HDBank Shares Surge to All-Time High, Masan Consumer Becomes Vietnam’s Largest Food and Beverage Company

The Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank) saw its share price soar to a historic high on December 30, 2023, closing at 26,650 VND per share, a 6.81% increase from the previous session. This surge marked the fourth consecutive day of gains for HDBank, resulting in a 14% rise since December 25. Compared to the beginning of the year, the share price has climbed an impressive 77%.

As a result, the bank’s market capitalization has surged to over 93.143 trillion VND. This upward momentum has positively impacted the wealth of HDBank’s shareholders, including billionaire Nguyen Thi Phuong Thao, whose holdings are now valued at nearly 3.485 trillion VND, reflecting a single-day increase of over 222 billion VND.

HDBank’s strong financial performance in the third quarter further bolstered investor confidence. The bank reported a 42.7% year-on-year increase in pre-tax profit, amounting to 4.490 trillion VND. For the nine-month period ending September 30, HDBank’s cumulative pre-tax profit reached 12.655 trillion VND, representing a 46.6% surge and fulfilling 79.8% of its full-year profit plan.

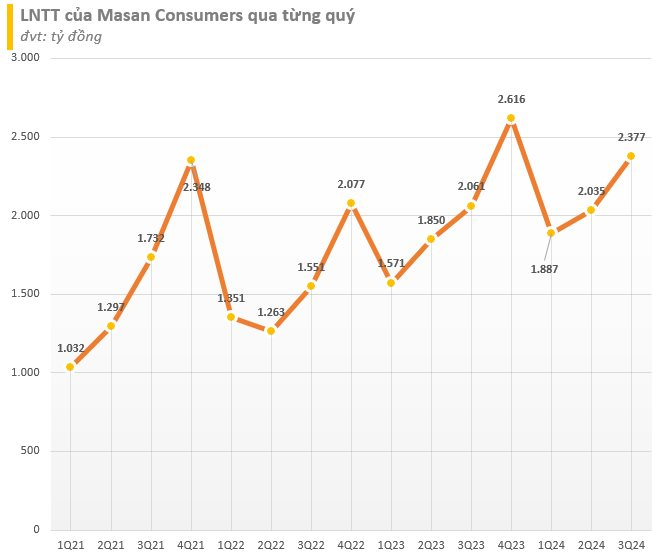

Meanwhile, Masan Consumer, a subsidiary of Masan Group, witnessed a remarkable seventh consecutive day of gains, with its share price soaring 10.78% to close at 260,000 VND per share. This surge propelled the company’s market capitalization to surpass 188.4 trillion VND (approximately 7.4 billion USD), surpassing that of the Vietnam Dairy Products Joint Stock Company (Vinamilk) and solidifying its position as the largest food and beverage company on Vietnam’s stock exchange.

Masan Consumer’s impressive performance can be attributed to its strategic focus on delivering high-quality products and innovative offerings. The company’s decision to pay out hefty dividends further bolstered investor confidence. In 2023, Masan Consumer distributed approximately 19 trillion VND in cash dividends, representing a staggering payout ratio of 268%.

Additionally, the company’s plans to uplist from UPCoM to HoSE in 2025 and its proposed private placement to existing shareholders at a price of 10,000 VND per share have also contributed to the positive sentiment surrounding the stock. The private placement aims to raise 3.268 trillion VND to primarily repay debts, with the potential to increase the company’s charter capital to 10.623 trillion VND.

Masan Consumer’s strong third-quarter financial results further reinforced its growth trajectory. The company reported an 11% year-on-year increase in net revenue, totaling 21.955 trillion VND for the nine-month period ending September 30, 2024. This solid performance was complemented by a 14% surge in net income over the same period, amounting to 5.553 trillion VND.

The Billionaire Stock Boom: Nguyễn Đăng Quang and Nguyễn Thị Phương Thảo’s Stocks Surge to Historic Highs at Year-End

As of December 30, billionaire Nguyen Thi Phuong Thao’s HDB stock holdings were valued at nearly VND 3,485 billion, marking an increase of over VND 222 billion for the day.

The Green Finance Framework: Pioneering Sustainability at HDBank

HDBank has unveiled its Sustainable Finance Framework, aligned with the standards set by the International Capital Market Association (ICMA) and the Loan Market Association (LMA). This framework was developed with technical support from the International Finance Corporation (IFC) and received a “very good” rating from Moody’s.