Ho Chi Minh City Selected to Develop a Comprehensive International Financial Center

|

On October 31, the Government Party Committee, based on the master proposal completed and submitted by the Ministry of Planning and Investment to the Government, issued a document seeking opinions from central agencies and localities to complete the proposal for submission to the Politburo. On November 15, the Politburo issued Conclusion No. 47 on building a regional and international financial center in Vietnam. Accordingly, it agreed to the policy of establishing a comprehensive international financial center in Ho Chi Minh City (Ho Chi Minh City Financial Center).

Developing Ho Chi Minh City into an international financial center is entirely in line with the orientation of the Party and the Government. However, in the process of realizing this ambition, Ho Chi Minh City has both great advantages and faces many challenges that need to be addressed.

Attractive Advantages

One of Ho Chi Minh City’s greatest advantages is its strategic geographical location. The city is located in the center of Southeast Asia, close to developed economies such as Singapore, Thailand, and Malaysia. This location not only facilitates Ho Chi Minh City’s connection with major financial centers in the region but also promotes trade and international capital exchange. The city’s transportation system, including its seaport and international airport, plays a crucial role in ensuring the flow of goods and financial services across borders.

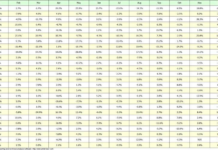

In terms of economics, Ho Chi Minh City accounts for a large proportion of the country’s GDP, approximately 23%, and is the center of many key economic sectors such as finance, technology, and services. This creates a dynamic business ecosystem where domestic and foreign companies can collaborate, grow, and innovate. Additionally, Ho Chi Minh City is home to numerous banks, securities companies, and financial institutions, providing a solid foundation for the development of an international financial center.

The pace of digital transformation in the financial technology sector is among the highest in the region and the world, coupled with significantly lower transaction costs in the financial system compared to international financial centers. For example, in Singapore, businesses are required to deposit between 5,000 USD and 300,000 USD as collateral when opening a bank account, depending on the bank. Transfer fees are also relatively high and calculated as a percentage of the transaction amount. In contrast, these costs are almost negligible in Vietnam.

High-quality human resources are another strength of Ho Chi Minh City. With a young population, well-educated through top universities and international cooperation programs, the city can provide a suitable workforce for the finance and technology industries. Moreover, the presence of startups in the Fintech sector drives innovation and technology application in finance, enabling Ho Chi Minh City to quickly adapt to global trends.

Notably, the Vietnamese government has been paying significant attention to transforming Ho Chi Minh City into an international financial center. Preferential policies, administrative reforms, and foreign investment attraction programs are being implemented to support the city in achieving this goal. Strong government support not only facilitates development but also enhances Ho Chi Minh City’s credibility with international investors.

Difficulties and Challenges

Despite its advantages, Ho Chi Minh City still faces several challenges in its journey to establish an international financial center. One of the most significant issues is the inadequate infrastructure to meet development needs. Overloaded traffic, environmental pollution, and the lack of international-standard financial centers are obstacles that need to be addressed. While the Long Thanh International Airport is under construction, completing major infrastructure projects requires considerable time and resources.

The legal framework also poses a significant challenge for Ho Chi Minh City. The current legal system has not entirely caught up with the rapid development of the international financial industry, especially regarding taxation, investor protection, and cross-border financial transactions. The licensing and management processes remain complex, creating difficulties for foreign businesses and investors.

Additionally, Ho Chi Minh City faces intense competition from well-established financial centers in the region, such as Singapore, Hong Kong, Kuala Lumpur, and Bangkok. These centers boast robust legal foundations, modern infrastructure, and advanced financial ecosystems. To compete effectively, Ho Chi Minh City needs a clear and synchronized strategy that focuses on creating differentiation and added value for investors.

Limitations in technology and cybersecurity are another significant challenge. Despite Vietnam’s rapid technological advancements, Ho Chi Minh City needs to invest more heavily in data systems, information security, and risk management to meet international standards. The threat of cybercrime and security vulnerabilities in financial transactions underscores the urgent need to enhance security and risk management capabilities in this sector.

Finally, the lack of synchronization in development strategies is a hindrance. Coordination between government agencies and businesses is sometimes inefficient, leading to delays in implementing critical projects.

Ho Chi Minh City requires a long-term, clear, and synchronized development strategy to ensure sustainable growth.

Development Orientation

To overcome challenges and maximize its advantages, Ho Chi Minh City should focus on several crucial orientations. Firstly, the city needs to prioritize infrastructure upgrades, including transportation, modern financial districts, and information technology systems. Projects such as the Long Thanh Airport, the Can Gio Super Port, and smart urban areas should be prioritized to facilitate development.

Concurrently, legal reform is imperative. Ho Chi Minh City should learn from leading international financial centers like Singapore and Hong Kong to establish a transparent, flexible, and supportive legal framework for the financial industry. Financial technology sandboxes should also be implemented to encourage innovation in this sector.

The city should also focus on attracting foreign investment by creating a favorable business environment, reducing administrative barriers, and offering attractive incentives. International events such as seminars, financial forums, and exhibitions should be organized regularly to promote the city’s image and attract investors’ attention.

Lastly, Ho Chi Minh City should promote the application of technology in the financial sector, including artificial intelligence (AI), blockchain, and big data. Simultaneously, enhancing security and risk management capabilities is essential to ensure cybersecurity and the safety of financial transactions. By implementing these solutions in a synchronized manner, Ho Chi Minh City can not only overcome challenges but also become a leading international financial center, significantly contributing to the economic development of Vietnam and Southeast Asia.

Prof. Dr. Nguyen Huu Huan (University of Economics Ho Chi Minh City)