Mr. Doan Nguyen Duc, Chairman of Hoang Anh Gia Lai Group (HAGL, stock code HAG), confirmed that HAGL Agrico (a company operated by Thaco) has paid over VND 1,000 billion to HAG to partially repay the principal of the bonds issued by the company to BIDV in late 2016.

Specifically, the HAGLBOND16.26 bond issued by HAG is valued at VND 6,596 billion, with an interest rate of 9.7% per annum and a maturity date of December 30, 2026. BIDV is the bondholder.

In its announcement on December 26, HAG stated that it had repaid VND 206 billion as partial repayment of the principal of this bond. On December 30, the Company continued to pay an additional VND 824 billion, bringing the total principal repayment for the above bond to VND 1,030 billion.

Of this, VND 1,000 billion came from the amount paid by HAGL Agrico to HAG under a tripartite agreement, and the remaining due amount of VND 766 billion has not been repaid as unprofitable assets have not been liquidated. This amount is expected to be paid in Q2 2025.

HAGL is currently focused on agriculture, with key products including bananas, durians, pigs fed with bananas, and some pork-based products such as sausages and pork rolls…

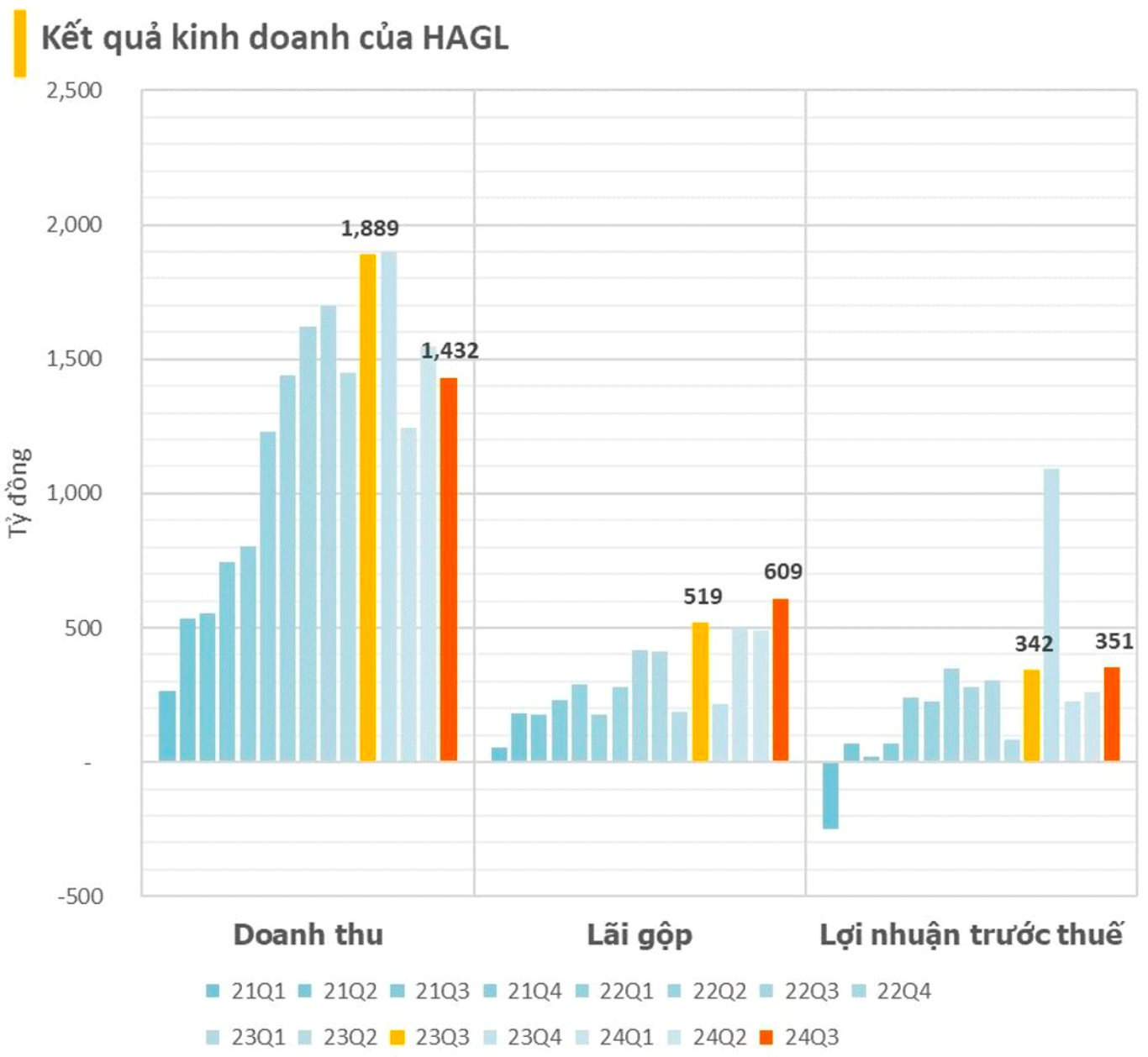

In Q3 2024, HAGL recorded net revenue of VND 1,432 billion, down 24% year-on-year. Of this, net revenue from fruit, the main source of revenue, was VND 880 billion, down 12% year-on-year. Revenue from pig sales reached VND 234 billion, down 52% year-on-year.

Despite the decrease in revenue, the cost of goods sold decreased more significantly, resulting in a 17% increase in gross profit to VND 609 billion. The company’s gross profit margin improved from 27.45% in Q3 2023 to 42.56% in Q3 2024. The fruit segment had the highest gross profit margin of approximately 52%.

After deducting expenses, HAGL reported a net profit of nearly VND 351 billion, up 8% year-on-year. Net profit attributable to the company’s shareholders was VND 332 billion, up nearly 4% year-on-year.

For the first nine months of the year, HAGL recorded net revenue of VND 4,194 billion, down 17% year-on-year, and net profit of VND 851 billion, up 20% year-on-year.

“BIDV Unveils Electronic Customer Authentication via VNeID”

Hanoi, December 2nd, 2024 – Vietnam Joint Stock Commercial Bank for Investment and Development (BIDV) and the Research and Application Center for Population Data and Civil Status (Center for RAR) under the Ministry of Public Security, have signed an agreement to implement electronic customer authentication services through VNeID on the BIDV SmartBanking application.