HDBank Shares Surge to All-Time High, Masan Consumer Becomes Vietnam’s Largest Food and Beverage Company

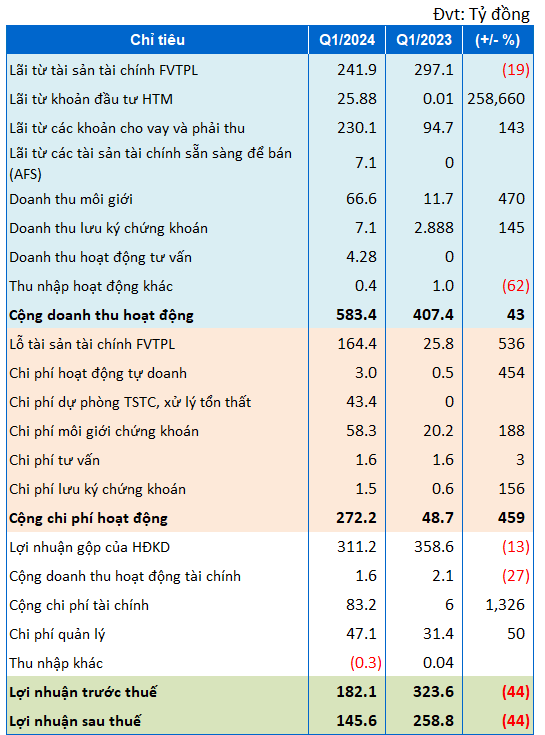

The Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank) saw its share price soar to a historic high on December 30, 2024, with a trading volume of nearly 10.6 million units. The share price closed at 26,650 VND, a 6.81% increase from the previous session, marking the fourth consecutive day of gains. This surge has pushed the bank’s market capitalization to over 93,143 billion VND.

HDBank’s impressive performance was reflected in its third-quarter financial report, showing a 42.7% increase in pre-tax profit compared to the same period in 2023. The nine-month cumulative profit reached 12,655 billion VND, a 46.6% increase, and achieved 79.8% of the annual plan.

HDBank’s share price performance

As a result, the stock price surge has positively impacted the wealth of HDBank’s shareholders. Notably, billionaire Nguyen Thi Phuong Thao’s HDB shares are now valued at nearly 3,485 billion VND, reflecting a daily increase of over 222 billion VND. In addition, Sovico Joint Stock Company holds over 501 million HDB shares.

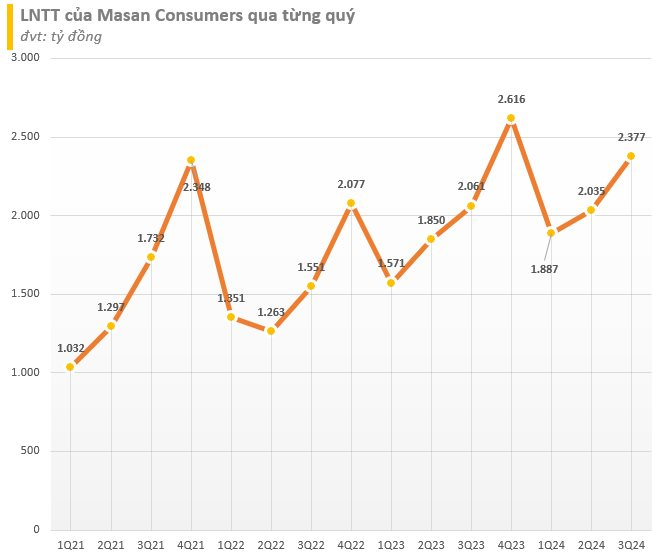

Turning to the consumer goods sector, the Masan Consumer Holdings Corp (MCH) also witnessed a remarkable performance on the stock market. MCH shares surged by 10.78% on the same day, closing at 260,000 VND per share. This marks the seventh consecutive session of gains for MCH, which has also hit a new all-time high. Over the past seven sessions, MCH shares have climbed by 18%.

When compared to the 75,000 VND price at the beginning of the year, MCH shares have skyrocketed by a staggering 245%. Consequently, Masan Consumer’s market capitalization has surpassed the 188,400 billion VND mark (approximately 7.4 billion USD), surpassing the Vietnam Dairy Products Joint Stock Company (Vinamilk) to become the largest company in the food and beverage industry on the Vietnamese stock exchange.

Masan Consumer’s market capitalization surpasses Vinamilk’s

Masan Consumer, a subsidiary of the Masan Group Joint Stock Company, has been likened to a “family jewel” by the group’s chairman, billionaire Nguyen Dang Quang. Mr. Quang himself holds 30,417 MCH shares, valued at over 7.9 billion VND.

The upward trajectory of Masan Consumer’s stock price began in early November, fueled by news of exceptionally high dividend payouts. The session on December 30 also marked the distribution of nearly 7,000 billion VND in 2024 dividends to shareholders. Prior to this, Masan Consumer had finalized the list of shareholders eligible for this dividend payout on December 20 and completed the distribution within just ten days.

Demonstrating its commitment to shareholder returns, Masan Consumer distributed approximately 19,000 billion VND in cash dividends for the full year of 2023, representing a remarkable payout ratio of 268%. This generous dividend distribution comes as Masan Consumer prepares for its planned listing on the Ho Chi Minh Stock Exchange (HoSE) in 2025, having previously traded on the Unlisted Public Company Market (UPCoM).

Furthermore, Masan Consumer intends to raise 3,268 billion VND by offering 326.8 million shares to existing shareholders at a ratio of 100:45.1, with a share price of 10,000 VND. The majority of the proceeds will be allocated to debt repayment, and the successful completion of this offering will result in an increase in the company’s charter capital to 10,623 billion VND.

The company’s third-quarter financial results further bolstered investor confidence, with Masan Consumer recording a 10% year-over-year increase in revenue, totaling 7,987 billion VND. After expenses, the company’s post-tax profit exceeded 2,094 billion VND, a 14% increase compared to the previous year. The profit after tax attributable to the company’s parent entity reached 2,072 billion VND, also reflecting a 14% year-over-year increase.

Masan Consumer’s impressive financial results