The State Bank of Vietnam (SBV) is set to announce the mandatory transfer of two banks, DongA Bank and GPBank. Similar to the case of OceanBank (now known as MBV Bank) and Construction Bank (CB), GPBank was one of the three banks bought by the SBV for “0 VND” since 2015.

DongA Bank, on the other hand, does not fall under the “zero-dong” category like the other three struggling banks, despite being placed under special control by the SBV since August 2015.

*DongA Bank’s mandatory transfer is expected this week. Source: Luong Bang*

Following the instructions of the Special Control Board of DongA Bank, from August 14, 2015, all shareholders of DongA Bank were prohibited from transferring their shares. In exceptional cases, the SBV will consider the transfer of shares based on the proposal of the Special Control Board.

This decision effectively freezes the assets of the shareholders pending further decisions regarding the fate of the bank.

Prior to being placed under special control, DongA Bank had a chartered capital of 5,000 billion VND. Its shareholders were entirely domestic, with institutional shareholders holding 40.68% and individual shareholders holding 59.32%.

Based on the shareholder list updated as of December 31, 2014, the large institutional shareholders included: Construction Company Bac Nam 79 (owned by Phan Van Anh Vu, also known as Vu “Nhom”), holding 10% of the chartered capital; Phu Nhuan Jewelry, Gold and Gemstone Joint Stock Company (PNJ, the family company of Tran Phuong Binh and Cao Thi Ngoc Dung), holding 7.7% of the chartered capital; Ho Chi Minh City Party Committee Office holding 6.9%; Ky Hoa Tourism and Trading Company Limited holding 3.78%; An Binh Capital Joint Stock Company holding 2.73%; and Phu Nhuan Construction and Trading Company Limited holding 2.14%.

The largest individual shareholders of DongA Bank were Tran Phuong Ngoc Ha and Tran Phuong Ngoc Giao, children of Tran Phuong Binh and Cao Thi Ngoc Dung, holding 2.06% and 2% respectively.

According to the latest governance report for the first six months of 2024, Hoang Thi Xuan, the wife of independent board member Tran Van Dinh, who is related to a board member, owns 1.015% of DongA Bank’s chartered capital.

Additionally, some board members and related individuals also hold shares in the bank, with a ratio of less than 0.1%.

According to the indictment of the Supreme People’s Procuracy announced in 2018 in the case that occurred at DongA Bank, the founding shareholders held 13.21%, and the regular shareholders held 86.79%. Of this, the family of former General Director Tran Phuong Binh and Cao Thi Ngoc Dung, along with their children, held 10.24% of the bank’s chartered capital.

In reality, before being placed under special control, DongA Bank had already fallen into a negative owner’s equity situation.

According to Clause 1, Article 179 of the Law on Credit Institutions (CIs) 2024, the mandatory transfer of a commercial bank under special control shall be carried out when all the conditions specified in the law are fully met. The first condition is: “The commercial bank has accumulated losses greater than 100% of the value of its chartered capital and reserves as stated in the latest audited financial statements.”

The handling of shares and the rights of shareholders in DongA Bank, in particular, and in banks subject to mandatory transfer, in general, has been specifically prescribed in this Law.

Specifically, Article 183 of the Law on Credit Institutions 2024 stipulates the implementation of the mandatory transfer plan, with the SBV deciding on the mandatory transfer and approving the mandatory transfer plan.

Accordingly, from the date of the SBV’s decision on the mandatory transfer, all rights and interests of the owners, contributing members, and shareholders of the commercial bank subject to mandatory transfer shall be terminated.

The SBV decides to write off the entire chartered capital of the commercial bank subject to mandatory transfer to offset the accumulated losses accordingly.

The receiving organization shall carry out the procedures for changing the license and implementing the approved mandatory transfer plan.

Thus, with the above regulations, the family of Cao Thi Ngoc Dung and related shareholders also terminate their shareholder rights in DongA Bank.

Tuân Nguyễn

– 05:39 15/01/2025

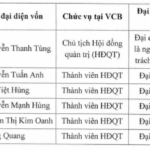

“State Representative Nguyen Thanh Tung: Guardian of Vietcombank’s 30% State-Owned Capital”

On January 10, 2025, the State Bank of Vietnam (SBV) appointed a representative to manage the state capital at Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank, HOSE: VCB).

Vietnam-Russia Joint Venture Bank: A Dynamic Evolution in Charter Capital

The State Bank of Vietnam has approved an adjustment to the charter capital of the Vietnam-Russia Joint Venture Bank, bringing it up to a substantial $170.2 million. This change reflects the updated contributions and reinforces the bank’s strong financial standing.