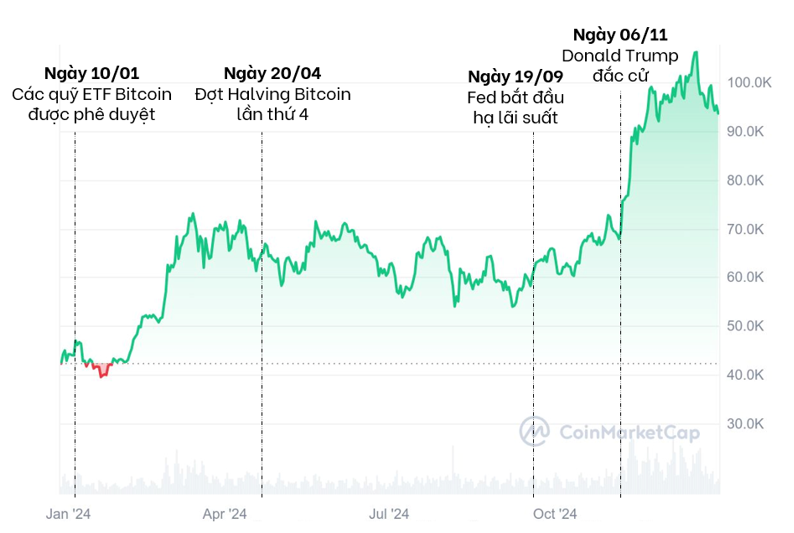

The leading cryptocurrency has witnessed an impressive 140% surge over the past 12 months, climbing from $42,000 at the start of the year to a record high of $108,000, outperforming both stock indices and gold.

Bitcoin Price Movement

This growth momentum has been fueled by three key factors.

Firstly, a pivotal moment occurred when the SEC approved the first Bitcoin spot ETFs to be listed. This decision not only facilitated easier access to Bitcoin for investors but also paved the way for institutional capital to flow into the cryptocurrency market.

The listing was a game-changer for Bitcoin, providing investors with a convenient avenue to exposure to the world’s largest cryptocurrency without directly holding it. Additionally, it attracted more institutional investors to the digital asset space.

The second factor was the significant shift in the Fed’s monetary policy. For the first time in four years, the Fed embarked on a rate-cutting cycle starting in September 2024, with three consecutive cuts: a 50-basis-point cut in September and two 25-basis-point cuts in November and December. This eased the flow of capital into riskier assets, including Bitcoin.

Donald Trump’s victory in the US presidential election was the third factor, raising expectations for a more favorable legal environment for the cryptocurrency industry. Binance CEO Richard Teng told the Financial Times that this was a “big boost for crypto.” Particularly, Trump’s nomination of Paul Atkins, a crypto advocate, as the SEC chair, further bolstered hopes for a “golden era” for digital assets.

In Europe, the regulatory environment also turned more favorable as Poland and Italy reconsidered their tax policies, while the EU made progress with the Markets in Crypto Assets Regulation (MiCA) framework. Even China, traditionally cautious, began to demonstrate a more open approach to digital assets.

Can Bitcoin Reach $200,000?

With the strong growth trajectory since 2024, experts are optimistic about Bitcoin’s prospects for 2025.

Elitsa Taskova, Product Director at the digital asset lending platform Nexo, predicts, “We forecast Bitcoin could double to $250,000 USD within the next year.”

According to Taskova, this forecast is based on the growing recognition of Bitcoin as a reserve asset, the rise of crypto-related ETF products, and increasing acceptance from traditional financial institutions. “The Fed’s monetary policy, balancing interest rates and inflation while avoiding stagnation, will be key,” she adds.

Sid Powell, co-founder and CEO of the financial platform Maple Finance, offers a more conservative prediction, targeting a price range of $180,000 to $200,000 USD by the end of 2025. “If we look at history, when gold ETFs were introduced, inflows surged in the first year and continued to grow in subsequent years. I think we can expect a similar trend with Bitcoin ETFs,” Powell states.

However, experts also caution about potential corrections in the new growth cycle. In previous market cycles, Bitcoin often experienced sharp rallies followed by deep retracements. For instance, in the previous cycle, Bitcoin surged to nearly $70,000 in 2021 but later plummeted to below $17,000 due to a string of crypto company bankruptcies.

Nevertheless, Sid Powell emphasizes that corrections of 70-80%, as seen in the past, are unlikely to recur in 2025, owing to “increased institutional support.” This sentiment is shared by many experts, who believe that the deepening involvement of traditional financial institutions will contribute to market stability.

With positive forecasts from leading experts and an increasingly favorable legal environment, 2025 is shaping up to be a notable year for Bitcoin and the cryptocurrency market at large. However, investors are advised to remain vigilant amidst potential volatility stemming from macroeconomic factors such as persistent inflation and global geopolitical tensions.

– 09:17 01/08/2025

The Crypto Swindle: How Scammers Stole Tens of Billions in a Virtual Heist

Recently, there has been a spate of high-profile scams involving fraudulent investment schemes in the digital asset space.

The Bitcoin Frenzy and Easy Money Policy

If financial conditions are truly tight, as Fed governors claim, then the markets are yet to get this message.