HDBank Shares Soar to All-Time High, Boosting Shareholder Value

The Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank) saw its share price soar to an all-time high on December 30, 2024, with a trading volume of nearly 10.6 million units. The share price closed at 26,650 VND, a 6.81% increase from the previous session, marking the fourth consecutive session of gains. This surge has pushed HDBank’s market capitalization to over 93,143 billion VND.

This upward trend has been consistent since December 25, with a 14% increase in the share price over this period. Compared to the beginning of the year, HDBank’s share price has skyrocketed by more than 77%.

HDBank’s share price performance

As a result, the stock value of HDBank’s shareholders has significantly increased. Notably, billionaire Nguyen Thi Phuong Thao’s holdings are now worth nearly 3,485 billion VND, reflecting a gain of over 222 billion VND on the day. In addition, Sovico Joint Stock Company holds over 501 million HDB shares.

HDBank’s impressive performance is further highlighted by its financial reports. The bank’s pre-tax profit for the third quarter of 2024 reached 4,490 billion VND, a 42.7% increase from the same period in 2023. Moreover, the nine-month cumulative profit stood at 12,655 billion VND, a 46.6% increase, and the bank has already achieved 79.8% of its annual profit plan.

Masan Consumer’s Stock Surges, Making It the Largest Company in Vietnam’s Food and Beverage Sector

In other news, the shares of Masan Consumer Holdings (MCH) also witnessed a remarkable surge, climbing 10.78% to close at 260,000 VND per share on the same trading day. This marks the seventh consecutive session of gains for MCH, which has now reached a new all-time high. Over the past seven sessions, MCH shares have risen by 18%.

If we consider the share price from the beginning of the year, which was at 75,000 VND, MCH has seen an astonishing 245% increase in value. Consequently, Masan Consumer’s market capitalization has surpassed 188,400 billion VND (approximately 7.4 billion USD) for the first time. This makes it the largest company in Vietnam’s food and beverage sector on the stock exchange, surpassing even Vinamilk, which has a market capitalization of 132,000 billion VND.

Masan Consumer’s market capitalization surpasses Vinamilk’s

Masan Consumer, a subsidiary of the Masan Group, has been likened to a “family jewel” by the group’s chairman, billionaire Nguyen Dang Quang. Mr. Quang himself owns 30,417 MCH shares, valued at over 7.9 billion VND.

The upward momentum of Masan Consumer’s shares can be traced back to early November, with a significant boost following the announcement of extremely high dividend payments. The session on December 30 also marked the day when nearly 7,000 billion VND in 2024 dividends were paid out to shareholders. Prior to this, Masan Consumer had finalized the list of dividend recipients on December 20 and completed the payment within just ten days.

Throughout 2023, Masan Consumer distributed approximately 19,000 billion VND in cash dividends, representing a staggering dividend rate of 268%. This generous distribution of profits comes as Masan Consumer plans for a listing on the HoSE in 2025, as decided by its Board of Directors in October 2024.

Additionally, Masan Consumer intends to offer 326.8 million shares to existing shareholders at a ratio of 100:45.1, with a price of 10,000 VND per share. The expected proceeds of 3,268 billion VND from this offering will primarily be used to repay debts, and the company’s charter capital is projected to increase to 10,623 billion VND.

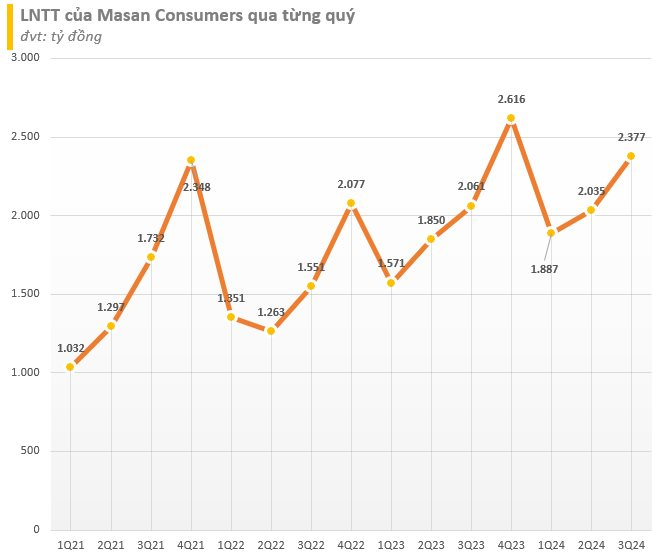

The company’s strong third-quarter performance further fueled this growth. Masan Consumer recorded a 10% year-over-year increase in revenue, reaching 7,987 billion VND. After expenses, the company’s post-tax profit exceeded 2,094 billion VND, a 14% increase from the previous year. This positive trend continued in the nine-month period ending in September 2024, with a revenue of 21,955 billion VND and a post-tax profit of 5,553 billion VND, representing an 11% and 14% increase, respectively, compared to the same period in 2023.

Masan Consumer’s impressive business results