I. MARKET ANALYSIS OF STOCKS ON 01/02/2025

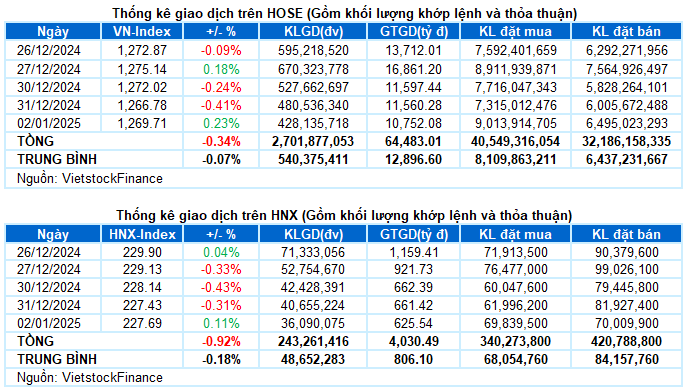

– The main indices turned slightly green in the first trading session of the year. VN-Index closed up 0.23%, reaching 1,269.71 points; HNX-Index increased by 0.11% compared to the previous session, reaching 227.69 points.

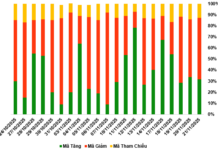

– The matching volume on HOSE reached nearly 372 million units, a further decrease of 8.7% compared to the low volume of the previous session. The matching volume on HNX also decreased by 14.7%, reaching more than 31 million units.

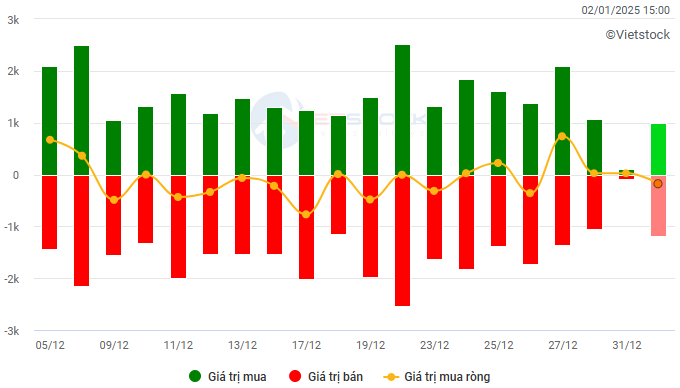

– Foreign investors net sold on the HOSE with a value of more than VND 156 billion and net sold nearly VND 9 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

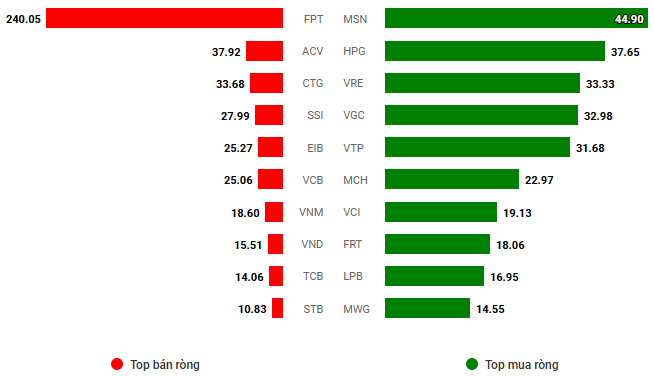

Net trading value by stock code. Unit: VND billion

– The first securities trading session of 2025 took place in a tug-of-war. The VN-Index started with a slight green but quickly lost points as some large-cap stocks weakened, along with market liquidity continuing to be low. However, improved demand in the afternoon session helped the index recover and return to green. At the close, the VN-Index gained 2.93 points (+0.23%), reaching 1,269.71 points.

– In terms of impact, BID and VCB contributed the most positively to the VN-Index with more than 2 points increase. Meanwhile, TCB and HDB faced significant selling pressure, taking away nearly 1 point from the overall index.

– VN30-Index closed slightly down 0.12%, to 1,343.2 points. The breadth of the basket was quite divided, recording 11 declining stocks, 12 rising stocks, and 7 stocks standing at the reference price. On the rising side, stocks that increased by more than 1% included BID, PLX, BVH, HPG, and MSN. In contrast, HDB and TCB were at the bottom with a decrease of 1.6% and 1.2%, respectively.

Green dominated in industry groups. Among them, the industry group led the market in the first year, with a focus on transportation and construction stocks such as ACV (+1.52%), HVN (+1.92%), VTP (+5.19%), GMD (+1.53%), PHP (+2.14%), CTD (+1.31%), HBC (+4.84%), C4G (+1.28%), and DPG (+3.26%).

The large-cap industry groups, such as finance and real estate, were mixed. Most stocks rose and fell slightly around the reference price, except for some stocks with significant fluctuations such as BID (+1.73%), TCB (-1.22%), HDB (-1.57%), OCB (-3.07%), EIB (-2.85%), BVH (+1.58%), VCI (+1.2%), KDH (-2.63%), SIP (-1.32%), HDG (+1.93%), and NVL (+1.46%).

On the negative side, the essential consumer group ranked last due to the significant influence of the stock with an overwhelming market cap in the industry, MCH (-3.82%). In addition, stocks also faced significant selling pressure, including SBT (-1.91%), MPC (-1.34%), MML (-1.63%), and VNM (-0.47%). However, a few names still shone brightly, such as HNG hitting the ceiling price, HAG (+2.07%), MSN (+1.14%), QNS (+1.37%), and DBC (+1.98%).

VN-Index rebounded after testing the Middle line of the Bollinger Bands, while the trading volume remained below the 20-day average. This indicates that the money flow into the market is still very limited. Currently, the Stochastic Oscillator indicator shows a sell signal again. If, in the next sessions, the MACD indicator also gives a similar signal, the risk of correction will increase.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Above the Middle line of Bollinger Bands

VN-Index rebounded after testing the Middle line of the Bollinger Bands, while the trading volume remained below the 20-day average. This indicates that the money flow into the market is still limited.

Currently, the Stochastic Oscillator indicator shows a sell signal again. If, in the next sessions, the MACD indicator also gives a similar signal, the risk of a downward correction will increase.

HNX-Index – Stochastic Oscillator and MACD indicators show sell signals

HNX-Index slowed its decline with a slight increase after testing the SMA 50-day line. However, trading volume remained below the 20-day average, indicating that buying demand was still not positive.

Currently, the Stochastic Oscillator and MACD indicators have shown sell signals. This suggests that the outlook for the coming period remains uncertain.

Money Flow Analysis

Fluctuation of smart money flow: The Negative Volume Index indicator of VN-Index cut down below the EMA 20-day line. If this state continues in the next session, the risk of an unexpected drop (thrust down) will increase.

Fluctuation of foreign capital flow: Foreign investors continued to net sell in the trading session on January 2, 2025. If foreign investors maintain this action in the coming sessions, the situation will be less optimistic.

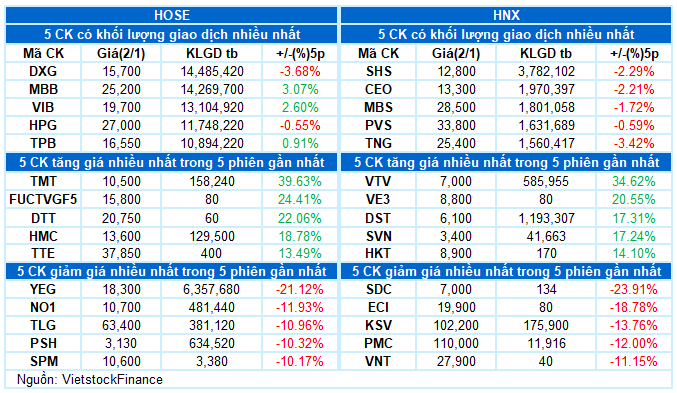

III. MARKET STATISTICS ON 01/02/2025

Economic Analysis and Market Strategy Department, Vietstock Consulting

– 16:56 01/02/2025