The General Assembly has ratified many essential aspects, such as the 2023 business performance report, the 2024 business plan, the 2023 profit allocation plan, and many more.

2024 Profit Target of 368 Billion VND

Concerning the 2024 business plan, the SAIGONBANK’s General Meeting of Shareholders has approved a pre-tax profit target of 368 billion VND, representing an increase of 36 billion VND compared to 2023. The total assets are forecasted to grow by 3% to 32,300 billion VND. Outstanding credit balance is expected to rise by 12.87% to 23,000 billion VND. Capital mobilization is anticipated to increase by 3% to 27,300 billion VND. SAIGONBANK also targets to keep the bad debt ratio under control as per the State Bank of Vietnam’s (SBV) regulations and plans to make foreign payments of approximately 240 million USD in 2024.

The bank’s leaders have announced their plans to expand operations and promote safe and sustainable growth. SAIGONBANK will digitally transform operations methodically, establishing a foundation for offering a wide range of products and services. The bank is committed to developing and implementing a digital transformation plan for the period up to 2025, with a vision extending to 2030. The bank will simultaneously prioritize controlling credit quality, strengthening the collection and recovery of outstanding debts, improving corporate governance and risk management systems, and more.

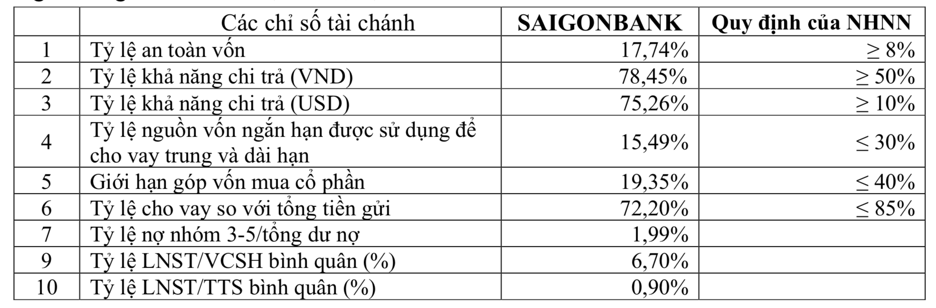

In the previous year, 2023, SAIGONBANK accomplished its business plan with a pre-tax profit of 332 billion VND, which is more than 40% higher than in 2022, fulfilling 111% of the target. The bad debt ratio has been kept at 1.99%. Capital safety, liquidity, and risk management indicators all comply with SBV requirements. For instance, the bank’s year-end capital adequacy ratio in 2023 reached 17.74%, substantially higher than the minimum requirement set by Circular 41 (8%). The short-term capital ratio for medium and long-term lending is 15.49%, which falls within the prescribed limit of 30%. The loans-to-total-deposits ratio is 72.2%, below the regulatory ceiling of 85%.

(The bank’s safety ratios align well with the State Bank of Vietnam’s regulations)

Profit Distribution Plan: Prioritizing Stock Dividends

The bank has also adopted a 2023 profit distribution plan. Notably, the bank’s after-tax profit for 2023 is 266 billion VND. After deducting mandatory reserves, including the additional capital reserve fund and the financial contingency fund, the remaining profit stands at 226 billion VND. The board of directors will determine the allocation of the remaining reserves (bonus fund, employee welfare fund, and management bonus fund) and prioritize allocating the increased capital for stock issuance to pay dividends to shareholders. SAIGONBANK’s management has indicated that it will compute the optimal dividend rate to present to the General Meeting of Shareholders, consistent with the SBV’s policies.

Furthermore, Chairman Vu Quang Lam stated that the remaining profit from 2023 will be presented to the extraordinary shareholders’ meeting for a final decision on stock dividends. Assuming no unexpected changes, the dividend rate is expected to be 8%. Consequently, shareholders will be entitled to two consecutive dividend payments.

Following the approval of the stock dividend proposal by relevant authorities, SAIGONBANK has completed the registration process with the Vietnam Securities Depository and Clearing Corporation. The record date for the stock dividend payment of 10% has been set as April 25, 2024. SAIGONBANK’s current charter capital stands at 3,080 billion VND. Upon completion of the 10% stock dividend distribution, SAIGONBANK’s charter capital will increase to 3,388 billion VND.

The bank aims to maintain a consistent dividend policy to ensure shareholder benefits. Distributing dividends in the form of shares allows SAIGONBANK to strengthen its capital base, enhance its financial capabilities, and expand its credit growth potential.

Responding to a shareholder’s proposal for cash dividends, the Chairman of SAIGONBANK explained, “The bank has ample funds to distribute cash dividends. However, the SBV is currently encouraging banks to distribute stock dividends to bolster the sector’s capital. Stock dividends will allow shareholders to easily convert their holdings into cash through market transactions if desired.”

During the AGM, SAIGONBANK’s management provided information and answered shareholders’ questions regarding the bank’s performance in 2023, business prospects for 2024, and the risk provisioning and asset quality control plan for 2024. Shareholders also inquired about the bank’s plans for a stock exchange transfer. According to Mr. Vu Quang Lam, SAIGONBANK’s financial performance has met the criteria to move from UPCoM to HoSE. The bank has engaged a securities firm to advise on the transfer process. However, it is a lengthy and complex undertaking, with the earliest possible completion date.

Vu Quang Lam, Chairman of SAIGONBANK’s Board of Directors, confidently stated, “Based on the achievements of 2023, SAIGONBANK is consolidating a robust foundation for continued growth and robust performance in the future.”