YEG Shares Plummet as Yeah 1 Faces Post-Concert Reality

YEG shares of Yeah 1 Group Joint Stock Company plummeted to the floor price of 7% to VND 18,600/share on December 31, 2024, marking the third consecutive session of losses. This sharp decline wiped out the gains made over the previous seven sessions, which saw the share price double in just a few months following the second concert of “Anh Trai Vượt Ngàn Chông Gai” in Hung Yen.

By 10:30 am on December 31, nearly 3 million YEG shares were matched, but more than 2.6 million shares were stuck at the floor price. This sell-off comes as Yeah 1 faces the post-concert reality, with their latest show, “Chi Dep Dap Gio 2024,” struggling to attract viewers. The show’s YouTube views have been declining with each episode, and apart from the first episode, the rest have only managed to garner 1-2 million views. The concert performances have also failed to make it to the YouTube trending page.

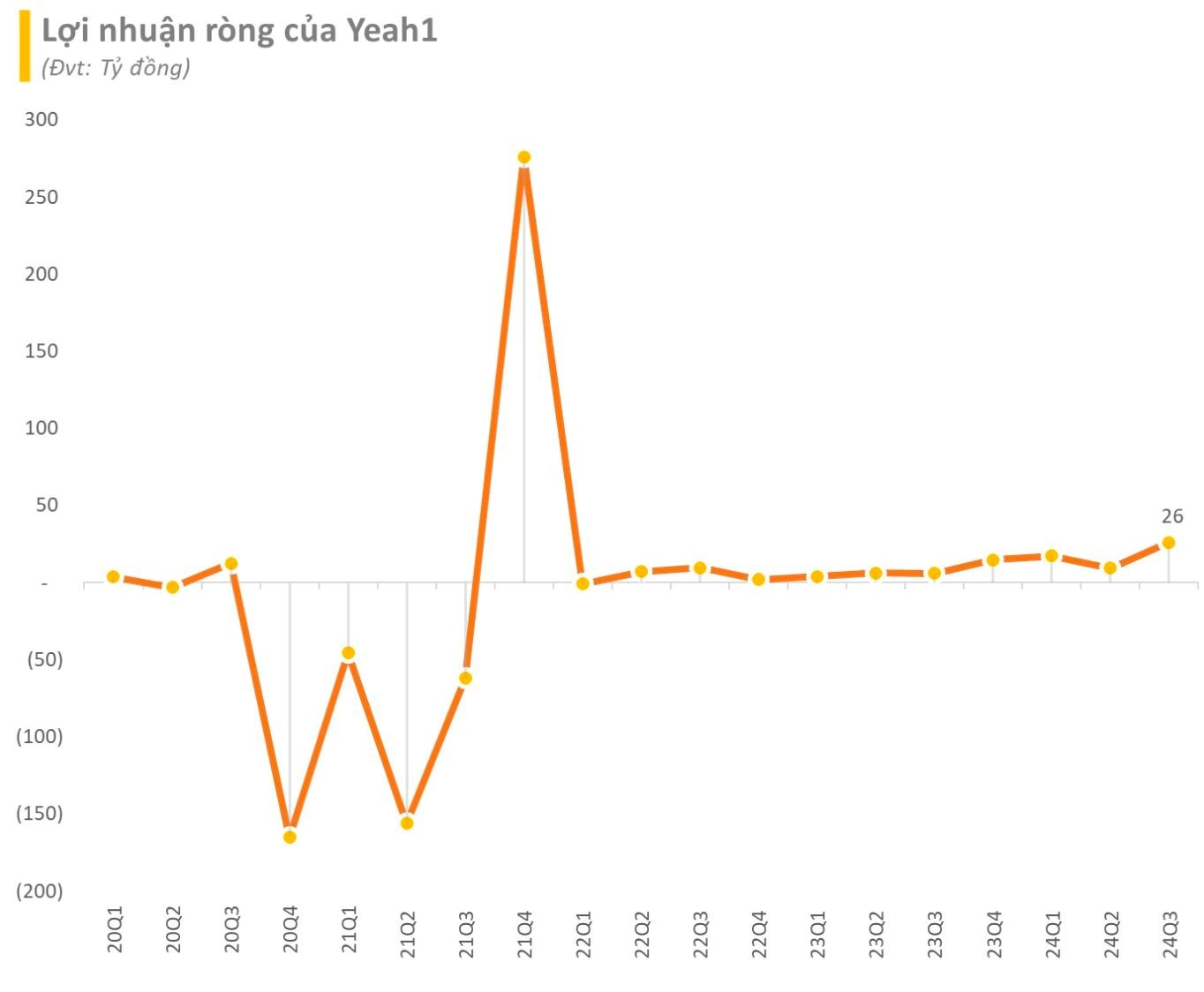

On a positive note, Yeah 1’s Q3/2024 financial results revealed a threefold increase in revenue year-on-year, totaling VND 345 billion, the highest since Q4/2020. After deducting related expenses, the company reported a tenfold increase in profit compared to the same period last year, amounting to over VND 34 billion.

For the first nine months of 2024, Yeah 1 recorded a revenue of over VND 629 billion, a 2.4-fold increase, and a net profit of nearly VND 56 billion, a 4.5-fold increase compared to the same period in 2023.

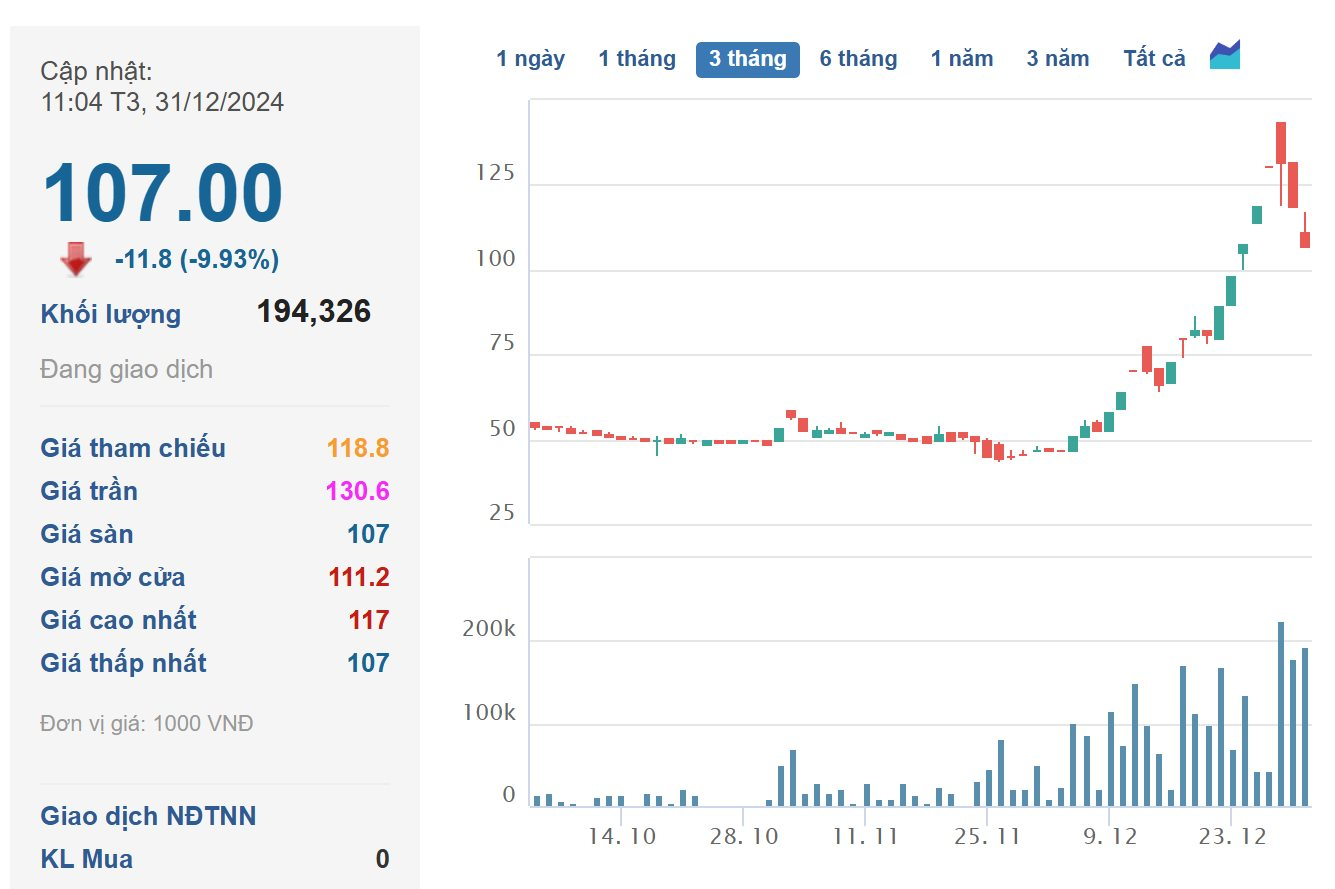

KSV Shares Also Form a “Christmas Tree” Pattern with YEG

During the same period that YEG shares were on a winning streak, KSV shares of the Vietnam National Coal-Mineral Industries Group (Vinacomin) also witnessed consecutive ceiling sessions, followed by a sharp decline, including one floor session, corresponding to a 16% drop.

KSV shares had hit a historical peak of VND 132,000/share on December 27, marking an 180% increase in just one month and a 340% surge since the beginning of the year. Vinacomin, the parent company of Vimico, is engaged in the mining of minerals, non-ferrous metals, rare earth minerals, and black metals. It is renowned for its leadership in copper mining and processing in Vietnam, with access to the country’s largest copper mine, Sin Quyen.

Vimico also holds the rights to the Dong Pao rare earth mine, the largest of its kind in Vietnam, with a total geological reserve of over 11.3 million tons, accounting for more than half of the country’s rare earth reserves. Other sources of rare earth minerals are found in Nam Xe (Lai Chau), Muong Hum (Lao Cai), and Yen Bai.

In a recent meeting with Vinacomin’s General Director, Vu Anh Tuan, the leadership of the Mineral Corporation-TKV shared their impressive consolidated revenue of VND 11,968 billion for the first 11 months, expecting to reach VND 13,327 billion for the full year. They also reported a profit of VND 1,117 billion, projected to be VND 1,296 billion for the year. Additionally, their tax contribution stood at VND 1,205 billion, anticipated to reach VND 1,595 billion for the entire year.

The average income was VND 16.1 million/person/month for the first 11 months and is expected to be VND 16.34 million/person/month for the full year.