A single electricity price increase despite EVN being allowed to adjust prices once every 3 months

On March 26, the Prime Minister approved Decision No. 05/2024/QD-TTg on the mechanism for adjusting the average retail electricity price.

The latest decision shortens the minimum time between two electricity price adjustments from 6 months to 3 months, but some conditions must be met. Specifically, when the average electricity selling price decreases by 1% or increases by 3% or more compared to the current price, a corresponding adjustment is allowed.

|

Despite being allowed to increase prices, EVN has only done so once in 2024

|

The decision also states that in the event that, after calculation and updating, the calculated average electricity selling price is 1% or more lower or 3% to less than 5% higher than the current price, EVN is responsible for adjusting the average electricity selling price accordingly.

In the case of an increase of 5% to less than 10%, EVN is allowed to increase the price after reporting and obtaining approval from the Ministry of Industry and Trade. For increases of 10% or more, input from the Ministry of Finance and other relevant ministries and branches is required, or it must be reported to the Steering Committee for Price Management before reporting to the Prime Minister.

However, throughout the past year, EVN has only adjusted electricity prices once. From October 11, 2024, the average retail electricity price increased from 2,006.8 VND/kWh to 2,103.1 VND/kWh (excluding VAT), equivalent to an increase of 4.8% from October 11, 2024. In 2023, electricity prices were adjusted twice, the first time on May 4, 2023, with an adjustment of more than 55.9 VND/kWh (an increase of 3%) and the second adjustment on November 9, 2023, of more than 86.4 VND/kWh (a 4.5% increase).

EVN’s electricity price hike was not unexpected as the Group is still financially burdened. According to the Ministry of Industry and Trade, EVN lost more than 34 trillion VND in electricity production and trading activities in 2023. Income from activities related to electricity production and trading in 2023 was 12,423 billion VND, with a total loss of nearly 22 trillion VND. In the first six months of 2024, the Group continued to lose about 13 trillion VND.

As of the end of 2023, EVN sold electricity at a price about 135 VND/kWh lower than the production cost, or 6.92% lower.

Through the Direct Power Purchase Agreement (DPPA) mechanism for renewable energy

The Direct Power Purchase Agreement (DPPA) mechanism is one of the issues that has been raised for many years and was partly resolved in 2024.

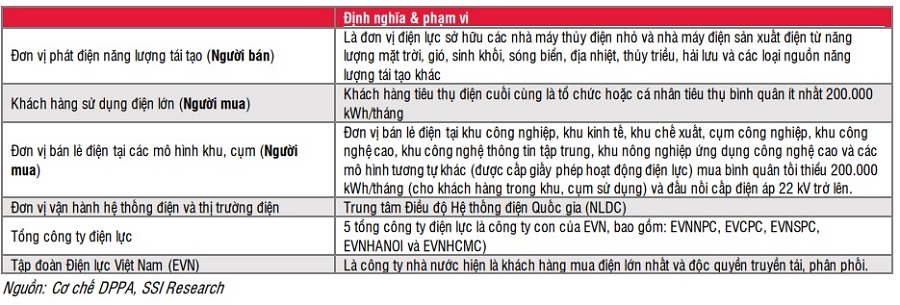

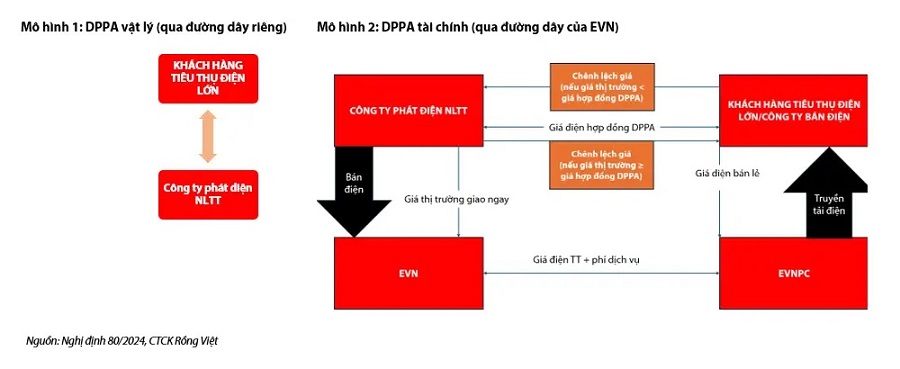

Specifically, on July 3, 2024, the Government issued a decree on the DPPA mechanism between renewable energy generation units (RE Gencos) and large electricity consumers for production purposes.

The decree states that direct electricity purchases are activities involving the physical delivery of electricity, carried out through two forms: direct electricity purchases through a dedicated connection line, and direct electricity purchases through the National Grid.

According to Dragon Capital Securities (VDSC), there are currently about 7,700 large customers in reality, with a minimum consumption of 200,000 kWh/month, accounting for 36.5% of total electricity consumption in Vietnam. DPPA is a mechanism for renewable energy project investors to start investing in new projects after a long period without a deployment mechanism following the issuance of the FiT-2 preferential price mechanism in 2020.

The DPPA mechanism will apply to renewable energy projects that receive a Commercial Operation Date (CoD) certificate after November 2021, including transitional renewable energy projects, and will replace the fixed price and FiT price mechanisms applied to previous projects.

SSI Securities believes that the introduction of DPPA is expected to reduce dependence on EVN and the national grid, while creating a more competitive environment for participating parties and addressing EVN‘s financial issues. In addition, Electricity Planning 8 (Power Development Plan 8 – PDP8) sets a net-zero emissions target by 2050 and continues to expand capacity (reaching over 150,000 MW by 2030 and nearly 600,000 MW by 2050), with renewable energy expected to play a key role in implementing this roadmap.

However, the implementation of DPPA is expected to face many challenges. For physical DPPA, investors will encounter difficulties in adding the grid to provincial and regional planning. Meanwhile, virtual DPPA faces the challenge of optimizing the efficiency of negotiating output and forward contract (cfD) prices with large electricity consumers. Determining whether the contract price should be fixed for the year or adjusted daily, monthly, or seasonally to ensure a balance between supply and demand is an issue.

In addition, for the surplus electricity that is not fully delivered to customers who have signed DPPA contracts, investors will face difficulties in operating price bidding on the wholesale electricity market (VWEM), with a trading cycle of 48 sessions/day and each session lasting 30 minutes. Furthermore, optimizing investment efficiency when bidding prices in the wholesale electricity market is also something to consider.

Surplus solar rooftop electricity: from the proposal of 0 VND to being sold up to 20%

The issue of surplus solar rooftop electricity has also been a headache in the past year. According to a draft in April 2024, agencies, organizations, and individuals were allowed to discharge or not discharge the surplus electricity (if any) of solar rooftop systems that were self-produced and self-consumed into the national electricity system. However, the power unit recorded the electricity output at a price of 0 VND and no payment was made. In other words, it could only be used and not sold.

|

Surplus solar rooftop electricity can be sold to the system up to 20% of capacity

|

However, the proposal has been changed with the issuance of Decree No. 135/2024/ND-CP on October 22. The decree provides mechanisms and policies to encourage the development of self-produced and self-consumed solar rooftop systems. Notably, solar rooftop systems with a capacity of less than 100 kWh that are connected to the national electricity system and have surplus electricity can be sold, but not exceeding 20% of the actual installed capacity.

In addition, self-produced and self-consumed solar rooftop projects also enjoy tax incentives and streamlined administrative procedures… Households and detached houses are exempt from or do not need to adjust their business licenses. In addition, organizations and individuals are encouraged to install energy storage systems (BESS) to ensure safe and stable operation.

Passing the amended Law on Electricity

On November 30, the amended Law on Electricity was officially passed, consisting of 9 chapters and 81 articles, stipulating the planning of electricity development and investment in electricity projects; development of renewable and new energy; electricity business licenses; competitive electricity market, electricity prices, and electricity trading activities; responsibilities, rights, and obligations of electricity organizations, individuals, and electricity users; operation, dispatch of the national electricity system, and transaction management of the electricity market; protection of electricity works and safety in the field of electricity; state management of electricity.

One of the notable contents is that the amended Law on Electricity helps resolve problems in electricity trading transactions by supplementing term electricity contracts. These are derivative financial contracts for parties to manage risks in the electricity market. The stipulation of term electricity contracts in the law is the legal basis for guiding the value-added tax (VAT) mechanism for these contracts.

The Ministry of Industry and Trade considers this a necessary requirement to address the shortcomings of the current wholesale electricity market, creating conditions for expanding the scope of the competitive wholesale electricity market and laying the foundation for the future retail electricity market.

Proposing to apply a two-part electricity price from 2025

Also in 2024, EVN proposed to build a two-part electricity price system – including capacity price and electricity price – along with a roadmap for application in the electricity industry.

EVN stated that the consulting unit suggested that the ideal option to apply the two-part electricity price mechanism is from January 1, 2025, if the pilot phase is implemented and completed as planned. The immediate target is production customers who buy directly from EVN (production customers) including: at high voltage (from 110 kV and above), medium voltage (from 6 kV to less than 110 kV), and low voltage (less than 6 kV).

|

The two-part electricity price table is expected to plug the holes in the electricity price structure

|

In fact, the two-part electricity price table has appeared in documents requesting research from the Government more than 10 years ago but has not been implemented. Experts believe that the two-part electricity price mechanism will be fairer as it accurately reflects the cost of each customer, avoiding the cross-subsidization among customers as is currently the case.

In addition, the new mechanism will prevent customers from registering for large capacity and then not using it, or a factory registering for large capacity, requiring the power company to prepare wires and transformers but not using them for many years. The cost of wires and transformers in those years is wasted and passed on to other customers.

Proposing to adjust the plan to implement Electricity Planning 8 (PDP8)

More than a year after the approval of PDP8 in May 2023, the Ministry of Industry and Trade has proposed to adjust the implementation plan.

There are many reasons behind this. The Ministry of Industry and Trade said that the growth rate of commercial electricity has been much higher than expected in PDP8, making the targets difficult to achieve.

In each type of electricity generation, there are also many difficulties. Gas-fired power is expected to reach over 30,000 MW by 2030 with 23 domestic gas and LNG projects, but investment and construction face challenges, leading to the risk of power shortages.

For coal-fired power, PDP8 sets a target of adding nearly 3,400 MW by 2030 and not using coal-fired power by 2050. Currently, there are 5 coal-fired power projects that are behind schedule. Moreover, with the orientation to reduce coal-fired power, many projects face difficulties and are not approved by local authorities and credit institutions, leading to difficulties in capital arrangement and new power sources.

Meanwhile, hydropower can develop according to the plan (over 29,000 MW by 2030), but it is less favorable because there is not much room for development, not to mention the risks of climate change, which are force majeure events.

For wind power, the Ministry of Industry and Trade assesses that it is very difficult to achieve the capacity scale according to PDP8 (nearly 22,000 MW by 2030 and 60,000-77,000 MW by 2050). As of September, no offshore wind power project has been granted investment approval, while the implementation time from the time of survey can take up to 6-8 years, so it is very difficult to implement.

For solar power, the Ministry of Industry and Trade assesses that the development scale by 2030 is not large. In the context that large power sources such as gas and coal are difficult to meet the progress, it is necessary to implement additional solar power to meet the demand.

In addition, the Ministry of Industry and Trade evaluates that the current power grid is passive and confused, many power projects are slow to implement, and it is difficult to meet the progress of PDP8.

– 10:00 27/12/2024