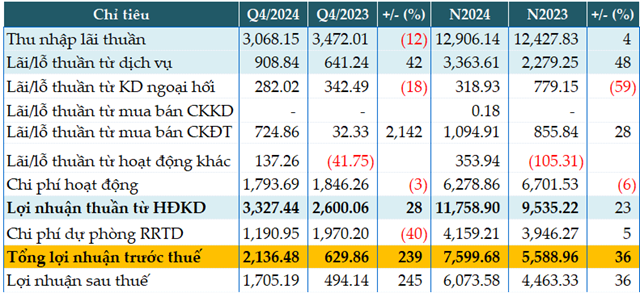

In Q4 2024, TPBank reported a 12% decrease in net interest income compared to the same period last year, amounting to just over VND 3,068 billion.

TPBank explained that their profit structure has shifted away from a reliance on credit, moving towards a more diverse business model. As a result, net income from services increased by 42%, reaching nearly VND 909 billion, attributed to the development of digital services and payment conveniences. Additionally, the bank has been actively promoting digital services, ranging from lending and insurance to payments, which has significantly contributed to fee-based revenue.

Notably, income from securities investment yielded profits of nearly VND 724 billion, a staggering 23 times higher than the previous year.

Furthermore, the bank successfully reduced operating expenses by 3%, totaling VND 1,794 billion. Consequently, the net profit from business operations amounted to VND 3,327 billion, marking a 28% increase compared to the previous year.

With a provision of VND 1,190 billion set aside for credit risk reserves, reflecting a significant 40% decrease, the bank’s pre-tax profit increased by 3.4 times year-on-year, reaching over VND 2,136 billion.

For the full year 2024, TPBank’s pre-tax profit stood at nearly VND 7,600 billion, a 36% increase from the previous year. With this, the bank successfully achieved its annual target of VND 7,500 billion.

|

TPB’s Q4 and 2024 business results. Unit: Billion VND

Source: VietstockFinance

|

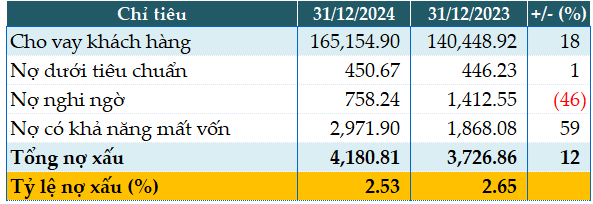

As of the end of 2024, TPBank’s total assets reached VND 418,028 billion, a 17% increase from the beginning of the year. Customer lending increased by 18%, reaching VND 250,331 billion, while customer deposits grew by 17% to VND 242,805 billion.

The bank’s loan quality improved, with total non-performing loans as of December 31, 2024, decreasing by 9% from the beginning of the year to VND 3,803 billion. All categories of non-performing loans witnessed a decline. The non-performing loan ratio to total loans also improved, decreasing from 2.05% to 1.52% during the same period.

|

Loan quality of TPB as of December 31, 2024. Unit: Billion VND

Source: VietstockFinance

|

Han Dong

– 20:30 24/01/2025

How Are Banks Preparing for the End of Circular 02?

Circular 02, effective until late 2024, has provided a much-needed reprieve for banks and businesses to recalibrate their strategies and financial restructuring. However, as this policy nears its end, the focus shifts to the lingering challenges of non-performing loans and risk governance within the financial system. Maintaining stability requires banks to not only optimize their bad debt coverage ratios (LLR) in balancing profitability and risk but also demands prudence in crafting their lending portfolios in the forthcoming period.

The Revenue Slump: ThaiBev’s Vietnam Sales Retreat for the Second Year Running

According to Thai Beverage Public Company Limited’s (ThaiBev) 2024 financial statements (covering the period from September 2023 to September 2024), the parent company of Sabeco (HOSE: SAB) experienced growth in both revenue and profit. However, the Vietnamese market saw a second consecutive year of declining revenue.

The Largest Industrial Park Owner in Tay Ninh Prepares to Dish Out Over VND 210 Billion in Advance Dividends for 2024

Saigon VRG Investment Corporation (HOSE: SIP) has announced December 12, 2024, as the record date for determining the shareholders’ eligibility for the first cash dividend of 2024.