I. VIETNAMESE STOCK MARKET WEEK 16-20/12/2024

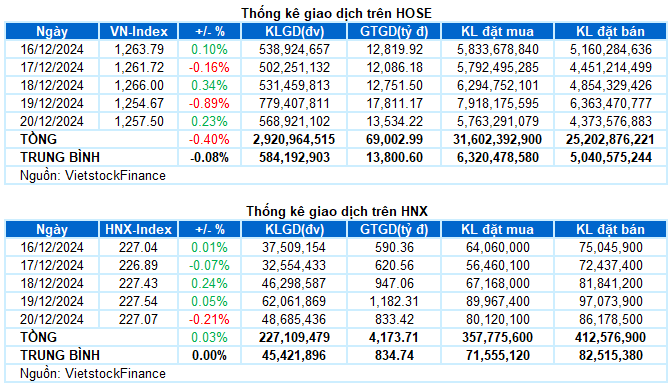

Trading: The main indices moved in different directions during the last trading session of the week. By the end of the day on the 20th of December, the VN-Index increased by 0.23% from the previous session, reaching 1,257.5 points. Conversely, the HNX-Index decreased by 0.21%, settling at 227.07 points. For the whole week, the VN-Index lost a total of 5.07 points (-0.4%), while the HNX-Index slightly rose by 0.07 points (+0.03%).

The stock market last week witnessed a tug-of-war situation as cautious sentiment prevailed. The VN-Index mostly fluctuated around the 1,260-point level, with trading volume remaining below the 20-week average. News from the Fed about interest rate policy orientation for 2025 caused Vietnamese stocks to face selling pressure, similar to most global markets, resulting in a sharp decline on Thursday. Nevertheless, the market’s recovery efforts at the end of the week helped the VN-Index narrow its losses, ending the week at 1,257.5 points.

In terms of impact, HVN, VNM, and FPT were the main pillars contributing positively to the market today, helping the VN-Index gain more than 2 points. On the other hand, the top 10 negative stocks took away just over 1 point from the overall index, led by HPG and BVH.

All sectors ended the week in the green. Transportation and telecommunications were the two main highlights today, attracting strong buying interest from the beginning of the session. The most notable were the purple colors of HVN, MVN, VOS, VTO, and YEG. In addition, many other stocks recorded outstanding gains, such as ACV (+4.38%), PHP (+4.57%), HAH (+1.65%), SGP (+6.37%), VSC (+1.94%); VGI (+3.23%), FOX (+2.22%), etc.

The financial and utility groups came last, inching up by less than 0.1%. A dominant divergence prevailed, with most stocks fluctuating slightly around the reference price, except for a few names with more significant movements, including SSB (+1.21%), SGB (+2.48%), VAB (+2.25%), PVI (+4.24%), BVH (-2.29%), VND (-1.93%); DTK (+6.19%), QTP (+1.38%), GEG (+2.22%), TMP (+2.96%), POW (-1.61%), TDM (-6.48%), DNW (-6.3%), etc.

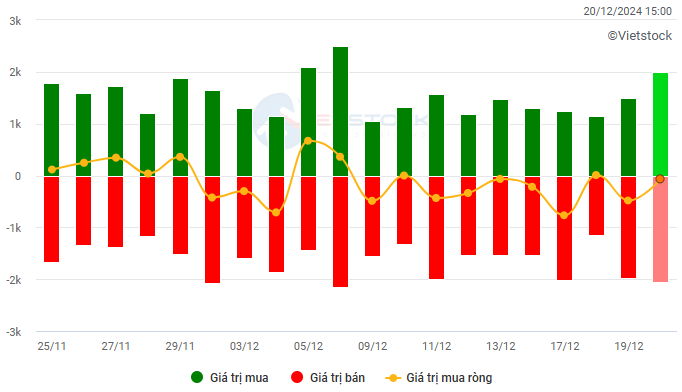

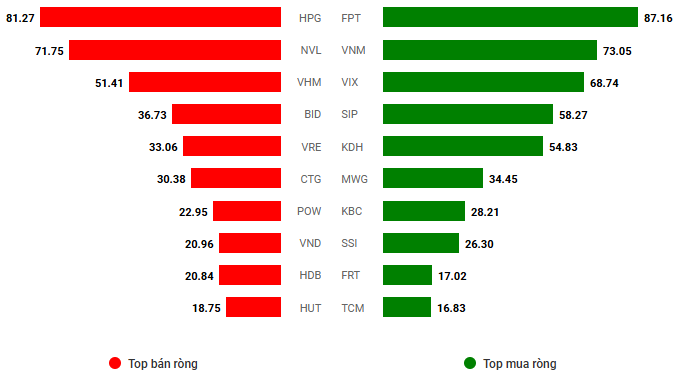

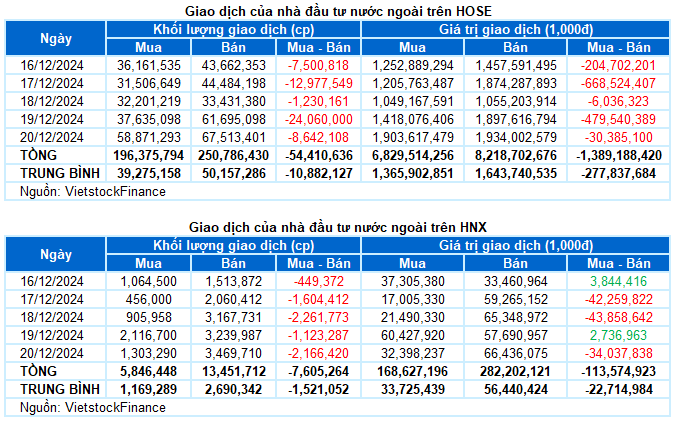

Foreign investors continued to sell a net of over 1,500 billion VND on both exchanges last week. Specifically, they net sold nearly 1,400 billion VND on the HOSE and over 113 billion VND on the HNX exchange.

Trading value of foreign investors on HOSE, HNX, and UPCOM by day. Unit: Billion VND

Net trading value by stock code. Unit: Billion VND

Stocks with notable increases last week included YEG

YEG rose by 29.25%: YEG experienced a vibrant trading week, surging by 29.25%. The stock continuously soared with the emergence of a Rising Window candlestick pattern. At the same time, the trading volume exceeded the 20-day average, indicating a very optimistic investor sentiment.

However, the Stochastic Oscillator indicator has ventured deep into overbought territory. If, in the coming time, the stock shows a sell signal, the risk of a correction will increase.

Stocks with significant declines last week included VCA

VCA fell by 13.41%: VCA underwent a rather negative trading week, continuously losing ground in 3 out of 5 sessions. Nevertheless, the recovery efforts in the last two sessions of the week eased the pressure on this stock.

Currently, the index is still maintaining above the Middle line of the Bollinger Bands. If it holds above this threshold, coupled with a trading volume surpassing the 20-day average, the short-term outlook may not be too pessimistic.

II. STOCK MARKET STATISTICS FOR LAST WEEK

Economic Analysis and Market Strategy Department, Vietstock Consulting