**Coteccons’ Financial Performance in Q2 FY2025**

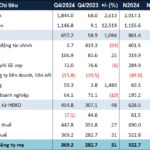

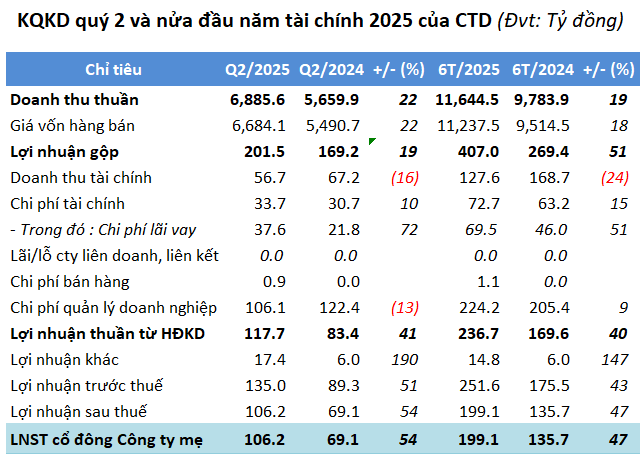

Coteccons concluded the second quarter of the 2025 financial year (from Oct 1 to Dec 31, 2024) with consolidated revenue of nearly VND 6,886 billion, a 22% increase compared to the same period last year. The main source of revenue remained construction contracts, contributing almost VND 6,766 billion, a 20% increase.

Total expenses for the period decreased by 8% to VND 141 billion, resulting in a net profit of over VND 106 billion, a significant 54% increase. Coteccons attributed this performance to the proactive risk management and provision policies implemented by the management since the previous year, which mitigated the impact of fluctuations in labor costs, construction material prices, and macroeconomic factors on the cost of goods sold.

Source: VietstockFinance

|

For the first half of the 2025 financial year (from Jul 1, 2024, to Dec 31, 2024), Coteccons achieved nearly VND 11,645 billion in revenue and almost VND 200 billion in net profit, representing increases of 19% and 47%, respectively, compared to the same period in the previous year.

The company also reported that the value of new contracts signed during the first six months of the 2025 financial year reached VND 16,800 billion, bringing the total backlog for the second half of the 2025 financial year to nearly VND 35,000 billion.

With targets set for the full 2025 financial year (from Jul 1, 2024, to Jun 30, 2025) of VND 25,000 billion in revenue and VND 430 billion in after-tax profit, Coteccons has achieved 46% of both targets.

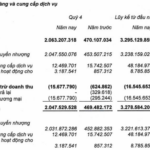

As of the end of 2024, Coteccons’ total assets amounted to nearly VND 27,085 billion, an 18% increase compared to the beginning of the year. Bank deposits increased by 15% to over VND 4,400 billion, accounting for 16% of capital sources. Short-term receivables stood at nearly VND 13,696 billion, a 14% increase, with a provision of almost VND 1,424 billion for difficult-to-recover short-term receivables.

Inventories totaled nearly VND 4,999 billion, a 60% increase, mainly comprising the value of investment properties for sale at the Marina Tower commercial housing project in Binh Duong and the Thanh Do smart urban area project in Can Tho. In contrast, construction work in progress decreased by 43% to nearly VND 65 billion, mainly attributed to the Gem Sky World project in Dong Nai, with a value of approximately VND 35 billion.

Payables stood at over VND 18,394 billion, a 29% increase, due to a 73% rise in short-term financial loan obligations to nearly VND 2,634 billion.

– 07:00, Jan 30, 2025

The Power of Words: Unlocking Online Success with Captivating Copy

Unleash the Potential: Discover the Secrets to Writing Compelling Content that Boosts Revenue for Cao Su Dong Phu with Soaring Rubber Prices

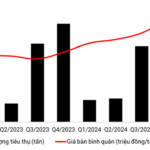

In 2024, the continuous rise in rubber prices propelled Dong Phu Rubber Joint Stock Company (HOSE: DPR) to record peak revenue in a decade.

“Struggling to Stay Afloat: Can Phaat Dat Stay on Course to Meet their 2024 Business Goals?”

The fourth quarter saw positive growth; however, CTCP Phat Dat Real Estate Development JSC (HOSE: PDR) witnessed a 24% year-over-year decline in net profit for the full year 2024.