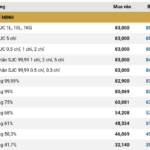

Saigon Jewelry Company listed the SJC gold bar price at 83.8 – 85.3 million VND per tael, an increase of 300,000 VND from yesterday.

Other gold businesses, such as Phu Quy Gold and Silver Jewelry Group and Mi Hong gold system, have also raised the price of SJC gold bars to 85.3 million VND per tael.

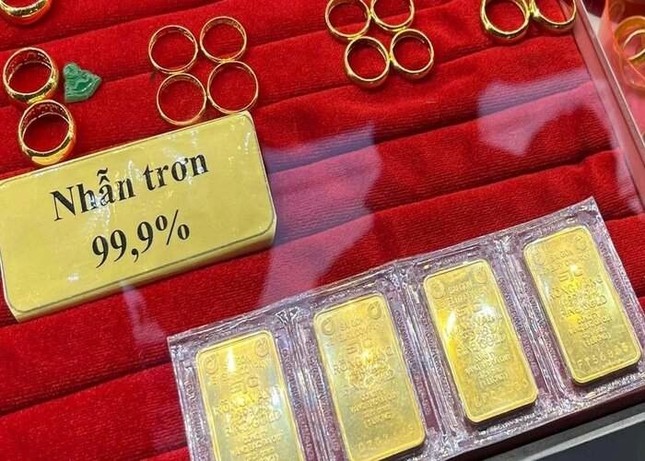

The gold ring price has also increased, surpassing the gold bar price. Specifically, Phu Quy Gold and Silver Jewelry Group listed the gold ring price at 84.3 – 85.5 million VND per tael, 500,000 VND higher for buying and 200,000 VND higher for selling compared to gold bars.

Gold ring price is higher than SJC gold bars.

Bao Tin Minh Chau Jewelry Company listed the gold ring price at 84.4 – 85.6 million VND per tael, 600,000 VND higher for buying and 300,000 VND higher for selling compared to gold bars.

At the same time, the world gold price was listed at 2,650 USD/ounce, a 16 USD/ounce increase from yesterday.

In the currency market this morning, the State Bank of Vietnam set the central exchange rate at 24,332 VND/USD, a decrease of 5 VND from yesterday.

Commercial banks listed the USD exchange rate at 25,208 – 25,548 VND/USD.

In the free market, the USD decreased sharply to 25,643 – 25,743 VND/USD.

At the press conference of the State Bank of Vietnam on January 7th, Deputy Governor Dao Minh Tu stated that Vietnam’s exchange rate has been under significant pressure due to the openness of the economy, along with factors such as the economic policies of major countries, fluctuations in the USD, geopolitical instability, and import-export activities.

“In 2024, the USD exchange rate increased by more than 7% at some points. At the end of the year, the exchange rate fluctuation was around 5.03%, which we consider a harmonious level, ensuring that businesses and investors do not worry and there is no speculation or hoarding of USD,” said the Deputy Governor.

Deputy Governor Dao Minh Tu emphasized that in the future, the State Bank of Vietnam will flexibly manage the exchange rate, making appropriate contributions to absorbing external shocks. This will help maintain stability in the foreign currency market, ensure smooth foreign currency liquidity, and fully meet the foreign currency demands of the economy.

The Golden Question: Should You Buy Now or Hold Your Horses?

This morning (December 6th), domestic gold prices remained stagnant for the second day around the 84-85 million VND per tael mark. Experts suggest that investors may consider buying, but it is advisable to purchase in moderate quantities.