Stock Market Review for Week of December 16-20, 2024

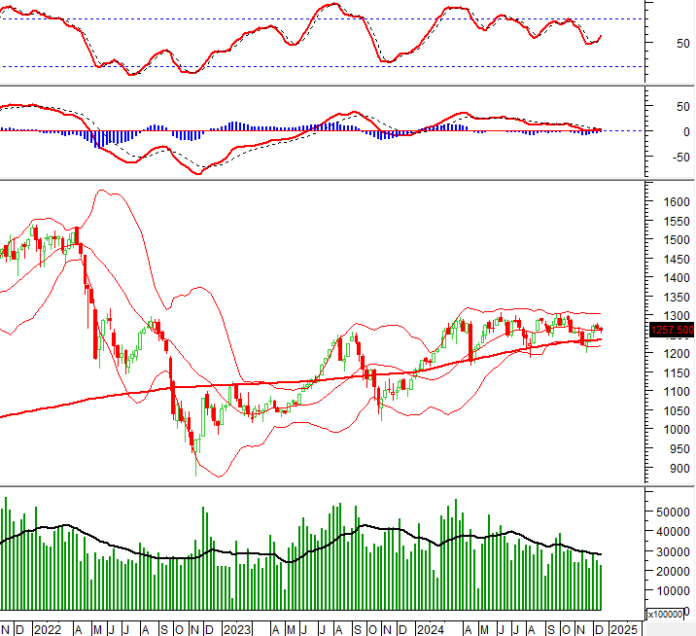

During the week of December 16-20, 2024, the VN-Index closed on a less optimistic note as it continued to lose ground and fell below the Middle Bollinger Band. Moreover, trading volume dropped below the 20-week average, indicating limited participation in the market.

Currently, the MACD indicator is likely to give a sell signal after narrowing the gap with the Signal Line. If this happens in the coming period, the situation for the index will turn even more negative.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – Spinning Top Candlestick Pattern Emerges

On December 20, 2024, the VN-Index posted a slight gain and formed a Spinning Top candlestick pattern, while trading volume exhibited erratic fluctuations in recent sessions, reflecting investors’ unstable sentiment.

Additionally, the Stochastic Oscillator has dropped out of the overbought region after generating a sell signal. This suggests an elevated risk of a downward correction.

HNX-Index – ADX Continues to Weaken

On December 20, 2024, the HNX-Index declined and moved closer to the Middle Band, while the Bollinger Bands contracted (Bollinger Squeeze) and trading volume exceeded the 20-session average, indicating a moderation in investor optimism.

Furthermore, the ADX indicator continued to weaken and remained below 20, signifying a feeble current trend and predicting continued price fluctuations in the upcoming period.

Money Flow Analysis

Smart Money Flow Variations: The Negative Volume Index of the VN-Index dipped below the 20-day EMA. Should this condition persist in the next session, the risk of a sudden downturn (thrust down) will heighten.

Foreign Capital Flow Variations: Foreign investors continued net selling on December 20, 2024. If this trend persists in the coming sessions, the outlook will become increasingly pessimistic.

Technical Analysis Department, Vietstock Consulting