Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 447 million shares, equivalent to a value of more than 10.5 trillion VND; HNX-Index reached over 45.9 million shares, equivalent to a value of more than 788 billion VND.

VN-Index opened the afternoon session with a prolonged tug-of-war and selling pressure increased towards the end of the session, but the index still closed in the green. In terms of impact, HVN, VNM, FPT, and BCM were the most positive influences on the VN-Index, contributing over 2.3 points. On the other hand, HPG, BVH, NVL, and VPI were the most negative influences, but their impact was not significant.

|

Source: VietstockFinance

|

On the contrary, the HNX-Index witnessed a less optimistic performance, with the index negatively impacted by IDC (-1.41%), PVS (-1.44%), VIF (-2.86%), and MBS (-1.03%)…

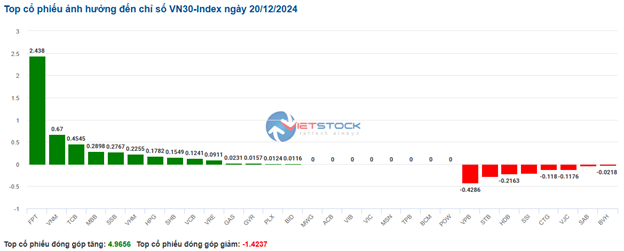

| Top 10 stocks impacting the VN-Index on December 20, 2024 (in points) |

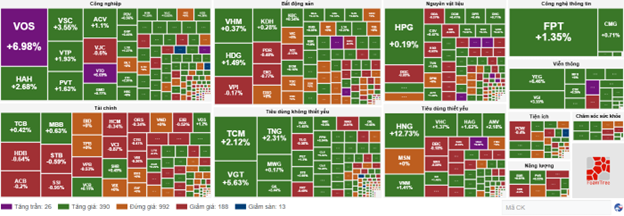

The industrial sector was the best-performing group in the market, with a 3.19% gain, mainly driven by transportation stocks such as HVN (+6.93%), VOS (+6.98%), VTP (+1.57%), and HAH (+1.65%). Following the recovery were the telecommunications and energy sectors, with increases of 2.86% and 1.02%, respectively. Additionally, the financial sector was the market’s most modest gainer, with a 0.02% increase, mainly driven by buying in SSI (+0.19%), VIX (+0.98%), VPB (+0.53%), and VCB (+0.11%).

In terms of foreign trading, they continued to net sell over 30 billion VND on the HOSE exchange, focusing on HPG (81.27 billion), NVL (71.75 billion), VHM (51.41 billion), and BID (36.73 billion). On the HNX exchange, foreigners net sold more than 34 billion VND, focusing on HUT (18.75 billion), CEO (9.61 billion), SHS (8.03 billion), and IDC (6 billion).

| Foreign Buying and Selling Activity |

Morning Session: Pillar Stocks Diverge, Market Struggles to Break Out

The sole brilliance of sectors such as transportation and telecommunications was not enough to boost the market as the pillar stocks remained relatively quiet. At the end of the morning session, the VN-Index managed a slight gain of 0.05%, settling at 1,255.33 points; while the HNX-Index dipped 0.12% to 227.27 points. In terms of market breadth, the number of advancing stocks still outnumbered declining ones, but the gap was narrowing, with 384 gainers and 256 losers.

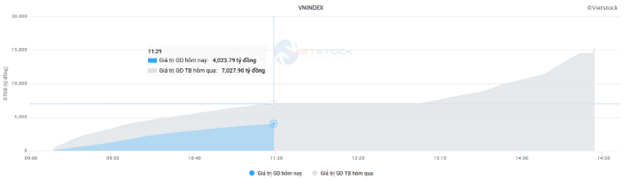

After yesterday’s steep decline with high liquidity, a cautious sentiment prevailed in the morning session. The matching volume of the VN-Index reached over 166 million units, equivalent to a value of more than 4 trillion VND, a decrease of nearly 43% compared to the previous session. The HNX-Index recorded a matching volume of over 19 million units, with a value of over 329 billion VND.

Source: VietstockFinance

|

FPT and VNM were the two pillar stocks with the most positive influence, contributing over 1 point to the VN-Index‘s gain. Meanwhile, half of the top 10 most positive stocks were from the banking sector. CTG alone took away nearly half a point from the overall index, while the others had a negligible impact.

Telecommunications and transportation were the two main highlights of the morning session, attracting strong buying interest from the opening bell. The standouts were YEG, MVN, VOS, and VTO, which hit the daily limit-up price. Additionally, several other stocks recorded impressive gains, including VGI (+3.01%), FOX (+1.59%), ELC (+1.26%); HAH (+1.96%), PVT (+1.27%), VTP (+1.79%), SGP (+4.87%), VSC (+2.26%), and PHP (+2.79%),…

However, the pillar sectors of finance and real estate exhibited a divergent trend, preventing the overall index from surging higher. Most stocks in these sectors fluctuated slightly around the reference price, except for a few notable movers: BVH (-2.1%), HDB (-1.06%), VCI (-1.16%), NAB (+1.28%); DIG (-1.79%), HDG (+1%), IJC (+1.82%), SJS (+4.69%), and SCR (+1.59%),…

Foreigners continued to net sell slightly over 36 billion VND across all three exchanges in the morning session. No stock experienced a significant sell-off, with VHM leading the net sell value at over 38 billion VND. On the buying side, FPT attracted the most foreign interest, topping the net buy list with a value of over 87 billion, far surpassing the other stocks.

10:30 am: Tepid Trading Continues, Money Flows into Transportation and Telecommunications

Investor hesitation resulted in subdued trading volume, and the main indices fluctuated around the reference level. As of 10:30 am, the VN-Index gained 2.32 points, hovering around 1,256 points. The HNX-Index rose 0.11 points, trading around 227 points.

The breadth of the VN30 basket showed a divergence, with the buying side holding a slight advantage. Specifically, FPT added 2.43 points, VNM contributed 0.67 points, TCB added 0.45 points, and MBB gained 0.28 points. Conversely, financial stocks like VPB, STB, HDB, and SSI were among the most sold, deducting more than 1 point from the overall index.

Source: VietstockFinance

|

The telecommunications group led the recovery, with a gain of 3.10%. Most stocks in this sector traded in positive territory, including VGI, which rose 3.12%; MFS, up 7.47%; and CTR, which climbed 0.25%… Notably, YEG advanced 3.37%, extending its winning streak to three consecutive sessions and trading at the maximum daily limit price for six days in December. This upward momentum in the share price coincided with Yeah1’s buzz in the entertainment industry, thanks to the grand concert series “Anh trai vượt ngàn chông gai” (Brother Overcoming Countless Obstacles). During the online conference on the culture, sports, and tourism industry on December 18 in Hanoi, Prime Minister Pham Minh Chinh even suggested replicating such concert models, including “Anh trai,” to boost the cultural industry. This bodes well for YEG‘s business prospects in the coming period.

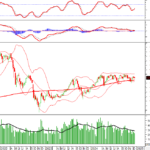

Next was the industrial sector, which also witnessed a broad-based advance. Buying interest primarily focused on transportation stocks like HAH, which climbed 2.58%; VSC, up 3.23%; VTP, gaining 2.15%; and ACV, which rose 1.26%… Notably, VOS hit the daily limit-up price early in the morning session. From a technical perspective, VOS formed a bullish White Marubozu candlestick pattern on December 20, 2024, accompanied by a surge in trading volume above the 20-day average, indicating increased participation from market players. Additionally, the stock is testing the upper boundary (corresponding to the 16,700-17,600 range) of the Ascending Triangle pattern, while the Stochastic Oscillator and MACD have generated buy signals. If the stock can break above this range in the upcoming sessions, the potential upside target is the 21,600-22,500 region.

Source: VietstockFinance

|

Compared to the opening, the buying side maintained a slight edge. There were 390 advancing stocks and 188 declining stocks.

Source: VietstockFinance

|

Opening: Green Dominates

At the start of the December 20 session, as of 9:30 am, the VN-Index hovered around the reference level, reaching 1,256.48 points. The HNX-Index also dipped slightly, trading around 227.61 points.

Green temporarily prevailed in the VN30 basket, with 9 declining stocks, 11 advancing stocks, and 10 stocks trading flat. Among them, SSI, VPB, and CTG were the most negative performers. Conversely, SSB, VNM, and FPT were the top gainers.

Telecommunications services stocks led the market higher this morning, with a growth rate of 2.73%. Within this sector, most stocks traded in positive territory from the opening bell, including VGI, which climbed 3.34%; FOX, up 1.69%; CTR, advancing 0.25%; and YEG, which rose 2.53%,…

Additionally, industrial stocks also contributed positively to the market’s performance. Notable gainers in this sector included ACV, which rose 1.94%; HAH, up 0.1%; VOS, climbing 2.22%; and HBC, which surged 4%,…

Vietstock Weekly: Navigating Short-Term Risks

The VN-Index ended a rather pessimistic trading week as it continued to lose points and fell below the Middle Bollinger Band. The decline was accompanied by a drop in trading volume below the 20-week average, indicating limited participation of funds in the market. Currently, the MACD indicator is poised to give a sell signal as it narrows its gap with the Signal Line. Should this occur in the coming period, the index’s situation will turn even more negative.

Stock Market Week of 12/16/2024 – 12/20/2024: Caution Prevails

The VN-Index edged higher last week, with alternating sessions of gains and losses. While the index inched up, the trading volume fell below the 20-day average, indicating that investors remain cautious. Moreover, foreign investors’ continued net selling streak suggests that the short-term outlook for the market is still not optimistic.

The Cautious Sentiment Rises

The VN-Index witnessed a negative trading session with a decline in trading volume below the 20-day average. This indicates a resurgence of cautious sentiment among investors. However, it’s important to note that the index is currently sitting above the middle Bollinger Band. If the index manages to hold its ground above this level in upcoming sessions and the MACD indicator continues to flash a buy signal, the situation may not be as pessimistic as it seems.

The Market Beat: Transport Sector Shines Amid Dull Liquidity

The market ended the session on a positive note, with the VN-Index climbing 0.23% to 1,257.5, a gain of 2.83 points. In contrast, the HNX-Index dipped 0.21%, or 0.47 points, settling at 227.07. The market breadth tilted in favor of the bulls, with 452 tickers advancing against 284 declining stocks. The VN30 basket also witnessed a similar trend, as 14 stocks added value, 12 stocks retreated, and 4 remained unchanged, ending with a slightly bullish tilt.

The Ultimate Headline: “Is Short-Term Optimism Premature?”

The VN-Index rebounded after testing the middle Bollinger Band, with trading volumes remaining below the 20-day average. This indicates a continued lack of liquidity in the market. Currently, the Stochastic Oscillator indicates a sell signal, and if the MACD follows suit in upcoming sessions, the risk of a market correction will increase.