YEG Shares Plummet as Yeah 1 Faces Post-Concert Reality

YEG shares of Yeah 1 Group Joint Stock Company plummeted to their daily limit of 7% to VND 18,600 per share on December 31, 2024, marking the third consecutive session of losses.

By 10:30 am local time, nearly 3 million YEG shares were traded, but more than 2.6 million shares were stuck at the floor price.

This downward trend comes after YEG witnessed seven consecutive sessions of gains, fueled by the explosive effect of the second “Anh trai vượt ngàn chông gai” concert in Hung Yen. The share price had doubled in just a few months, adding over VND 1,000 billion to the company’s market capitalization.

However, in the aftermath of the concert, Yeah 1 is facing a reality check as their new show, “Chị đẹp đạp gió 2024,” struggles to captivate viewers. The TV show, which followed the success of “Anh trai vượt ngàn chông gai,” has failed to attract a similar level of interest, with views declining over subsequent episodes. Aside from the first episode, which garnered attention, subsequent episodes have only managed to attract around 1-2 million views, and the performance stages have largely failed to trend on YouTube.

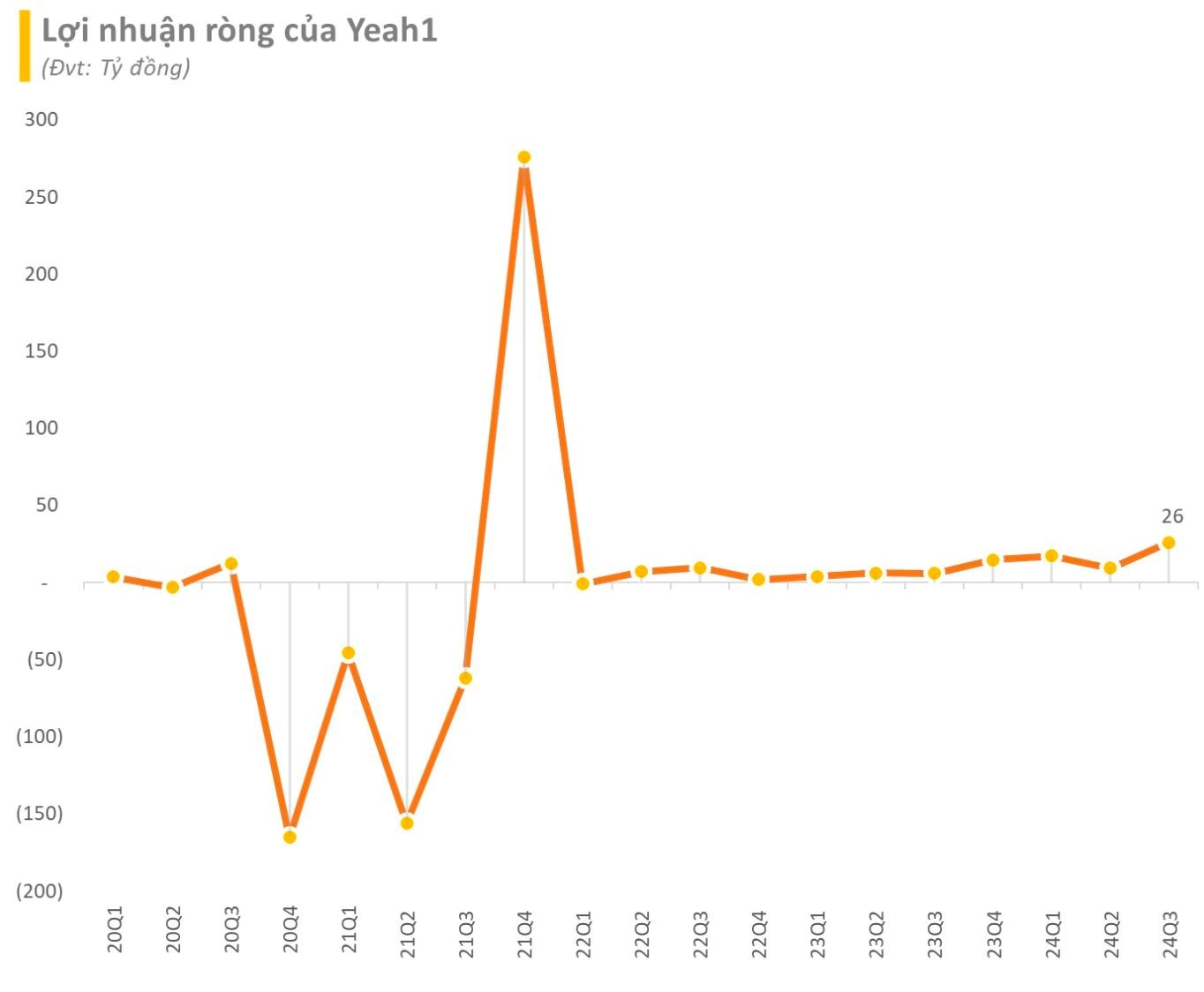

In terms of business performance, Yeah 1 revealed that their revenue for Q3 2024 exceeded VND 345 billion, a threefold increase compared to the same period last year, and the highest quarterly revenue since Q4 2020. After deducting related expenses, the company reported a tenfold increase in profit compared to the previous year, amounting to over VND 34 billion.

For the first nine months of 2024, Yeah 1 recorded a revenue of more than VND 629 billion, a 2.4-fold increase, and a net profit of nearly VND 56 billion, a 4.5-fold increase compared to the same period in 2023.

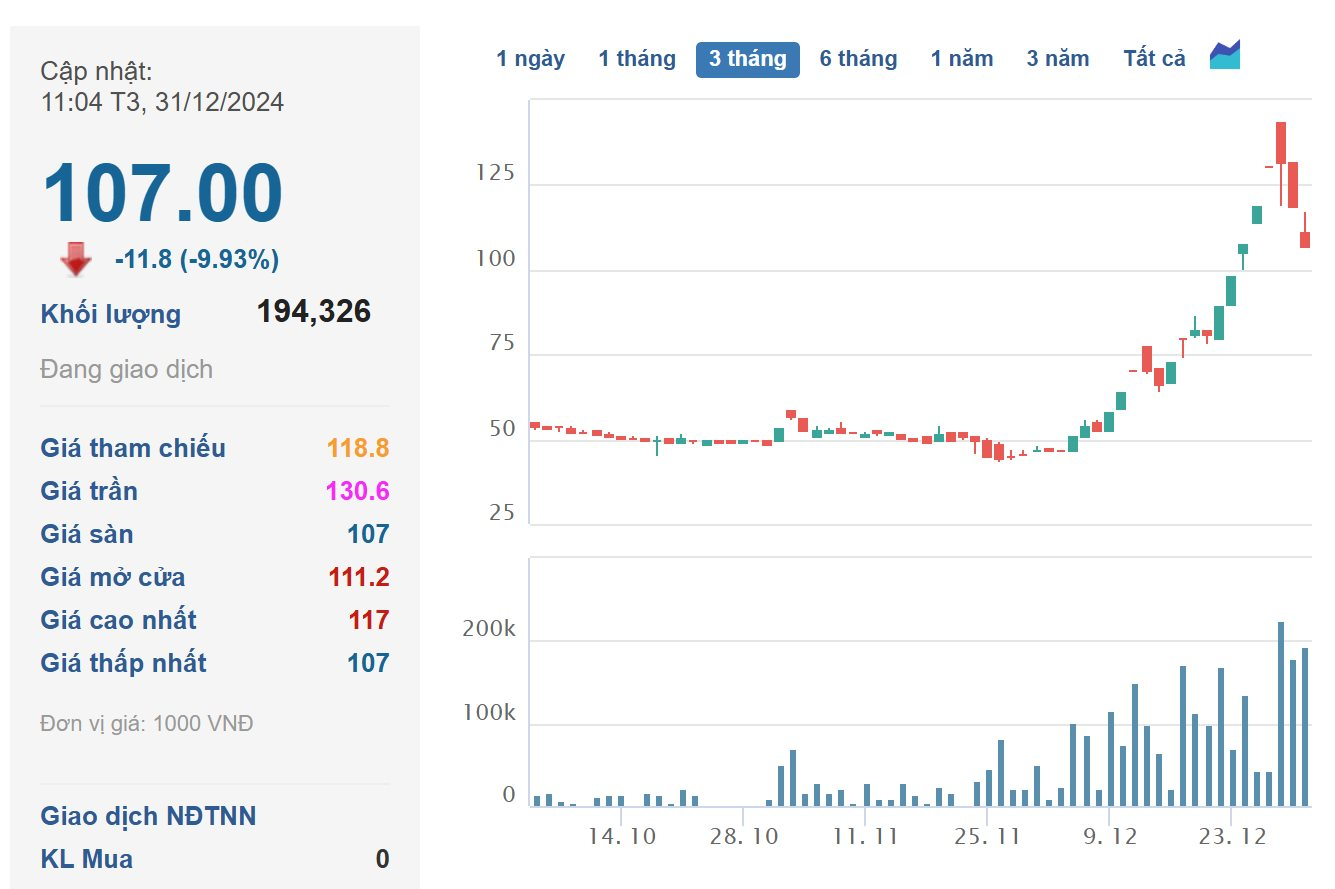

KSV Shares Also Form a “Christmas Tree” Pattern with YEG

During the same period of YEG’s consecutive ceiling-hitting sessions, KSV shares of the Vietnam National Coal-Mineral Industries Group (Vinacomin) also witnessed a significant rise, followed by a sharp decline, including one floor session, corresponding to a 16% drop.

Prior to this, KSV had reached a historical peak of VND 132,000 per share on December 27, 2024, marking an 180% increase within just one month and a 340% surge since the beginning of the year.

As a subsidiary of Vinacomin, Vimico primarily focuses on mineral and non-ferrous metal mining, as well as rare earth minerals and ferrous metals. The company is renowned for its leadership in copper mining and processing in Vietnam, with access to the country’s largest copper mine, the Sin Quyen mine.

Vimico also currently owns the Dong Pao rare earth mine, which boasts the largest reserves in the country. Spanning nearly 133 hectares in Ban Hon, Tam Duong district, Lai Chau province, Dong Pao is estimated to hold over 11.3 million tons of geological dry reserves, accounting for more than half of Vietnam’s total rare earth reserves. The remaining sources of rare earth elements are mainly distributed in Nam Xe (Lai Chau), Muong Hum (Lao Cai), and Yen Bai.

In a recent meeting with Vinacomin’s General Director, Vu Anh Tuan, the leadership of the Vinacomin Mineral Corporation shared their impressive consolidated revenue of VND 11,968 billion for the first 11 months, with an expected annual revenue of VND 13,327 billion. They also reported a profit of VND 1,117 billion for the same period, with an anticipated annual profit of VND 1,296 billion.

Additionally, they disclosed a budget contribution of VND 1,205 billion for the first 11 months, with an expected annual contribution of VND 1,595 billion. The average income was reported to be VND 16.1 million per person per month for the given period, with an expected annual average of VND 16.34 million.

“Mortgaging KBC’s 12.6 Trillion VND Stake in the Trang Cat Urban Area Project”

The Kinh Bac City Development Holding Corporation (HOSE: KBC) has leveraged its assets as collateral to secure loans for the Trang Cat urban and service area development project.

The Art of Refinancing: TCO Holdings Prepares to Issue Convertible Bonds to Restructure Debt.

“TCO Holdings JSC (HOSE: TCO) is planning to offer private bonds worth VND 180 billion (at par value) to Lighthouse Investment Fund Management and Vietnam Industrial and Commercial Bank Fund Management Joint Stock Company (Vietinbank Capital).”