At a depth of almost 1,000 meters below the earth’s surface, explosives break through ancient rocks to extract a critical mineral that plays a key role in reducing carbon emissions and combating climate change: Nickel.

Image: Carboncredits

Harder than iron, as durable as copper but superior in its resistance to oxidation and corrosion, nickel serves a wide range of industries, including the production of stainless steel, which consumes nearly 80% of the world’s nickel supply.

With the explosive growth of the global electric vehicle industry amid the urgency to mitigate climate change, metals capable of long-term energy storage are in high demand. Nickel, a shiny, silver-white metal, is one of them. Its strategic importance was highlighted by Forbes back in 2019, which stated, “Gold is hot, but there’s another metal that’s even hotter: Nickel.” The magazine substantiated this claim by pointing out that nickel outperformed gold in terms of returns, delivering twice the gains of gold during a two-month period in 2019, and this gap could widen further due to stagnant supply and surging demand from the EV battery and energy storage sectors.

This in-demand metal is also found in Vietnam, particularly in the northern provinces. According to a 2021 study by ThS. Dao Cong Vu from the Institute of Mining and Metallurgy (Ministry of Industry and Trade), Vietnam’s total nickel reserves and resources are estimated at approximately 3.6 million tons of nickel metal, mainly concentrated in Thanh Hoa (3,067,020 tons), Son La (420,523 tons), and Cao Bang (133,677 tons).

While Vietnam’s reserves may not be as abundant as those of other countries, producing nickel salts and utilizing nickel ore for battery manufacturing can bring dual benefits. This approach not only supports the development of electric vehicles and renewable energy but also maximizes the potential of Vietnam’s valuable natural resources.

Nickel to Stir Up the Global Market in 2025

As of mid-2024, the global nickel market continues to experience a short-term surplus. However, despite these short-term pressures, nickel remains a crucial component in the green transition, especially in electric vehicle (EV) batteries, as emphasized by ING Bank (Netherlands).

The International Nickel Study Group (INSG) has recently updated its market forecast, predicting that the surplus will narrow to 135,000 tons by 2025, with production reaching 3.649 million tons and demand climbing to 3.514 million tons.

The year 2025 could be a turning point, triggering a dramatic surge in nickel prices. Bloomberg reports that the Indonesian government is considering cutting nickel mining quotas by nearly 40% in 2025. According to Macquarie Group Ltd, these proposed restrictions on nickel mining activities could “reduce global supply by more than a third, sending prices soaring.”

A recent analysis by Benchmark delved into the key trends and risks shaping the future of this energy transition material, with a particular focus on nickel. By 2034, nickel is expected to face a supply deficit of 839,000 tons, nearly seven times the current surplus. This underscores the urgent need to address potential supply shortages.

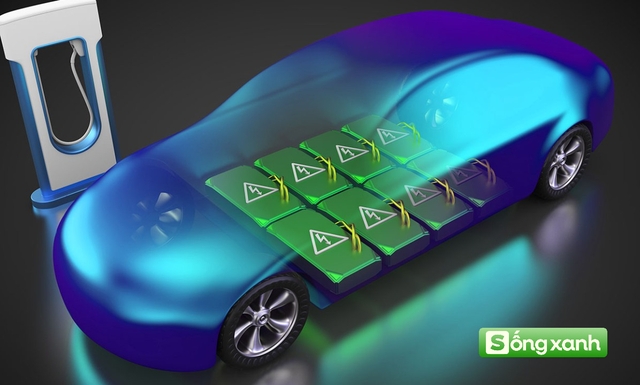

Soaring demand for electric vehicles has driven up the prices of metals capable of long-term energy storage. Image: Internet

Benchmark estimates that the world needs to invest approximately $514 billion (with $220 billion allocated to upstream projects) to meet global battery demand by 2030. Of this, nickel requires $66 billion—the highest among all green materials. Without these investments, sustaining the rapidly expanding EV market could become significantly challenging.

Benchmark further explains how the nickel market is grappling with slow project development. While large-scale production plants and processing facilities can become operational within five years, mines typically take between 5 and 25 years to develop. This imbalance creates a “supply-demand disconnect” for nickel, threatening the EV supply chain.

Nickel’s pivotal role in the energy transition calls for immediate investment in extraction. Without sufficient raw materials, even the most advanced gigafactories will fall short of EV production targets. Addressing this resource shortage is crucial for supply chain stability.

As demand for nickel continues to rise, securing the necessary $66 billion investment will be vital to overcome the challenges ahead by 2025. However, the market’s future hinges on resolving supply shortages and adapting to shifting global dynamics.

The U.S. Department of Energy’s Critical Materials Assessment, published in 2024, classified nickel as a near-critical material (along with uranium, platinum, magnesium, etc.). This classification underscores nickel’s increasing importance in green energy applications and supply risks.

References: Forbes, Carboncredits, USGS, Vietnam Ministry of Industry and Trade, International Energy Forum (IEF)