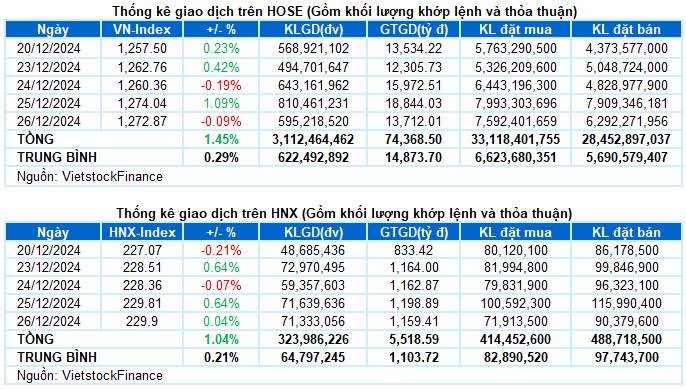

I. MARKET ANALYSIS OF THE STOCK MARKET ON 12/26/2024

– The main indices closed near the reference level in the trading session on December 26. The VN-Index closed slightly down 0.09%, at 1,272.87 points; HNX-Index edged up 0.04% from the previous session, reaching 229.9 points.

– The matching volume on the HOSE reached more than 502 million units, down 30.7% compared to the previous session. The matching volume on the HNX also decreased by 39.3%, reaching nearly 41 million units.

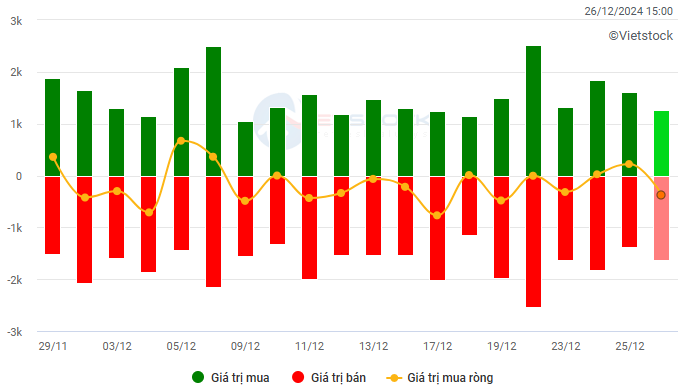

– Foreign investors net sold on the HOSE with a value of more than 381 billion VND and net sold nearly 11 billion VND on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: Billion VND

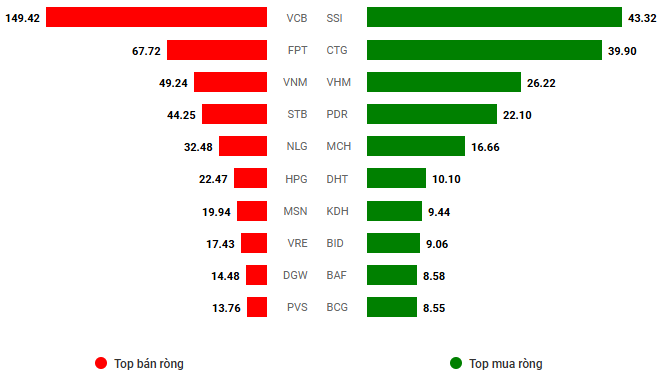

Net trading value by stock code. Unit: Billion VND

– The tug-of-war between buyers and sellers with low liquidity returned in the trading session on December 26. The market’s breakout yesterday did not boost investor confidence as there was a lack of clear supportive factors. The main indices fluctuated within a narrow range throughout the trading session. The VN-Index closed slightly down 0.09%, settling at 1,272.87 points.

– In terms of impact, MBB, BID, and VIB were the most supportive pillars, helping the VN-Index gain more than 1.5 points. On the opposite side, VCB, FPT, and MWG were dominated by sellers, taking away 1 point from the overall index.

– The VN30-Index also closed near the reference level, reaching 1,342.68 points. The breadth of the basket was balanced with 14 declining stocks, 12 advancing stocks, and 4 stocks standing at the reference level. Among them, VIB and STB broke out strongly with gains of over 2%. In contrast, SSB and BVH were the worst performers, losing about 2% in today’s session.

Sectors were mixed, with most sectors fluctuating below 1%, except for the telecommunications sector, which recorded the sharpest decline of 1.19%. The focus of this group was on YEG stock, which fell to the floor price after a series of impressive ceiling price increases. In addition, many large-cap stocks in the industry were dominated by sellers, typically VGI (-1.26%), FOX (-1.32%), and CTR (-0.71%).

On a positive note, the energy group led the market as buyers prevailed in many stocks such as BSR (+1.35%), PVD (+0.42%), CST (+4.15%), TMB (+0.65%), TVD (+1.87%), and PSB, which hit the ceiling price. The financial group, after shining in the previous session, only edged up 0.14% today. Stocks were quite divided, while STB, MBB, HDB, VIB, and BVB maintained their upward momentum, gaining about 1-2%, many stocks made significant adjustments such as SSB (-2.03%), EIB (-1.28%), LPB (-1.02%), BVH (-1.87%), and BSI (-1.43%),…

The VN-Index edged down as trading volume fell below the 20-day average. This suggests that investors turned more cautious after the previous strong gains. However, the MACD indicator has given a buy signal again after crossing above the signal line. At the same time, the Stochastic Oscillator has also just shown a similar signal. If this condition persists in the coming sessions, the outlook may not be too pessimistic.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – MACD and Stochastic Oscillator indicators give buy signals

The VN-Index edged down as trading volume fell below the 20-day average, indicating that investors became more cautious after the previous strong gains.

However, the MACD indicator has turned positive again, crossing above the signal line. Meanwhile, the Stochastic Oscillator has also just given a similar buy signal. If this condition is maintained in the coming sessions, the outlook may not be too pessimistic.

HNX-Index – High Wave Candle pattern appears

The HNX-Index continued to gain alongside the emergence of the High Wave Candle pattern. Additionally, trading volume remained below the 20-day average, suggesting that investors were somewhat hesitant. Currently, the MACD and Stochastic Oscillator indicators maintain positive signals. If this state is sustained in the upcoming sessions, the outlook for the index will become more optimistic.

Analysis of Money Flow

Changes in Smart Money Flow: The Negative Volume Index indicator of the VN-Index has crossed above the 20-day EMA. If this state persists in the next session, the risk of a sudden decline (thrust down) will be limited.

Changes in Foreign Investment Flow: Foreign investors returned to net selling in the trading session on December 26, 2024. If foreign investors maintain this action in the coming sessions, the situation will become more pessimistic.

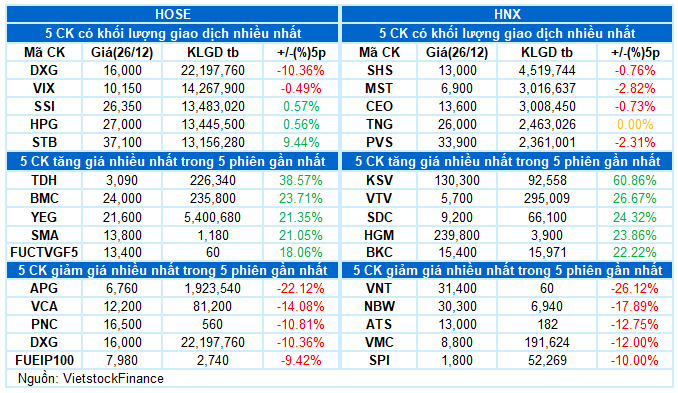

III. MARKET STATISTICS ON 12/26/2024

Economic Analysis and Market Strategy Department, Vietstock Consulting

– 16:58 12/26/2024

The Market Pulse: Is the Risk of Adjustment Rising?

The VN-Index witnessed a significant decline, forming a bearish Falling Window candlestick pattern and dipping below the Middle Bollinger Band. This suggests a potential shift in market sentiment. The volume also spiked above the 20-day average, indicating heightened investor anxiety. The Stochastic Oscillator is firmly in oversold territory and continues to signal a sell-off. If the MACD also turns bearish in the coming days, the likelihood of a more pronounced correction will increase.

Trump 2.0: Opportunity or Challenge for Stock Investors?

The upcoming livestream, “Trump’s Election Win: Opportunity or Challenge for Stock Investors?” airing at 3:00 PM on December 19, 2024, on the official Fanpage and YouTube channel of DNSE Joint Stock Securities Company, promises to deliver sharp insights and a multifaceted perspective on the 2025 stock market outlook.

What Will the Vietnamese Stock Market Look Like in 2025?

The Vietnamese stock market is projected to witness an impressive average liquidity of over 23 trillion VND per session in 2025. Amidst this vibrant liquidity, the VnIndex soared to its highest point, surpassing 1,400 marks, while fluctuating around the 1,341 mark throughout the year.