**KDH’s Impressive Performance in Q4 2024**

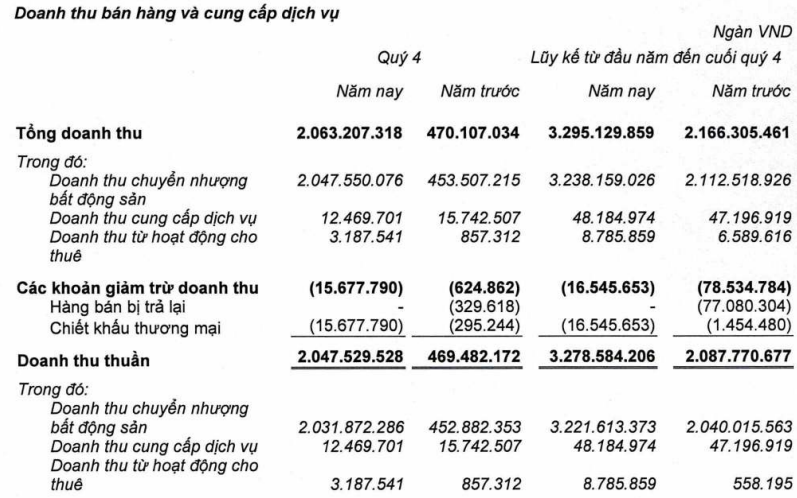

In Q4 2024, KDH recorded remarkable growth, with net revenue surpassing 2,000 billion VND, a staggering 4.4 times higher than the same period last year. The majority of this revenue was generated from real estate transfers.

|

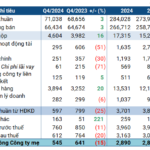

A breakdown of KDH’s revenue structure in 2024 is provided below:

Source: KDH

|

Starting October 15, 2024, Khang Phuc House Trading and Investment Company – a subsidiary of KDH – began handing over apartments to customers of the high-rise housing project in An Lac Ward, Binh Tan District, Ho Chi Minh City (commercially known as The Privia).

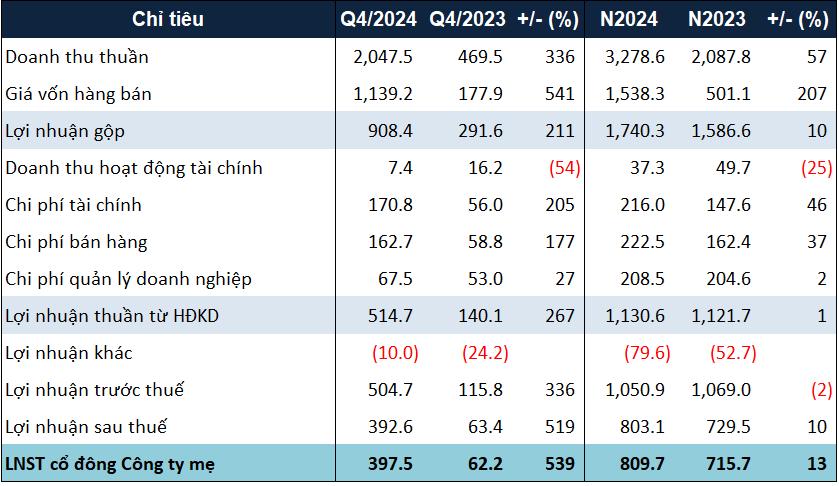

By recognizing revenue after project delivery, KDH’s net profit in the last quarter of 2024 reached nearly 398 billion VND, 6.4 times higher than the same period in 2023, despite a significant increase in related expenses such as financial costs (comprised entirely of payment discounts) and sales expenses.

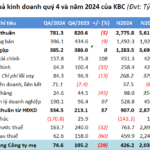

This strong performance in the final quarter pushed KDH’s net profit for the full year 2024 up by 13% compared to the previous year, totaling nearly 810 billion VND. Notably, the company exceeded its after-tax profit target of 790 billion VND for 2024 by almost 2%.

|

KDH’s business results for 2024 are summarized in the table below (in billions of VND):

Source: VietstockFinance

|

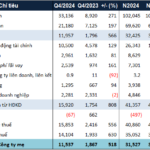

As per the balance sheet, KDH’s total assets as of December 31, 2024, amounted to nearly 30,800 billion VND, representing a 16% increase from the beginning of the year. Notably, short-term receivables and inventory witnessed substantial growth, climbing 65% and 18%, respectively, to over 3,000 billion VND and nearly 22,200 billion VND. In contrast, short-term cash holdings decreased by 10%, settling at nearly 3,400 billion VND.

The rise in receivables was primarily driven by a 2.3-fold increase in project transfer activities, totaling over 166 billion VND. Additionally, prepayments for land use rights purchases climbed 77%, reaching nearly 818 billion VND, and a new prepayment of 600 billion VND was made for the acquisition of capital contributions.

The increase in inventory was largely attributed to the construction costs associated with the development of the Binh Hung 11A Residential Area (commercially known as The Solina Khang Dien Binh Chanh), which surged from nearly 610 billion VND to over 1,800 billion VND, nearly tripling from the beginning of the year.

On the liabilities side, the company’s total liabilities increased slightly by 3%, reaching over 11,300 billion VND. Within this, total debt rose by 12%, amounting to nearly 7,100 billion VND. In 2025, KDH has two bond lots maturing, totaling 1,100 billion VND in principal value.

Ha Le

– 12:56 30/01/2025

“VHM Achieves Target of 35 Trillion VND Net Profit in 2024”

In 2024, Vinhomes Joint Stock Company (HOSE: VHM) recorded impressive figures with over VND 102 trillion in revenue and VND 31.5 trillion in net profit. The company successfully achieved its target of VND 35 trillion in after-tax profit set at the beginning of the year.

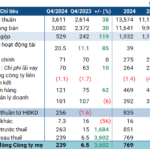

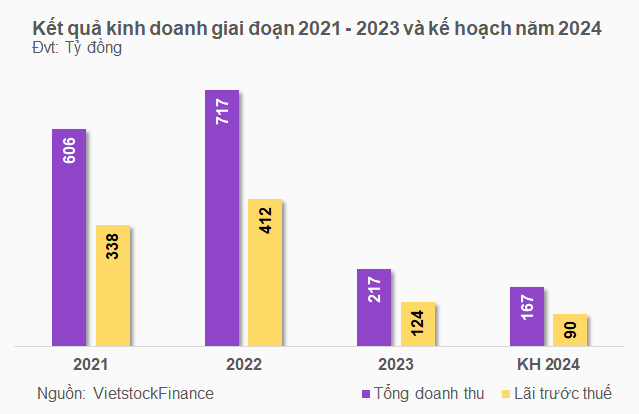

Industrial Land Rental Revenue Plummets, KBC Loses Nearly 80% of 2024 Profits

In 2024, Kinh Bac City Development Holding Corporation (HOSE: KBC) experienced a less impressive performance compared to the previous year, with a 51% and 79% decline in revenue and profit, respectively. This was largely due to a significant 77% drop in land and industrial infrastructure leasing revenue. Consequently, the enterprise achieved only 12% of its profit plan.