Silver prices remain high at Phu Quy Gold and Silver Group, with a buying rate of 1,136,000 VND per tael and a selling rate of 1,171,000 VND per tael in Hanoi.

Silver bar prices for 999 fineness increased compared to last week, with a buying rate of 30,293,258 VND per kg and a selling rate of 31,226,589 VND per kg as of 8:39 am on January 20th.

Global silver prices also witnessed a decline, with spot prices at $30.55 per ounce, equivalent to approximately 769,000 VND per ounce (buying) and 774,000 VND per ounce (selling). This decrease in silver prices can be attributed to weaker core inflation in the US, which reinforced expectations of further interest rate cuts by the Federal Reserve this year. Lower interest rates can stimulate demand for commodities by boosting economic growth and weakening the US dollar.

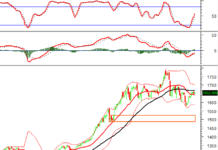

Silver prices peaked in October 2024, reaching $35 per ounce, the highest level in 12 years. However, concerns about uncertain industrial demand, particularly due to excess capacity in China’s solar panel manufacturing industry, led to a subsequent decline to around $30 per ounce. Despite this, silver is still considered a promising investment, given its crucial role in key industries such as technology and renewable energy. As the US dollar weakens, silver prices are expected to receive a boost in the future.

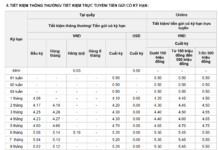

The Year-End Rush: A Race to Ramp Up Deposits and Accelerating Credit

“Market temperature” for year-end savings deposit mobilization always tends to rise, a tale as old as time. While the interest rate curve in the fourth quarter did not present any surprises, the increase in interest rates for some “key” terms was evident.

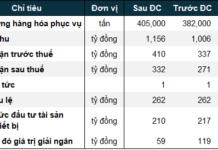

Low-Interest Rates to Support Production and Holiday Shopping

With the Lunar New Year fast approaching, businesses are bustling with production and inventory preparations to meet the surge in year-end shopping demands. The current low-interest rates offered by lending institutions are expected to further stimulate consumer spending during this peak shopping season.

Prime Minister Requests SBV to Implement Stronger Measures to Reduce Lending Rates

Prime Minister Pham Minh Chinh has issued Official Dispatch No. 135/CD-TTg on December 16, 2022, emphasizing the continued strengthening of measures to regulate interest rates and credit.