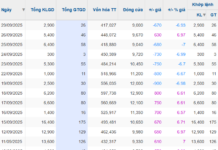

Source: VietstockFinance

|

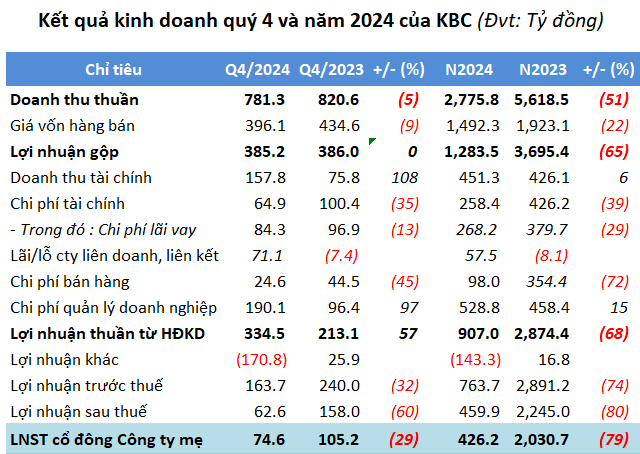

KBC’s fourth-quarter net revenue stood at over VND 781 billion, a 5% decrease year-on-year, while financial revenue reached nearly VND 158 billion, marking a significant 108% surge. Additionally, the company profited from joint ventures, earning over VND 71 billion, a remarkable turnaround from the previous year’s loss of over VND 7 billion.

However, total expenses rose by 16% to VND 280 billion, primarily due to soaring business management costs of more than VND 190 billion (double that of the previous year), which ate into KBC’s profits. Ultimately, the company’s net profit was nearly VND 75 billion, reflecting a 29% decline.

KBC attributed the profit decrease to unrecorded revenue from signed lease contracts during this period.

In 2024, KBC witnessed a downturn in its financial performance compared to the previous year, with a 51% drop in revenue to nearly VND 2,776 billion and a 79% plunge in net profit to over VND 426 billion. This downturn was largely due to a significant 77% decrease in land and industrial infrastructure lease revenue, totaling nearly VND 1,195 billion.

Source: KBC

|

With ambitious plans for 2024, targeting VND 9,000 billion in revenue and VND 4,000 billion in after-tax profit, KBC has accomplished only 31% and nearly 12% of these goals, respectively.

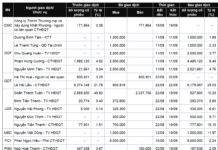

Currently, KBC is developing six real estate projects, with the most notable being the Tràng Cát Industrial Park and Urban Area project in Hai Phong. This project encompasses a planned area of 585 hectares and a commercial area of 282 hectares, requiring a total infrastructure investment of over VND 11,329 billion. The project has received land handover, approval for land leveling, and completed compensation for 582 hectares.

|

KBC’s Ongoing Projects

|

As of the end of 2024, KBC had invested over VND 8,448 billion in this project. The company’s total assets, those of a major industrial park developer in the North, increased by 34% from the beginning of the year to over VND 44,765 billion. Notably, cash and cash equivalents witnessed a substantial surge, climbing to over VND 6,566 billion, 7.8 times higher than at the start of the year, and accounting for 15% of capital sources. Inventories stood at nearly VND 13,867 billion, a 14% increase, making up 31% of total assets.

Meanwhile, payables also rose sharply by 83% to nearly VND 24,084 billion, mainly due to financial borrowings, which doubled from the beginning of the year to over VND 10,100 billion, constituting 42% of total debt. This included over VND 967 billion in bonds. Additionally, KBC had long-term payables of VND 5,761 billion in customer deposits, a staggering 210-fold increase from the beginning of the year, accounting for 24% of total debt.

Source: KBC

|

– 07:00 27/01/2025