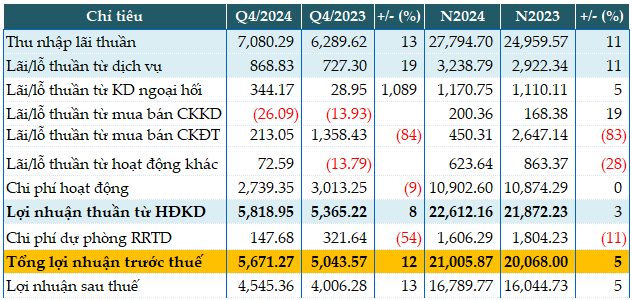

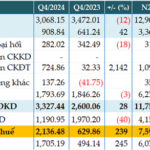

ACB’s fourth-quarter performance in 2024 was impressive, with a 13% year-over-year increase in net interest income, totaling over VND 7,080 billion.

The bank also witnessed growth in non-interest income streams. Service charges and fees generated nearly VND 869 billion, a 19% increase, while foreign exchange operations shone with a profit of over VND 344 billion, a significant jump from the previous year’s VND 29 billion.

During the quarter, ACB reduced its credit risk provisions by 54%, allocating only VND 148 billion. Consequently, the bank’s pre-tax profit exceeded VND 5,671 billion, marking a 12% increase.

For the full year 2024, ACB’s net interest income reached VND 27,795 billion, an 11% increase year-over-year. With a lower credit risk provision of over VND 1,606 billion (-11%), the bank’s pre-tax profit neared VND 21,006 billion, a 5% increase from 2023. However, ACB fell slightly short of its VND 22,000 billion pre-tax profit target for the year, achieving only 95%.

The bank’s ROE stood at 22%. Looking back at the 2019-2024 period, ACB’s pre-tax profit nearly tripled over five years, while the ROE consistently remained within the 22-25% range.

|

ACB’s Q4 and Full-Year 2024 Business Results. Unit: VND billion

Source: VietstockFinance

|

As of the end of 2024, ACB’s total assets grew by 20% year-over-year to VND 864,006 billion. Cash decreased by 18% to VND 5,696 billion, while deposits with the State Bank increased by 36% to VND 25,219 billion. Customer loans also saw a 19% uptick, totaling VND 580,686 billion.

Customer deposits increased by 11% year-over-year to VND 537,304 billion. ACB’s total funding, including customer deposits and securities, reached VND 639,000 billion in 2024, a 19% increase. The CASA ratio improved from 22.9% in 2023 to 23.3% in 2024.

Regarding digital transformation investments during 2019-2024, ACB successfully developed ACB ONE, its digital banking platform, into a significant business channel alongside traditional banking. This move expanded the bank’s funding channels and attracted new customer segments, increasing market share. ACB achieved compound growth, with a 98% increase in the number of online transactions and a 75% rise in their value during this period.

ACB maintained its compliance with financial safety regulations, including an LDR ratio of 78%, an 18.8% ratio for short-term capital for medium and long-term loans, and a consolidated CAR ratio of over 12%. The average risk weight for assets was managed at nearly 70%.

|

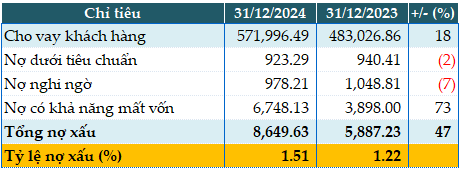

ACB’s Loan Quality as of December 31, 2024. Unit: VND billion

Source: VietstockFinance

|

Excluding VND 8,690 billion in margin loans from ACBS, ACB’s total non-performing loans as of December 31, 2024, amounted to VND 8,650 billion, a 47% increase from the beginning of the year. The NPL ratio also rose slightly from 1.22% to 1.51% during this period.

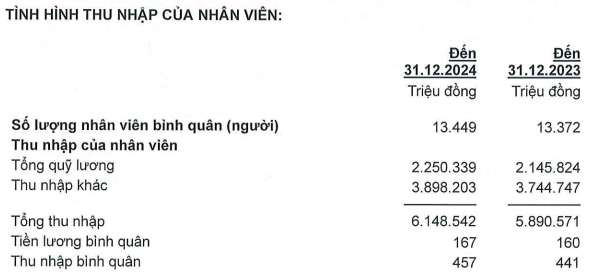

In 2024, ACB’s average employee income increased from VND 37 million to VND 38 million per person per month.

Han Dong

– 13:13, January 22, 2025

Unlocking Profits: OCB’s Core Business Flourishes with Impressive Q4 Performance

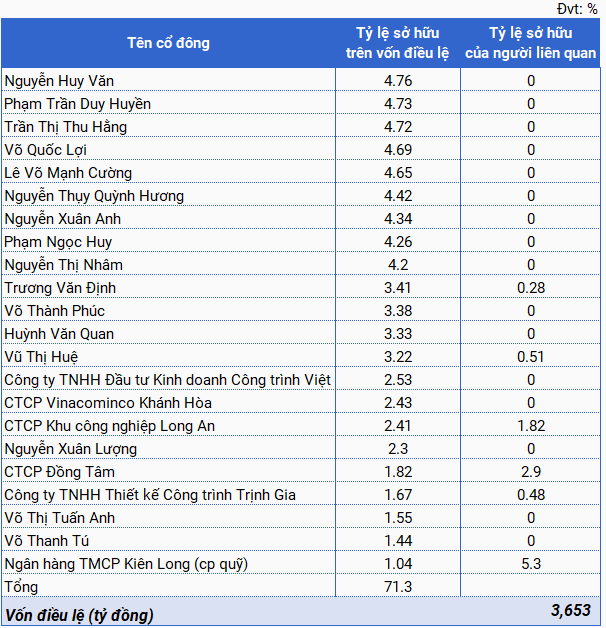

Oriental Commercial Joint Stock Bank (HOSE: OCB) has announced its Q4 2024 financial results, reporting a robust pre-tax profit of VND 1,453 billion, and a strategic shift towards a sustainable development portfolio.

Reaping Rewards from Investment Securities: TPBank’s Q4 Pre-Tax Profits Surge 3.4x YoY

For the fourth quarter of 2024, the Joint Stock Commercial Bank Tien Phong (TPBank, HOSE: TPB) reported a profit before tax of over VND 2,136 billion, a 3.4-fold increase compared to the same period last year. This impressive performance is attributed to a significant reduction in risk provisions and a surge in investment securities income.