Gold prices plunged during Monday’s trading session (January 27th) as investors sold gold to cover losses in their stock portfolios, triggered by a sell-off in US stock markets, particularly technology stocks. Despite a weaker US dollar and lower US Treasury yields, the safe-haven asset failed to find support.

At the close of trading in New York, spot gold prices fell by $30.1/oz compared to the previous session’s close, a decline of nearly 1.1%, settling at $2,741.5/oz, according to Kitco exchange data.

As of early Tuesday morning (January 28th) in Vietnam, spot gold prices in the Asian market slipped by an additional $1.1/oz compared to the US close, equivalent to a 0.04% decrease, reaching $2,740.4/oz. When converted using Vietcombank’s selling exchange rate, this price corresponds to approximately VND 83.5 million per tael.

Prior to this decline, world gold prices had surged to near all-time highs on Friday, fueled by a weak US dollar and risk aversion amid uncertainties surrounding the policies of newly inaugurated US President Donald Trump.

To start the week, stocks in the US and many other markets experienced a sharp sell-off as investors grew concerned about the potential burst of the artificial intelligence (AI) stock bubble following news of DeepSeek, a Chinese company, developing a lower-cost AI model compared to existing ones.

As stocks plummeted, investors flocked to safe-haven assets such as US Treasury bonds and safe-haven currencies like the Japanese yen and Swiss franc. Gold, traditionally considered a safe haven, failed to attract buyers on Monday as its recent strong performance led investors to choose it as a means to raise capital to cover stock losses.

“The sharp sell-off in gold is mainly related to the stock market turmoil rather than interest rates or exchange rates. There is a liquidity crunch in the market,” remarked Bart Melek, head of strategy at TD Securities, to Reuters.

“Some investors need liquidity, and some of the stocks they bought on margin have fallen sharply. So, liquidity is an issue, and gold is being sold along with other risk assets,” Melek emphasized.

The yield on the 10-year US Treasury note fell to 4.53%, its lowest level in over a month. The Dollar Index, measuring the greenback’s strength against a basket of six major currencies, closed at 107.34, down from the previous session’s 107.50.

This significant gold price drop occurred just before the first monetary policy meeting of the US Federal Reserve (Fed) in 2024. The meeting, commencing on Tuesday and concluding on Wednesday afternoon, will be followed by a statement from the Federal Open Market Committee (FOMC) and a press conference by Fed Chairman Jerome Powell.

According to the FedWatch Tool from the CME exchange, the market anticipates a likelihood of over 97% that the Fed will maintain interest rates at the current level during this meeting. Investors are more focused on hints about the future path of interest rates, given Trump’s return to the White House and his potential impact on inflation through his trade policies.

“Risk aversion will continue to support gold prices. The precious metal could break out and set new records as uncertainties surround the Trump administration’s agenda,” senior strategist Peter Grant of Zaner Metals told Reuters.

The Golden Opportunity: “Gold Prices Surge as Risk-Averse Investors Seek Safe Haven”

The mounting uncertainty surrounding President Donald Trump’s tariff plans continues to fuel demand for gold as a safe-haven asset.

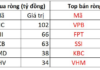

Unlocking Profits: YEG Stuck at Floor Price

The morning rally stalled as the breadth turned negative. While stocks that had surged in recent times faced selling pressure, most remained in the green. YEG stood out as the lone stock stuck at the floor price after a meteoric rise of 125% in December alone.