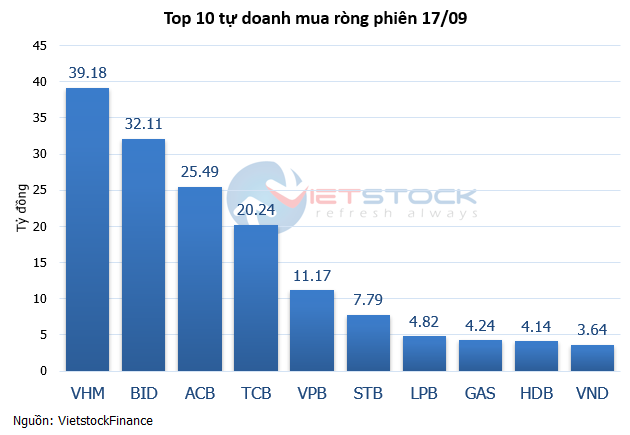

The Vietnamese stock market witnessed an unexpected surge in trading activity, with the VN-Index leading gains across Asia. This rally was characterized by a significant jump in trading volume and a return to net buying by foreign investors, setting the stage for a potential shift in market dynamics and investor sentiment.

Tomorrow’s Stock Market Outlook, November 29: Will Profit-Taking Pressure Subside?

In the November 28 stock session, profit-taking selling pressure on stocks eased. Investors hope that this signal will persist into the next session.