|

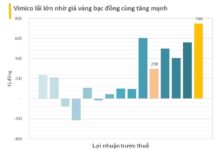

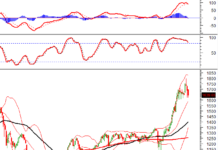

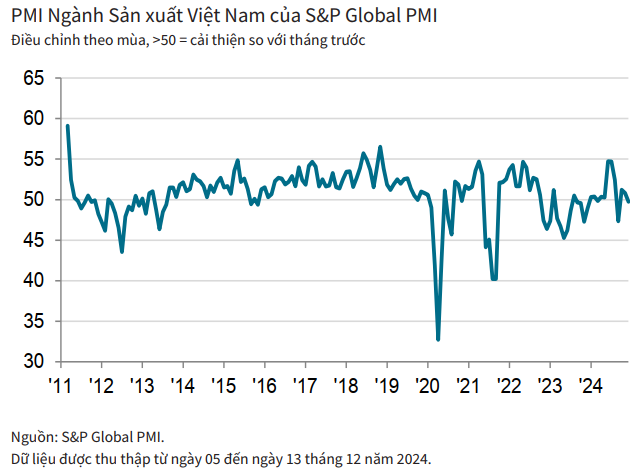

Output and new orders grew at the weakest rate in three months. While some businesses noted improved demand, many reported that market conditions were softening. Notably, export orders continued to fall for the second month running and at a faster rate.

Business confidence also dropped to a 19-month low amid concerns about global economic instability. However, firms still expected output to rise over the coming year, supported by expectations of improved orders and more stable economic conditions.

Inflationary pressures built, with input and output prices rising at the fastest rates since July 2024, linked to raw material shortages and exchange rate volatility. Nonetheless, purchasing activity increased at the quickest pace in four months, as firms expected higher output in the coming months. However, companies remained reluctant to stockpile, leading to a reduction in stocks of purchases. Stocks of finished goods also decreased.

Manufacturers reduced staffing levels for the third month in a row in December as weak new order growth led to a further increase in backlogs of work, thereby extending the current sequence of rising outstanding business to seven months.

Andrew Harker, Economics Director at S&P Global Market Intelligence, commented: “This was a gloomy end to the year for Vietnamese manufacturers, with output and order book growth softening. Uncertainty in global markets continued to weigh heavily on business confidence, pulling it down to its lowest in over a year-and-a-half. This partly reflected uncertainty regarding the incoming US administration’s plans on tariffs. Further announcements on this issue in the new year will help to clarify the potential impact on Vietnam’s manufacturers.”

Gia Nghi

– 09:43 02/01/2025