Illustrative Image

According to data from the General Department of Vietnam Customs, Vietnam exported a total of 2 million tons of rubber in 2024, a 6.2% decrease from 2023. However, due to sustained high prices, the export turnover of this commodity still increased strongly by 18.2% to a record high of over $3.4 billion.

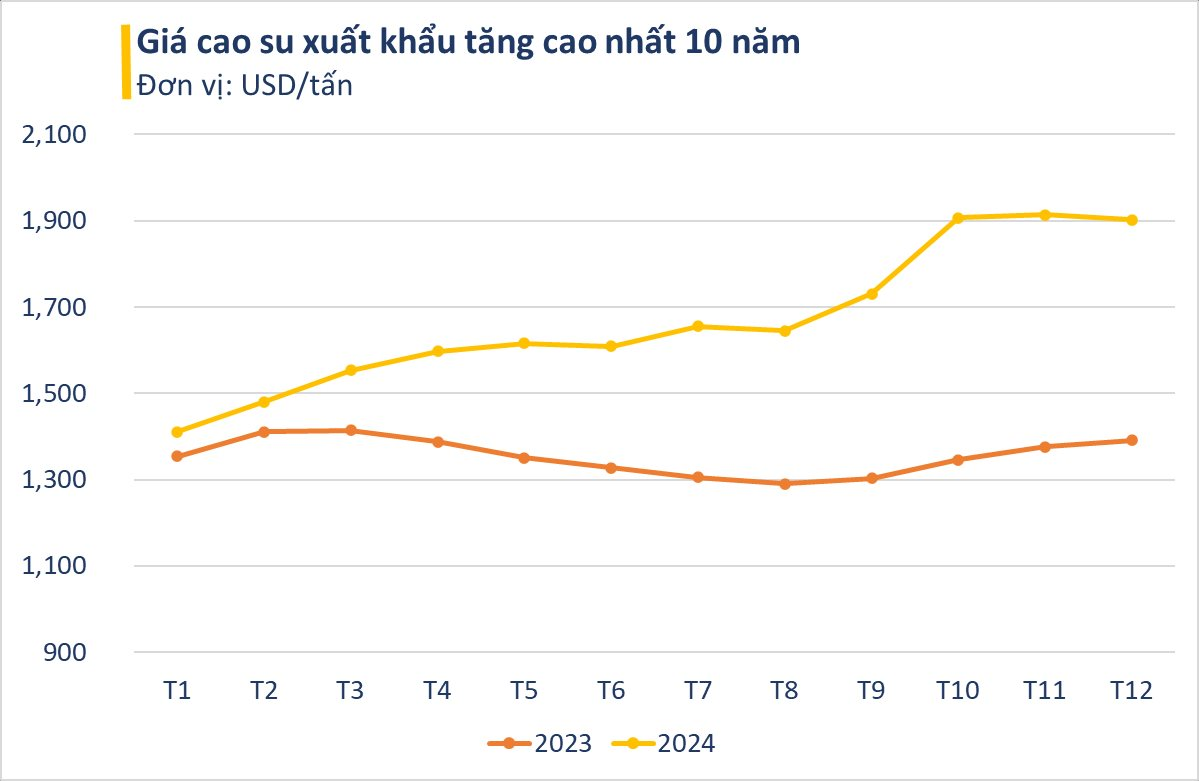

The average export price of rubber in 2024 reached $1,701 per ton, the highest recorded in over 10 years, up 26% (corresponding to an increase of $351 per ton) compared to 2023. This price increase was driven by a global supply shortage and unfavorable weather conditions in major producing countries.

Vietnam’s rubber exports in the past year recorded very positive results, despite the context of declining consumption demand in the main Chinese market. In 2024, Vietnam’s rubber exports to the Chinese market reached 1.45 million tons, valued at $2.44 billion, down 15.1% in volume but up 7.6% in value compared to 2023. This market accounts for 72.1% of Vietnam’s total rubber export volume.

The decrease in China’s rubber import demand in the past time was mainly due to the high prices of this commodity, while domestic inventory was abundant and consumer demand slowed down due to sluggish economic growth.

On the contrary, exports to the second-largest market, India, increased by 8.7% in volume and 35.2% in value compared to 2023. Meanwhile, exports to the third-largest market, South Korea, also decreased by 15.5% in volume but increased by 5.1% in value.

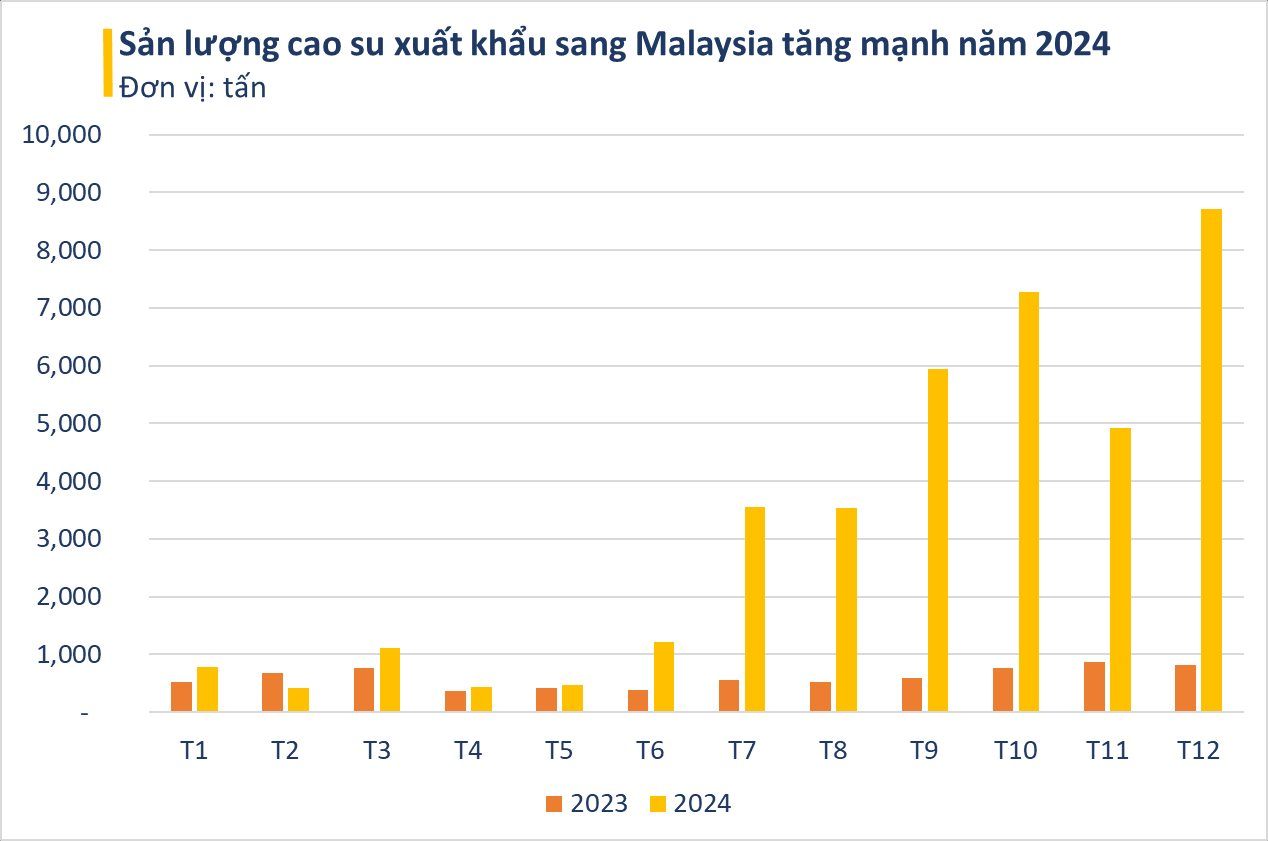

Businesses also expanded exports to many other markets such as Germany, the United States, Taiwan, Russia, and Indonesia. Notably, rubber exports to Malaysia increased by 433% compared to 2023, reaching 38,442 tons, with turnover increasing by 516% to $56.2 million. In December alone, imports surged to over 8,000 tons, the highest since the beginning of the year. The market share by volume of this market increased from 0.3% in 2023 to 1.9% in 2024.

The average export price to Malaysia reached $1,462 per ton, up 15.4% from the previous year. However, this is still the lowest price among the top 10 rubber export markets of Vietnam in 2024.

2024 also witnessed a 29% increase in rubber exports to the EU market, as European importers increased their imports ahead of the expected entry into force of the EU Deforestation Regulation (EUDR) at the end of 2024. However, the regulation was later postponed for one year.

In terms of prospects for 2025, Vietnam’s rubber exports are expected to continue to grow as demand from China shows signs of recovery. Meanwhile, global supply is expected to remain tight. ANRPC data shows that rubber production in major producing countries in Southeast Asia has been declining in recent years.

Thailand’s natural rubber production in the period 2019-2024 decreased from 4.85 million tons to 4.7 million tons. Similarly, production in Indonesia decreased from 3.3 million tons to 2.5 million tons, and production in Malaysia decreased from 640,000 to 340,000 tons during the same period. This decline in production may further exacerbate the global supply shortage, pushing prices higher in the coming years.