In the international market, the DXY index fell slightly by 0.23 points compared to the previous week, reaching 109.41 points – ending its six-week streak of gains. Despite the slowdown, the DXY index remains at its highest level in over two years.

According to the latest data from the US Bureau of Labor Statistics released on January 15, the core consumer price index (CPI) (excluding food and energy prices) rose 3.2% year-over-year, slightly lower than the 3.3% forecast by experts and the previous month’s increase. On a monthly basis, CPI core increased by 0.2%, also lower than the predicted 0.1 percentage points.

A notable bright spot was housing prices – accounting for about a third of the weight in the CPI basket – which rose only 0.3% in the month and 4.6% year-over-year, the weakest increase since January 2022. This is seen as a positive sign indicating that the pressure from housing costs is easing.

These indices bring positive signals about the cooling of inflation, especially in the housing sector, which is considered one of the primary concerns of the US Federal Reserve (Fed), leading to a significant decline in US Treasury bond yields.

The easing inflationary pressure raises expectations that the Fed will cut interest rates more than once, thereby reducing the appeal of the greenback.

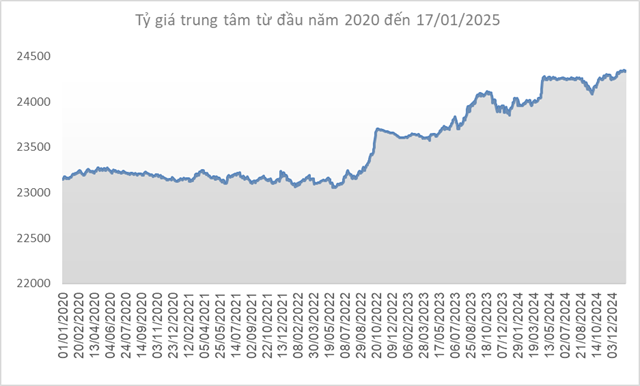

Source: SBV

|

Domestically, the central exchange rate of the Vietnamese Dong to USD remained unchanged from the previous week (January 10) at 24,341 VND/USD during the session on January 17, 2025.

With a 5% margin, the allowable trading range for commercial banks is between 23,124 and 25,558 VND/USD.

The State Bank of Vietnam’s Foreign Exchange Management Agency’s reference exchange rate for USD/VND is 23,400-25,450 VND/USD (buy-sell), unchanged from the previous week.

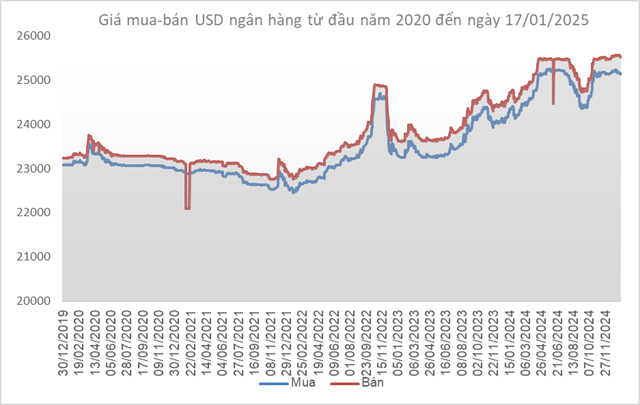

Source: VCB

|

At Vietcombank, the USD/VND exchange rate on January 17 was quoted at 25,120-25,510 VND/USD (buy-sell), a decrease of 48 VND/USD in both directions.

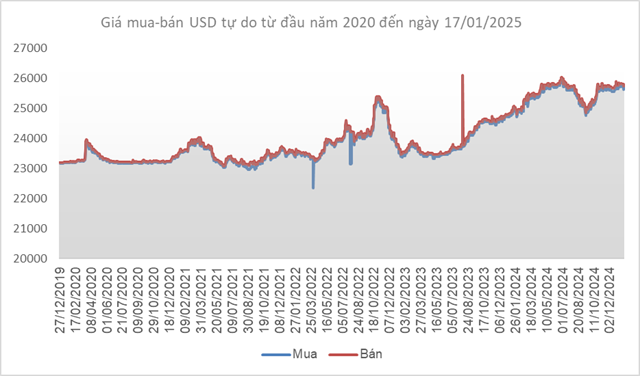

Source: VietstockFinance

|

In the free market, the exchange rate fell by 110 VND/USD in both buying and selling compared to the previous week, reaching 25,620-25,720 VND/USD (buy-sell).

– 17:16 19/01/2025

The Market Beat – 02/01: VN-Index Starts the Year on a Positive Note Despite Lackluster Liquidity

The market witnessed a rebound in the afternoon session, with the VN-Index recovering from 1,264 to 1,269.71. Meanwhile, the HNX-Index also gained 0.26 points to reach 227.69, while the UPCoM-Index dipped slightly by 0.01 points to 95.05. Overall, the liquidity of the three exchanges was relatively low, slightly exceeding 12 trillion VND.

Stock Market Outlook for Week of December 9-13, 2024: Short-Term Correction Pressure

The VN-Index had a lackluster performance last week, declining in 4 out of the last 5 trading sessions. Moreover, the trading volume remained below the 20-day average, indicating a shift towards cautious sentiment among investors. Adding to this, the return of net selling by foreign investors suggests that the short-term outlook for the market remains risky.

The Market Beat: A Tale of Diverging Fortunes

The market closed with the VN-Index down 3.12 points (-0.24%) to 1,272.02, and the HNX-Index fell 0.99 points (-0.43%) to 228.14. The market breadth tilted towards decliners with 436 losers and 274 gainers. Notably, 20 stocks in the VN30 basket ended in negative territory, with 6 advancing and 4 unchanged.