HDBank Shares Surge to All-Time High, Masan Consumer Becomes Vietnam’s Largest Food and Beverage Company

HDBank’s shares surged to an all-time high on December 30, 2023, with a closing price of VND 26,650 per share, marking a 6.81% increase from the previous session. The trading volume reached nearly 10.6 million units, showcasing strong investor confidence in the bank’s performance.

This upward momentum pushed the market capitalization of HDBank to over VND 93,143 billion, reflecting a significant increase in the bank’s value.

The rise in share price also positively impacted the wealth of its shareholders. Notably, billionaire Nguyen Thi Phuong Thao’s holdings in HDBank are now valued at nearly VND 3,485 billion, witnessing an increase of over VND 222 billion on this day alone.

Additionally, Sovico Holdings owns more than 501 million HDBank shares, further emphasizing the bank’s strong presence in the market.

HDBank’s financial reports revealed impressive results, with a 42.7% quarter-over-quarter increase in pre-tax profit for Q3 2023, amounting to VND 4,490 billion. The 9-month cumulative profit reached VND 12,655 billion, surpassing the yearly plan by 79.8% and showcasing a remarkable 46.6% year-over-year increase.

Masan Consumer’s Stock Soars, Making It Vietnam’s Largest F&B Company

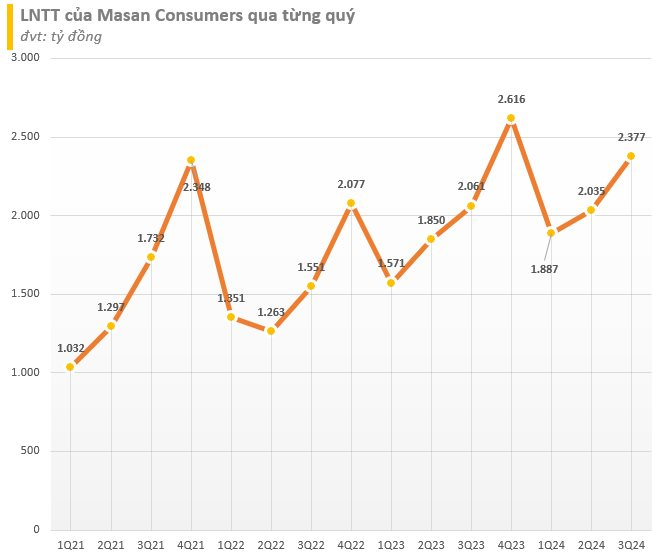

In a remarkable display of financial prowess, Masan Consumer, a subsidiary of Masan Group, has seen its market capitalization surpass VND 188,400 billion (approximately USD 7.4 billion), firmly establishing itself as the largest food and beverage company in Vietnam’s stock market.

This achievement surpasses that of Vinamilk, a long-standing leader in the industry, and underscores Masan Consumer’s exceptional growth and market dominance.

At the 2024 Annual General Meeting of Shareholders, billionaire Nguyen Dang Quang, Chairman of Masan Group, likened Masan Consumer to a family heirloom diamond, emphasizing its invaluable worth.

Mr. Quang himself owns 30,417 MCH shares, valued at over VND 7.9 billion, reflecting his confidence in the company’s long-term prospects.

Masan Consumer’s impressive performance can be attributed to a combination of factors, including a well-executed strategy, efficient management, and a strong commitment to delivering value to its shareholders. The company’s decision to pay out hefty dividends further underscores its financial strength and stability.

With a series of strategic moves, including plans to list on the Ho Chi Minh Stock Exchange (HoSE) in 2025 and a rights offering to existing shareholders, Masan Consumer is well-positioned to continue its remarkable growth trajectory and solidify its leadership in the highly competitive food and beverage industry.