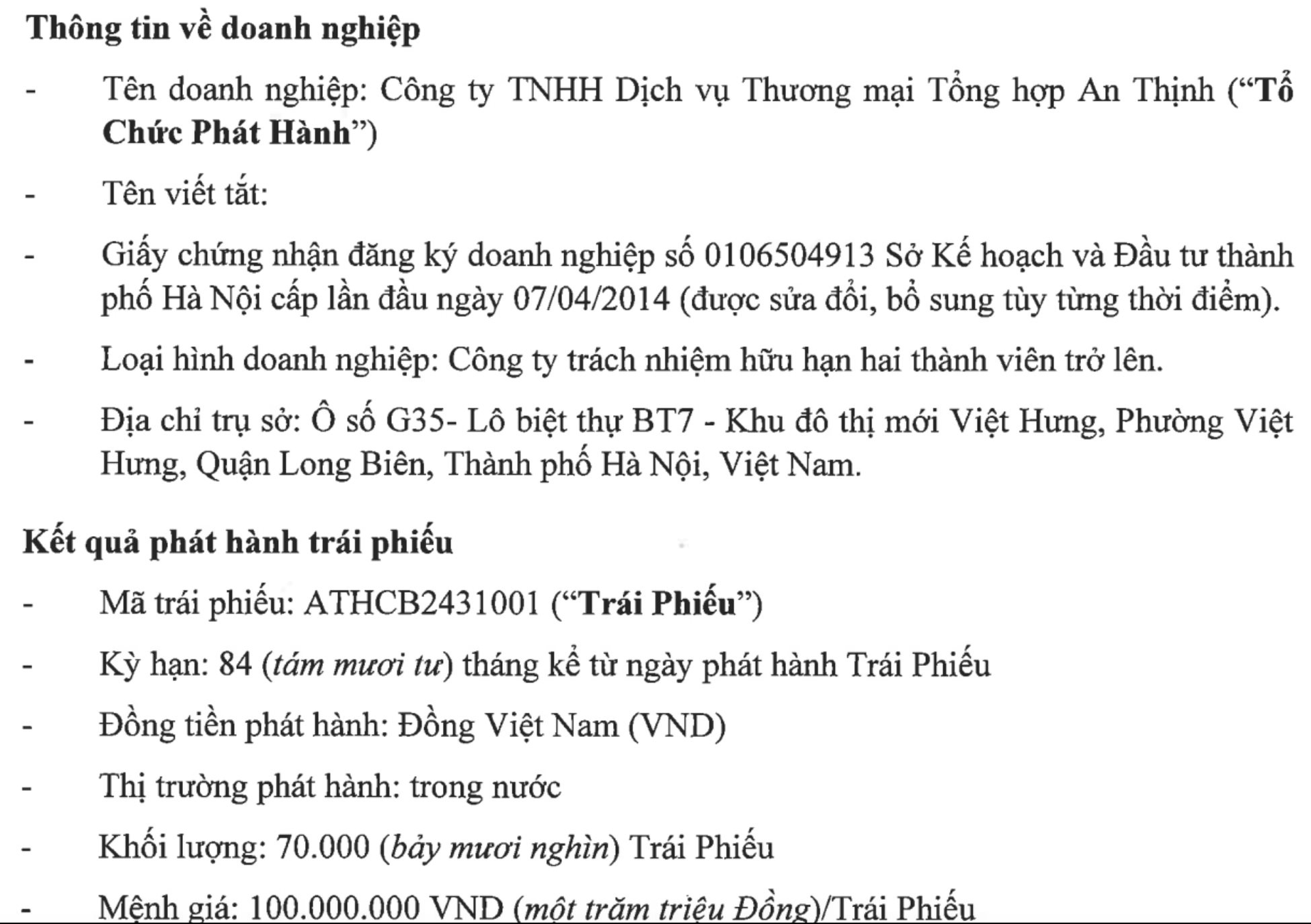

Hanoi Stock Exchange (HNX) information: An Thinh Commercial Services Trading JSC (An Thinh) has successfully issued bonds worth a total of VND 7,000 billion under the code ATHCB2431001.

The bonds have a term of 84 months, maturing on December 23, 2031, with a combined interest rate of 3% per annum. This type of bond is non-convertible, does not include warrants, and is guaranteed by a credit institution. Techcom Securities JSC (TCBS) is the registrar.

According to our understanding, An Thinh was established in 2014 and is currently headquartered at G35, BT7 Villa Lot, Viet Hung New Urban Area, Viet Hung Ward, Long Bien District, Hanoi.

According to the updated business registration on December 12, 2024, the company recently increased its charter capital from VND 1,156.2 billion to VND 2,906.2 billion. The shareholder structure includes General Director Phung Thu Hien holding 95% of the capital, Chairwoman of the Board of Directors Nguyen Thi Le Phan holding 2%, and Nguyen Huy Lam holding 3%.

On November 28, 2024, An Thinh and Hai Dang Real Estate Development and Investment JSC signed a non-binding agreement for the transfer of a real estate project under the number 2811/2024/HDNT CNDA BDS/HD-AT.

The project mentioned in the transfer contract is the high-rise residential area belonging to land lots CT-01, CT-05, and CT-06 – Eco-Urban Area Dream City (commercial name: Vinhomes Ocean Park 2), with Hai Dang Real Estate Development and Investment JSC as the investor.

On December 17, just a few days before the issuance of the aforementioned VND 1,000 billion bonds, An Thinh mortgaged the property rights arising from the transfer contract No. 2811/2024/HDNT CNDA BDS/HD-AT and its amendments (if any) at a bank.

The Stealthy Conglomerate’s Latest Acquisition: Vinhomes Ocean Park 2. A Quiet $7,000 Billion Bond Deal with a Mere 3% Interest Rate.

Prior to the issuance of the 1,000 billion VND bond, this company had mortgaged its contractual rights as collateral at a bank.

The Ultimate Cash Flow: Vicostone Prepares to Dish Out an Impressive 320 Billion VND in Dividends

“Vicostone Joint Stock Company (HNX: VCS) has announced a cash dividend of 2/2024, with a record date of December 12, 2024. As the direct holder of over 84% of VCS’s capital, Phenikaa Group stands to benefit significantly from this distribution.”

The Hydration Industry’s Hottest New Bond Offering: A Dehydrated Perspective.

The company, which is over 94% owned by Biwase, JSC – Binh Duong Water – Environment Corporation (Biwase, HOSE: BWE), has successfully raised a significant amount of bonds with an impressively low-interest rate of just 5.5% per annum, undercutting the bond interest rates offered by many other enterprises.