Marketing Update for December 25, 2024

Market liquidity increased from the previous trading session, with the VN-Index matching volume reaching over 724 million shares, equivalent to a value of more than 16.5 trillion VND. The HNX-Index reached over 67 million shares, equivalent to a value of more than 1.1 trillion VND.

The VN-Index opened the afternoon session with a slightly fluctuating trend as selling pressure returned, but buyers remained dominant, helping the index close in the green. In terms of impact, CTG, TCB, BID, and STB were the most positive influences on the VN-Index, contributing over 5.1 points to the rise. On the other hand, HVN, HAG, DBD, and EIB had the most negative impact, but their influence was not significant.

| Top 10 stocks with the strongest impact on the VN-Index on December 25, 2024 (in terms of points) |

Similarly, the HNX-Index also had a positive performance, influenced by the gains in KSV (+9.93%), DTK (+8.4%), MBS (+2.47%), and HUT (+2.53%)…

|

Source: VietstockFinance

|

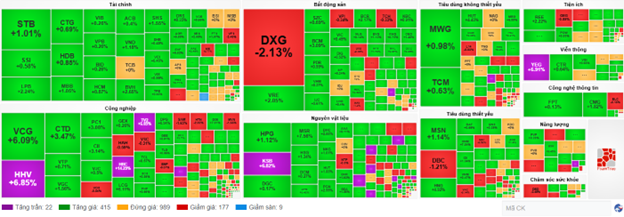

The financial sector was the top-performing industry group, surging 1.66% mainly due to gains in CTG (+5.52%), STB (+4.47%), SSI (+2.31%), and TCB (+1.88%). The materials and energy sectors followed with increases of 1.53% and 1.05%, respectively. On the other hand, the industrial sector declined the most, falling by -0.39%, dragged down by HVN (-3.86%), HAH (-1.77%), VTP (-0.85%), and VOS (-1.4%).

In terms of foreign trading activities, foreign investors continued to be net buyers on the HOSE exchange, focusing on HPG (107.83 billion VND), SSI (92.8 billion VND), STB (73.3 billion VND), and HDB (24.55 billion VND). On the HNX exchange, foreign investors were net sellers, offloading stocks such as PVS (17.35 billion VND), TNG (7.42 billion VND), IDC (7.06 billion VND), and BVS (1.39 billion VND).

| Foreign Trading Activities |

Morning Session: Uptrend Broadens Quickly Led by Large-cap Stocks

The market witnessed a broad-based rally, with the VN-Index extending its gains thanks to the strong performance of large-cap stocks. By the end of the morning session, the VN-Index climbed 15.93 points, or 1.26%, to 1,276.29; the HNX-Index advanced 0.83% to 230.26. The market breadth was positive, with 461 gainers and 214 losers.

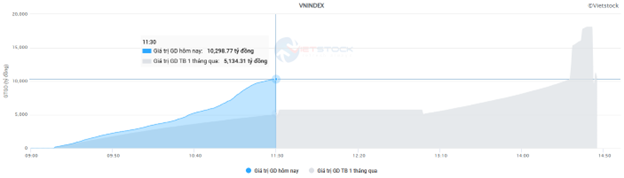

Buying interest was strong in large-cap stocks, resulting in improved liquidity. The VN-Index matching volume in the morning session reached over 465 million shares, equivalent to a value of nearly 10.3 trillion VND, doubling the average morning session liquidity over the past month. The HNX-Index recorded a matching volume of over 40 million shares, with a value of more than 698 billion VND.

Source: VietstockFinance

|

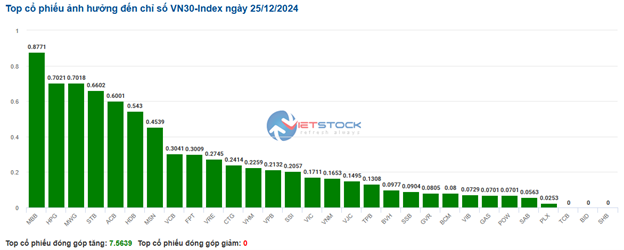

Among the top 10 stocks with the most positive impact on the VN-Index, nine were from the banking sector. CTG was the main driver, contributing over 3 points to the index’s gain. It was followed by BID, VCB, and TCB, which collectively added another 3 points to the rise. In contrast, there were no notable names on the downside, and the total impact of the 10 most negative stocks was not enough to offset half a point from the overall market.

Most industry groups were in positive territory, with the industrial and materials sectors standing out. Many construction and building materials stocks surged to their daily limit prices early on, such as HHV, HBC, TV2, FCN, PLC, and KSV…

As a result, the positive momentum spread across the market in the latter half of the morning session. The financial sector, with its large market capitalization, contributed the most to the VN-Index‘s strong performance. Many stocks rose over 2%, including CTG (+6.08%), STB (+3.31%), LPB (+2.68%), TPB (+2.49%), MBB (+2.3%), BID (+2.1%), TCB (+2.08%), MBS (+3.18%), HCM (+2.77%), FTS (+2.5%), VND (+2.35%), and PVI (+2.49%), among others.

On the other hand, telecommunications and healthcare were the only two sectors that remained in negative territory, weighed down by VGI (-0.53%), CTR (-0.32%), VNZ (-0.33%); and IMP (-0.93%), DBD (-1.81%), DVN (-0.79%), respectively…

Foreign investors were net sellers on the HOSE exchange in the morning session, offloading BID the most (38.41 billion VND). On the HNX exchange, foreign investors were net sellers, mainly selling PVS.

10:30 am: Industrial and Materials Sectors Support Market Recovery, VN-Index Surges

As of 10:30 am, the VN-Index had gained over 9.3 points, trading around 1,269 points. The HNX-Index rose over 1.1 points, trading around 229 points.

Stocks in the VN30 group dominated the market, with MBB contributing 0.87 points to the rise, followed by HPG (+0.7 points), MWG (+0.7 points), and STB (+0.66 points). Meanwhile, only three stocks, TCB, BID, and SHB, remained unchanged.

Source: VietstockFinance

|

Source: VietstockFinance

|

Opening: Market Opens in the Green, DXG Remains Under Selling Pressure

At the start of the November 29 session, as of 9:30 am, the VN-Index continued its upward momentum after a slight gain at the opening, trading around 1,264 points. The HNX-Index edged higher to 228 points. Notably, the VS-LargeCap group led the market recovery with a gain of 0.39%.

The market opened in the green, with several telecommunications stocks posting strong gains from the start, such as VGI (+2.12%), FOX (+0.93%), CTR (+0.64%), and YEG (+3.46%).

Large-cap stocks in the materials sector, including GVR, DCM, DPM, and DGC, led the index higher, although their gains were modest. On the other hand, DXG, KDH, TCH, and VPI from the real estate sector weighed on the market, but their impact was not significant.

Additionally, the industrial sector advanced steadily, with most stocks in the group trading in positive territory. Notable gainers included VTP (+1.98%), SCS (+1.6%), and VOS (+1.96%)…

The Cryptocurrency Comeback: Will Bitcoin Bounce Back in January 2025?

As investors look ahead to 2025, historical market data suggests that January could be a bullish month for Bitcoin and the broader digital asset market.

The Cautious Sentiment Rises

The VN-Index witnessed a negative trading session with a decline in trading volume below the 20-day average. This indicates a resurgence of cautious sentiment among investors. However, it’s important to note that the index is currently sitting above the Middle Bollinger Band. If the index manages to hold its ground above this level in the upcoming sessions and the MACD indicator continues to flash a buy signal, the situation may not be as pessimistic as it seems.

Stock Market Week of 12/16/2024 – 12/20/2024: A Prevailing Mood of Caution

The VN-Index edged higher last week, with alternating sessions of gains and losses. While the index inched up, the trading volume fell below the 20-day average, indicating that investors remain cautious. Moreover, foreign investors’ continued net selling streak suggests that the short-term outlook for the market is still not optimistic.