Vietcombank Securities Company (VCBS) is proud to announce its exceptional performance in 2024, earning a place among the top-performing companies. The top 10 companies on this list account for 68.25% of the total brokerage market share.

According to the Hanoi Stock Exchange (HNX), VCBS has also made significant strides, ranking among the top 10 securities companies with the largest brokerage market share in the listed and UPCoM stock markets in the fourth quarter of 2024.

Notably, in the government bond brokerage market, VCBS is among the top 3 securities companies with the largest market share in 2024.

The year 2024 witnessed intense competition in the securities market, heavily influenced by macroeconomic factors, exchange rate fluctuations, and interest rate changes. Despite these challenges, VCBS demonstrated resilience and achieved remarkable business results, contributing positively to the success of Vietcombank and the Vietnamese securities market as a whole.

As a subsidiary of Vietcombank, VCBS has built a strong reputation over its 23 years of operation in the market. Backed by the bank’s credibility, brand, capital, and extensive network, VCBS offers cross-selling opportunities and develops integrated products and services.

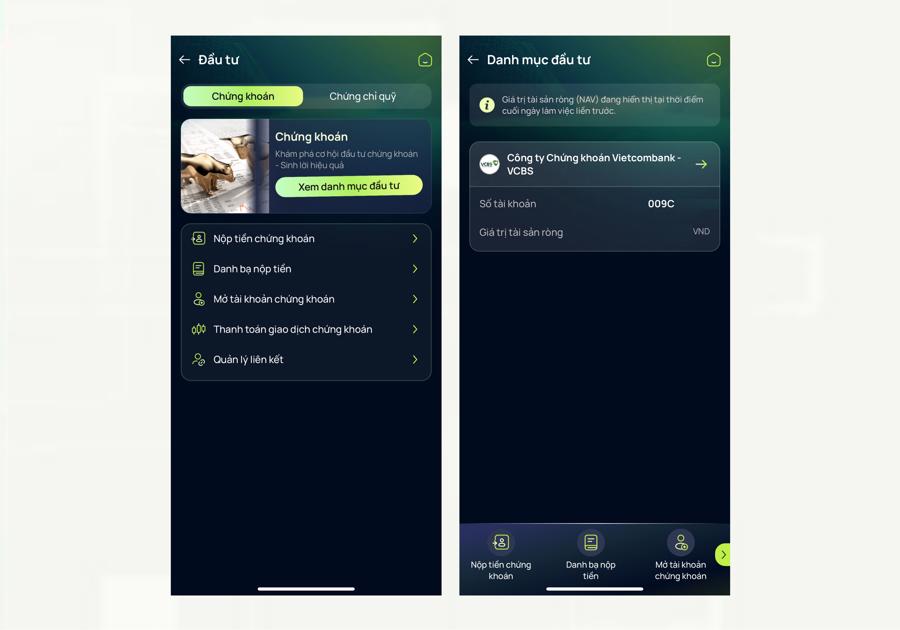

Currently, customers can open a securities trading account directly on the VCB Digibank application and link their VCB and VCBS accounts. This enables customers to manage their bank and securities accounts seamlessly on a single digital platform.

Additionally, VCBS is committed to accelerating its digital transformation journey. The company focuses on implementing quick-win initiatives, such as the Data Platform and Customer Data Platform, to enhance business data analysis and customer prediction capabilities. VCBS also invests in projects to improve operational quality and change management, enhancing work efficiency and competitiveness. Ensuring the safety and security of its information technology systems is a top priority for VCBS, as it guarantees the protection of customer transactions. The company regularly updates its investor support policies, offering optimal cost benefits, interest rates, and improved liquidity for customers.

With its impressive achievements, VCBS is proud to be a trusted partner, offering market-leading risk management capabilities. The company is dedicated to creating sustainable value for its customers, the investment community, domestic and international businesses, and contributing positively to the sustainable development of the Vietnamese securities market.

For more information on VCBS’s preferential policies, please visit: https://vcbs.com.vn/

Experience the convenient trading features of VCBS here: https://vcbs.com.vn/ekyc

VCBS is Among the Top 10 Brokerage Firms in 2024

Recently, the Ho Chi Minh City Stock Exchange (HOSE) released a list of the top 10 securities companies with the largest brokerage market share in Vietnam. This list is a testament to the thriving securities industry in the country and showcases the leading firms in this competitive market.

Unblocking Bottlenecks for a Nation’s Economy to Soar.

In 2025, the government is targeting a GDP growth rate of over 8%, with aspirations to reach double digits should favorable conditions prevail. Economic experts believe that Vietnam’s growth potential is evident, but it is currently hindered by certain regulatory and administrative bottlenecks. To achieve the desired economic acceleration, it is imperative to address and unblock these constraints.

“Steady Growth and Effective Risk Management: Nam A Bank’s Path to Success in 2024”

As of the end of 2024, Nam A Bank (HOSE: NAB) reported impressive growth in its business performance. The bank witnessed a significant expansion in its scale of operations, coupled with enhanced asset quality. Notably, the bank’s indicators for mobilization and credit outstanding balances demonstrated remarkable effectiveness, reflecting the bank’s strong performance and strategic success.