| Market witnesses a strong recovery in the afternoon session |

|

Source: VietstockFinance

|

Considering the VN-Index, the stock that contributed the most to today’s gain was BID with more than 1.1 points, followed by VCB with nearly 1 point. In the rear, a series of “big guys” including HPG, CTG, HVN, MSN, VGC, VTP, and PLX made positive contributions. In total, the top 10 stocks with the most positive impact brought in nearly 4.4 points, higher than the increase of the entire index. On the opposite side, the top 10 stocks with the most negative impact took away about 2.3 points.

| Many pillar stocks contributed to the VN-Index score |

In terms of sectors, the number of 13 rising sectors outweighed the number of 9 falling sectors. Among them, the healthcare sector led the gain with a 2.35% increase, driven by TNH up 3.54% and BBT up 2.29%. Following were three sectors that rose more than 1%: automotive and components, transportation, and insurance.

In the automotive and components group, tire giants such as CSM, DRC, and SRC all performed well, with SRC up 5.51%. An automobile distributor, TMT, also hit the daily limit of a 7% increase after news of its business restructuring plan.

In the transportation group, the upward momentum came from ACV up 1.52%, HVN up 1.92%, GMD up 1.53%, PHP up 2.14%, VTP up 5.19%, and even PAP up 14.05%.

The insurance sector also saw many familiar names with good gains, such as BVH up 1.58%, MIG up 4%, VNR up 1.83%, and AIC hitting the daily limit of a 15% increase.

In the smaller group of declining sectors, hardware led with a drop of up to 2.28%, with POT down 1.96% and VTB even hitting the daily floor of a 7% decrease. The remaining sectors saw negligible declines.

In addition to the above-mentioned stocks, the market also witnessed other notable movers such as HNG and DST, both hitting the daily limit of a 15% increase.

|

The number of rising sectors dominated the session on January 2, 2025

Source: VietstockFinance

|

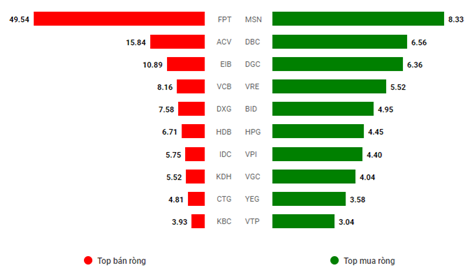

Foreign investors net sold nearly VND 178 billion, but in reality, the selling pressure was mostly on FPT with over VND 240 billion, creating a large gap compared to the next stock, ACV, which was net sold for nearly VND 38 billion. On the buying side, there was a relatively even distribution, led by MSN, which was net bought for nearly VND 45 billion.

| Trading value of foreign investors on the 3 exchanges |

Morning session: The market struggled as pillar sectors turned red

VN-Index slightly increased at the beginning of the morning session but soon entered a correction phase and ended the morning session of January 2, 2025, at 1,264.67 points, a decrease of 2.11 points. The UPCoM-Index also witnessed a decrease, while the HNX-Index turned green and advanced to the 227.46 level.

Source: VietstockFinance

|

There were 7 sectors that recorded increases, while the number of declining sectors was more prominent at 14.

Among the rising sectors, 3 sectors increased by more than 1%: automotive and components, insurance, and transportation. However, their impact on the market was not significant.

On the declining side, 4 sectors decreased by more than 1%: hardware, software, media and entertainment, and food and beverage & tobacco. In addition, although only decreasing by around 0.3%, sectors such as banking, real estate, and securities had a considerable influence on the overall market due to their large market capitalization.

|

The number of declining sectors dominated the morning session of January 2, 2025

Source: VietstockFinance

|

In the context of moderate liquidity and a lack of upward momentum, the market also faced net selling pressure from foreign investors of nearly VND 327 billion, heavily concentrated in FPT with nearly VND 152 billion.

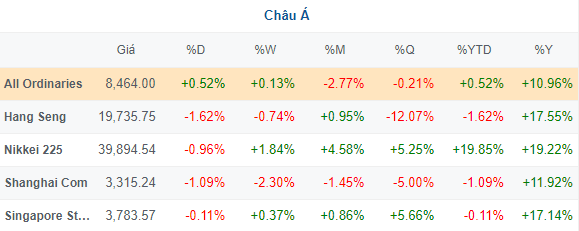

The performance of Vietnam’s stock market was not surprising, as a glance at other Asian markets showed a dominant decline, with Hang Seng down 1.63%, Shanghai Composite down 1.05%, and Nikkei 225 down nearly 1%…

Source: VietstockFinance

|

10:40 am: Lack of momentum to create a clear trend

VN-Index slightly increased at the beginning of the morning session but is now entering a correction phase, hovering around the reference level. As of 10:30 am, the VN-Index had gained only 0.18 points to reach 1,266.96, while the HNX-Index increased by 0.22 points to 227.65. In contrast, the UPCoM-Index decreased by 0.23 points to 94.82.

The market is showing a lack of momentum to create a clear trend on the first trading day of the year. This cautious sentiment is also reflected in the low liquidity of just over VND 3.7 trillion.

In terms of sectors, industrial stocks performed well, with notable mentions including CTD up 2.18%, ACV up 2%, VTP up 2.26%, VCG up 1.1%, and VOS up 3.5%… In addition, essential consumer stocks also rose sharply, especially DBC up 3.06%, HAG up 2.9%, and HNG hitting the daily limit of a 15% increase.

Apart from industrials and essential consumer stocks, the materials and real estate sectors also witnessed a dominant green hue. However, large-cap sectors such as banking and securities exhibited mixed performances.

Regarding foreign trading activities, buying pressure was generally light and spread across various stocks such as MSN, DBC, and DGC…, while selling pressure was concentrated on FPT, with a net sell value of nearly VND 50 billion, far exceeding the values of the following stocks. As of 10:30 am, foreign investors were net selling by nearly VND 88 billion.

|

Trading value of foreign investors on the 3 exchanges (VND billion)

Source: VietstockFinance

|

Opening: A mild increase at the beginning of the year, will it be a “smooth sailing” journey?

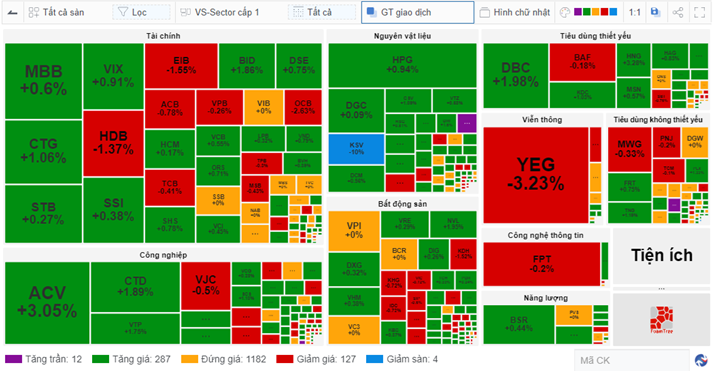

On the first trading day of 2025, the Vietnamese stock market witnessed a mild increase, raising hopes for a “smooth sailing” scenario, quite contrary to the performance of other Asian markets.

At 9:30 am, the main indices of the Vietnamese stock market mostly rose, with the VN-Index gaining 3.41 points to reach 1,270.19 and the HNX-Index increasing by 0.53 points to 227.96. In contrast, the UPCoM-Index decreased by 0.05 points to 95.01.

The market was dominated by green hues, with 287 stocks increasing, including 12 stocks hitting the ceiling price, while 127 stocks declined, and 4 stocks fell to the floor price.

Looking at the market map, some notable stocks that attracted money flows in the early morning session included ACV up 3.05%, CTD up 1.89%, VTP up 1.75%, BID up 1.86%, CTG up 1.06%, and DBC up 1.98%… On the other hand, there were also many cases of quick declines at the beginning of the day, typically YEG down 3.23%, HDB down 1.37%, EIB down 1.55%, and KSV hitting the floor price of a 10% decrease.

|

Green hues dominated the market at 9:30 am

Source: VietstockFinance

|

On other Asian markets, the opening performance was not as positive, with Nikkei 225, Shanghai Composite, and Hang Seng decreasing by around 1%, and Hang Seng even falling by more than 2%.

– 09:45 02/01/2025

The Market Beat: Transport Sector Shines Amid Dull Liquidity

The market closed with the VN-Index up 2.83 points (0.23%) at 1,257.5, while the HNX-Index fell 0.47 points (-0.21%) to 227.07. The market breadth tilted towards gainers with 452 advancing stocks against 284 declining stocks. The VN30 basket saw a slight dominance of green with 14 gainers, 12 losers, and 4 stocks unchanged.

Stock Market Outlook for Week of December 9-13, 2024: Short-Term Correction Pressure

The VN-Index had a lackluster performance last week, declining in 4 out of the last 5 trading sessions. Moreover, the trading volume remained below the 20-day average, indicating a shift towards cautious sentiment among investors. Adding to this, the return of net selling by foreign investors suggests that the short-term outlook for the market remains risky.

The Market Beat: A Tale of Diverging Fortunes

The market closed with the VN-Index down 3.12 points (-0.24%) to 1,272.02, and the HNX-Index fell 0.99 points (-0.43%) to 228.14. The market breadth tilted towards decliners with 436 losers and 274 gainers. Notably, 20 stocks in the VN30 basket ended in negative territory, with 6 advancing and 4 unchanged.

Market Beat: Final Hour Push Prevents Steep VN-Index Dip, HNX Turns Green

The market was poised for a significant downturn as the VN-Index briefly dipped below the 1,250-point threshold amid mounting pressures in the afternoon session. However, a surge of buying momentum from 2:20 pm onwards helped indices pare their losses, resulting in a less pessimistic close.